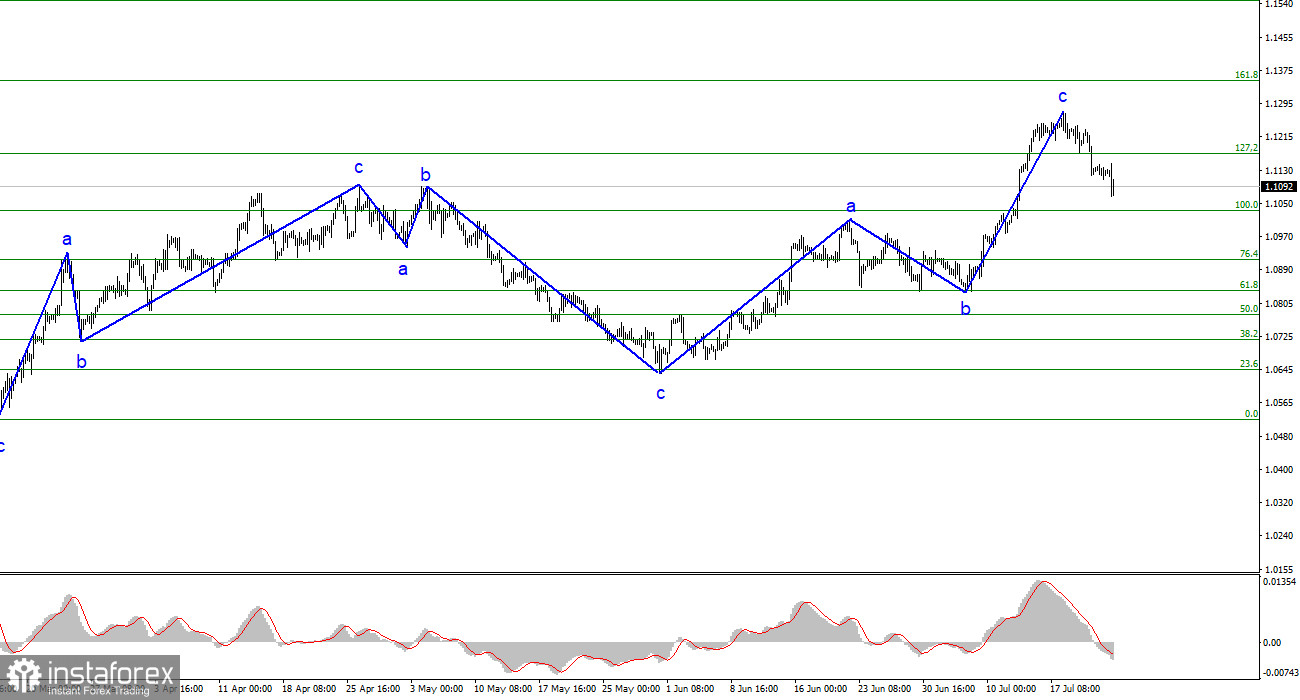

The wave analysis of the 4-hour chart for EUR/USD remains clear. The upward trend began last year and has taken on a complex structure, with only three alternating wave patterns observed in the last six months. As mentioned consistently, the pair is expected to approach the 1.1172 level, corresponding to 127.2% Fibonacci, indicating the market's readiness to sell, with target levels near the calculated 1.1034 level, equivalent to 100.0% Fibonacci.

The first two days of the week have favored the US dollar. On Tuesday, the euro/dollar currency pair declined by 20 basis points. Although price movements were weak, there was no significant news background that day. The demand for the US dollar continues to rise ahead of the ECB and FOMC meetings slowly. However, it isn't easy to attribute the increase in the American currency solely to these meetings, as both banks are 99% likely to raise rates by 25 basis points, leading to a certain parity in July. Consequently, the Fed's decision cannot be considered more "hawkish" than the ECB's. The European Central Bank may raise rates even more times than the Fed, potentially giving the euro an advantage. However, the market has been aware of these decisions for a while, and thus they are likely already factored into the euro and dollar exchange rates.

Based on the above, the primary reason for the pair's decline is the wave pattern. After the completion of wave C, which might also mark the end of the ascending trend, a corrective wave needs to be constructed, at least one such wave. This is what we are currently witnessing. The construction of a descending trend has started, which may also consist of three waves, although the ascending trend might have five waves due to the factor mentioned earlier. I do not expect a drastic change in market sentiment after the FOMC and ECB meetings unless Christine Lagarde or Jerome Powell discloses new essential information unknown to the market.

In conclusion, based on the analysis conducted, the construction of the ascending wave set is complete. I still find the targets around 1.0500-1.0600 quite realistic and recommend selling the pair with these targets in mind. The a-b-c structure appears solid and convincing, with the closure below the 1.1172 mark indirectly confirming the construction of the descending trend. Thus, I advise selling the pair with targets near the 1.1034 level, but in reality, the decline should be much more substantial if all three waves are fully constructed.

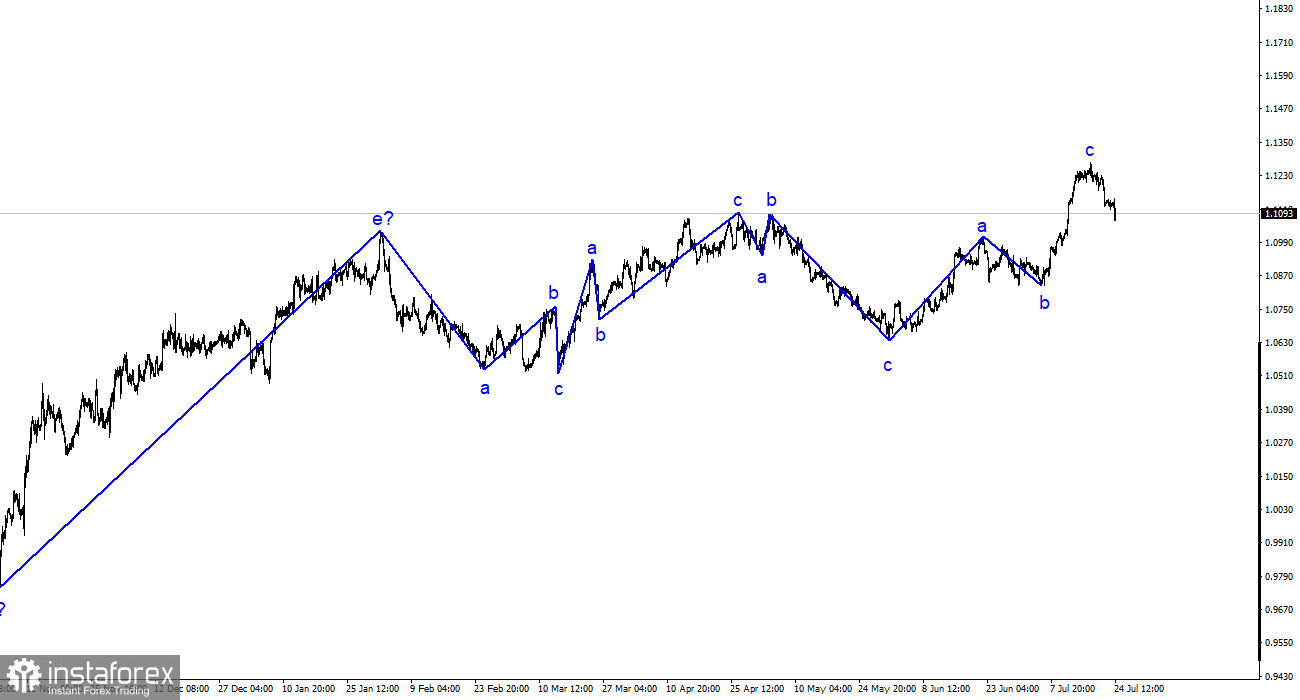

On a larger wave scale, the wave analysis of the ascending trend appears extensive but likely concluded. We have observed five upward waves, most likely forming part of the a-b-c-d-e structure. Subsequently, the pair formed four three-wave patterns, two downward and two upward. It has probably entered the stage of constructing another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română