AUD/USD:

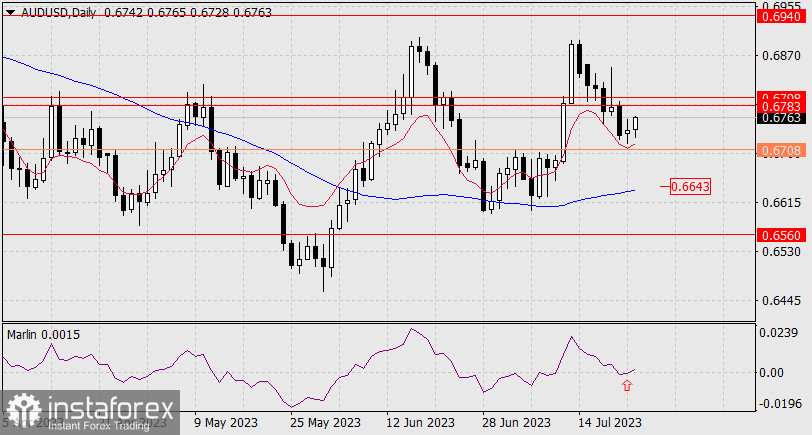

The Australian Dollar, unlike other currencies, clearly indicates a potential decline in the US Dollar after the Federal Reserve's rate hike tomorrow. The signs include a price reversal at the approaching signal line of 0.6708 and a false break of the Marlin oscillator's signal line below the zero line.

Currently, the Marlin oscillator is in positive territory. If the price breaks above the target range of 0.6783/98, there is potential for further growth towards the target level of 0.6940. On the other hand, if the price breaks below the signal level of 0.6708, it may aim to test the MACD line around 0.6643 with a perspective of declining to 0.6560.

On the four-hour chart, the Marlin oscillator has moved into the upward territory, and the price shows an intention to enter the target range of 0.6783/98, which would also mean breaking above the MACD line. The FX market awaits the outcome of tomorrow's Fed meeting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română