Analysis and Bitcoin trading tips

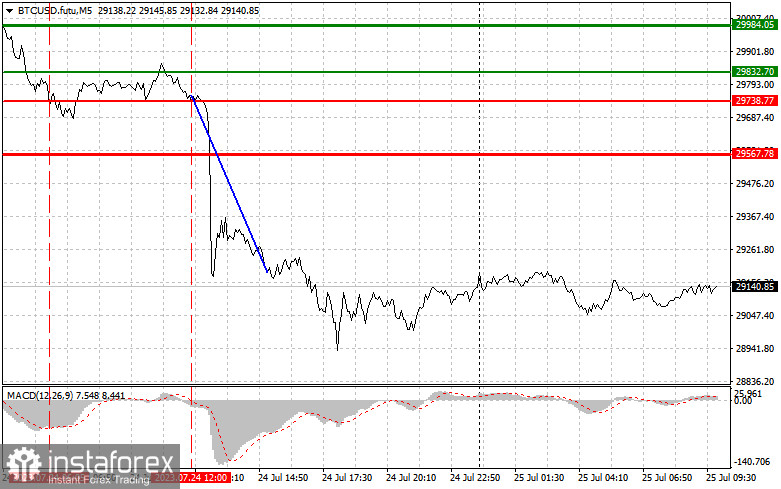

Bitcoin's correction continues, which can be clearly seen on the chart. Yesterday's breakout below a significant support level triggered a wave of Bitcoin sell-offs. The breach of the lower boundary of the sideways channel, in which the trading instrument has been confined for over a month, signals that more substantial sell-offs are likely in the near term. However, one important thing to consider is that BTC declines gradually and steadily, it could actually work to its advantage, as it would maintain the cryptocurrency's appeal. Then, prominent players might enter the market during each technical correction.

The best scenario for us is Bitcoin avoiding any sudden drops of $2000-3000 and sharp declines. Such a scenario would raise doubts about the possibility of a short-term rally and could lead to a significant downturn for the trading instrument, possibly even down to $20,000.

Bitcoin tested $29,738 in the first half of the day, which coincided with the MACD being in a sell area. It confirmed the correct market entry point for short positions. However, Bitcoin only declined in the afternoon after a similar entry point was confirmed. Today, I will make trading decisions based on the realization of the outlook's scenarios number one, expecting the downward technical correction to continue.

Buy signal

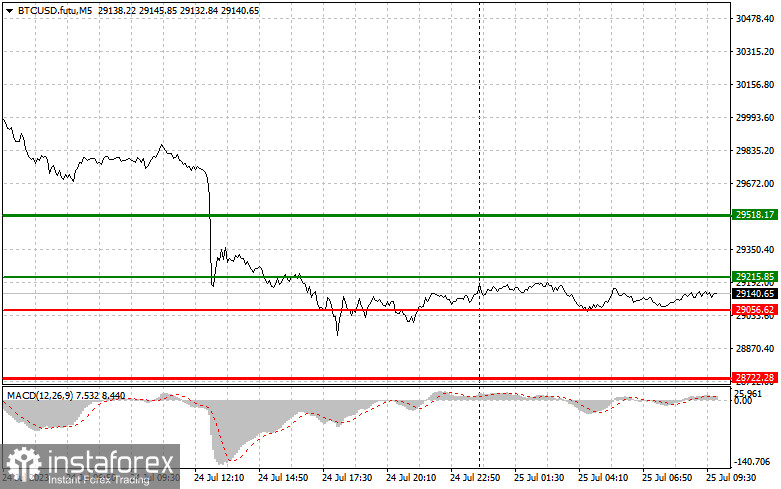

Scenario 1: You can go long on Bitcoin today once it reaches the entry point at 29,215 (the green line on the chart), targeting 29,518 (the thicker green line on the chart). Once the asset reaches the area of 29,518, you should close the long position and open a short position. Bitcoin is expected to rise strongly today in anticipation of a resumption of the bull market and an offset to yesterday's trend-threatening decline. Caution! Make sure the MACD indicator is above zero before going long on Bitcoin.

Scenario 2: long positions on Bitcoin can also be opened if the cryptocurrency tests 29,056 two times in a row while the MACD indicator is in the oversold area. This will limit the trading instrument's downward potential and lead to an upward reversal in the market. In such a scenario, Bitcoin might reach 29,215 and 29,518.

Sell signal

Scenario 1: short positions on Bitcoin can be opened after BTC hits 29,056 (the red line on the chart), which would lead to a rapid decline. The level of 28,722 will be a key target level for bearish traders, where you should close your position and open a long position immediately, expecting BTC to reverse upwards. The pressure on Bitcoin will increase if there is no strong demand in the first half of the day. Caution! Make sure the MACD indicator is below zero before going short on Bitcoin.

Scenario 2: you can also go short on BTC once Bitcoin tests 29,215 two times in a row while the MACD indicator is in the overbought area. This will limit the trading instrument's upside potential and lead to a downward reversal in the market. In such a scenario, Bitcoin might decline to 29,056 and 28,722.

Indicators on charts:

A thin green line indicates a buy entry point.

A thick green line indicates a point where you can set a Take Profit order or lock in profits manually because the price will unlikely go above this level.

A thin red line indicates a sell entry point.

A thick red line is the estimated price level where you should place a Take Profit order or close positions manually because the quote is unlikely to fall below this mark.

MACD. When entering the market, it is important to pay attention to the indicator's overbought and oversold zones.

Important! Novice crypto traders should be very careful when deciding to enter the market. Before the release of important fundamental data, you should stay out of the market in order to avoid sharp price fluctuations. If you decide to trade during news releases, make sure to always place a stop order to minimize losses. Without the order, you may quickly lose your entire deposit, especially if you do use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română