The European Central Bank meeting is scheduled for Thursday, but everyone already knows what decision the central bank will make. The interest rate will be raised by another 25 basis points, and this scenario is favored by the majority of economists and analysts. The latest eurozone inflation report did not show any unexpected values, which means that the ECB is not expected to do anything similar to what the Bank of England did at its last meeting (raising the rate by 50 basis points). It can be said that the monetary policy is slowly but steadily moving towards the inflation target. So now the markets are focused on the autumn and winter of 2023. At the moment, it is unclear whether the ECB plans to raise the rate with the onset of colder weather.

All the recent speeches by members of the ECB Governing Council speak only of one thing: additional tightening would be needed. Isabel Schnabel stated that core inflation proves stubborn, and the decline in energy prices may not push it down as strongly and as quickly as desired. Her colleague, Klaas Knot says that rate hikes are working, but he would like to achieve more progress in this matter. He also said that he supports the idea of raising the rate to 5%, if necessary, or even higher if underlying pressures continue to prove stubborn. Knot also noted that changes in rates affect inflation with a delay, so further slowdown in the pace should be expected.

ECB Governing Council member Peter Kazimir stated that interest rates may need to be raised for longer than the central bank had initially anticipated at the beginning of this year. "A September rate hike by the European Central Bank following an expected tightening in July was not certain and would depend on a fresh assessment of economic developments," Kazimir said. His colleague, Yannis Stournaras, said that the rate hikes will be completed this year, but there are still four more meetings until the end of the year, so Knot's forecast may not be fulfilled.

However, based on all the information received as of July, we can assume that interest rates will continue to rise in the autumn. Undoubtedly, the state of the EU economy matters, and the latest PMIs cast doubt on the most aggressive scenario of monetary tightening. But at the moment, it is not advisable to conclude that the rate hike will end in the autumn.

Based on the analysis, I conclude that the upward set of waves have been built. I believe that targets around 1.0500-1.0600 are quite realistic, and I advise selling the instrument with these targets. We presume that the a-b-c structure looks complete and appears convincing, and closing below the 1.1172 mark indirectly confirms the formation of a downtrend. Therefore, I recommend selling the instrument with targets located around the 1.1034 mark, but in reality, the decline should be much stronger if all three waves are formed.

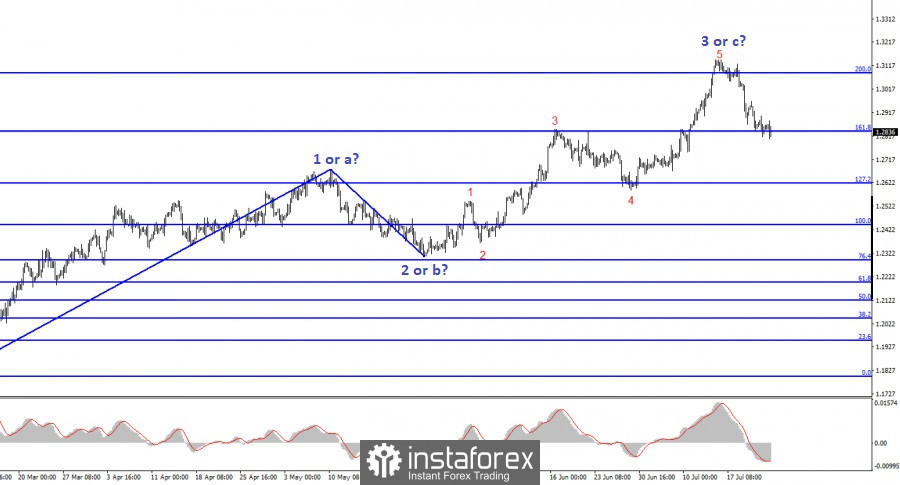

The wave pattern of the GBP/USD pair suggests a decline in the coming weeks. As the attempt to break through the 1.3084 mark (downwards) was successful, you could open short positions, as I mentioned in my recent reviews. Currently, the first target will be the 1.2840 mark, which the pair has already reached. An unsuccessful attempt to break this mark indicates a possible formation of an upward wave. However, if it succeeds on Monday or Tuesday, quotes will continue to fall as part of the first wave within the minimum required three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română