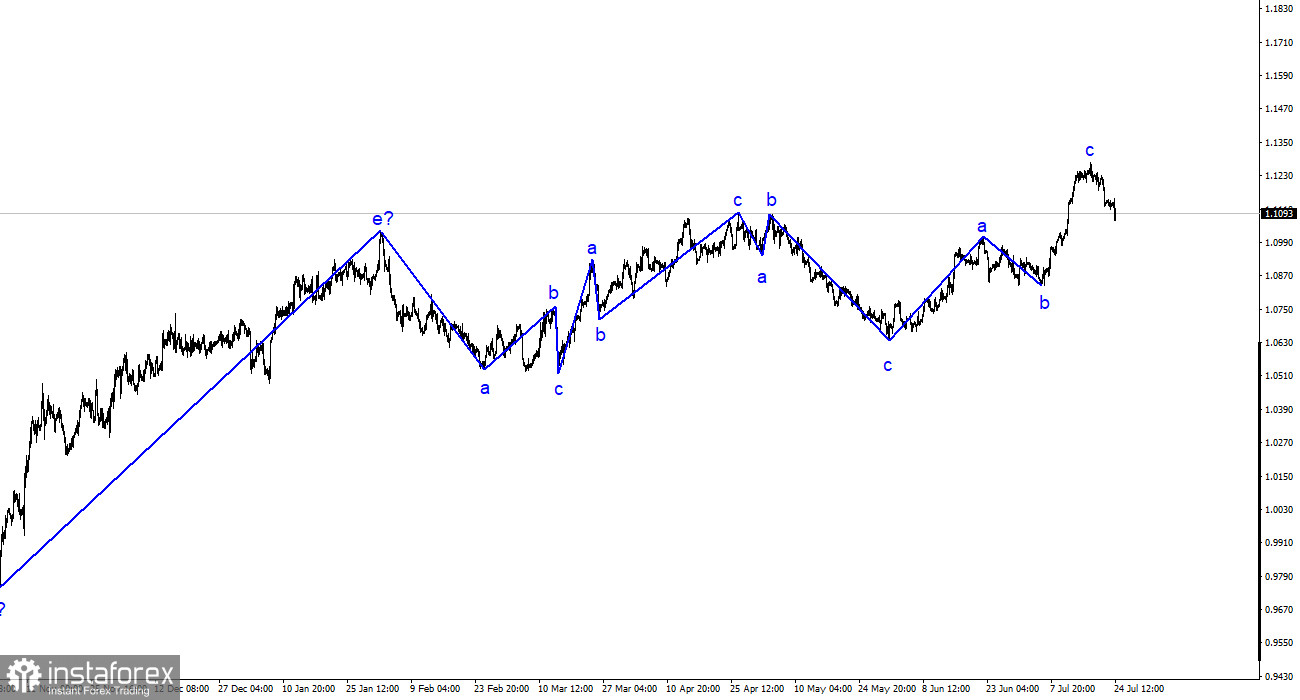

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The ascending trend, which began building last year, has become more complex, with the last six months showing alternating three-wave structures. I have consistently mentioned my expectation that the pair will be around the 5th figure, where the construction of the last upward three-wave pattern started. I am not abandoning this perspective, but we must wait for the current upward trend to complete. By the way, it may already be finished.

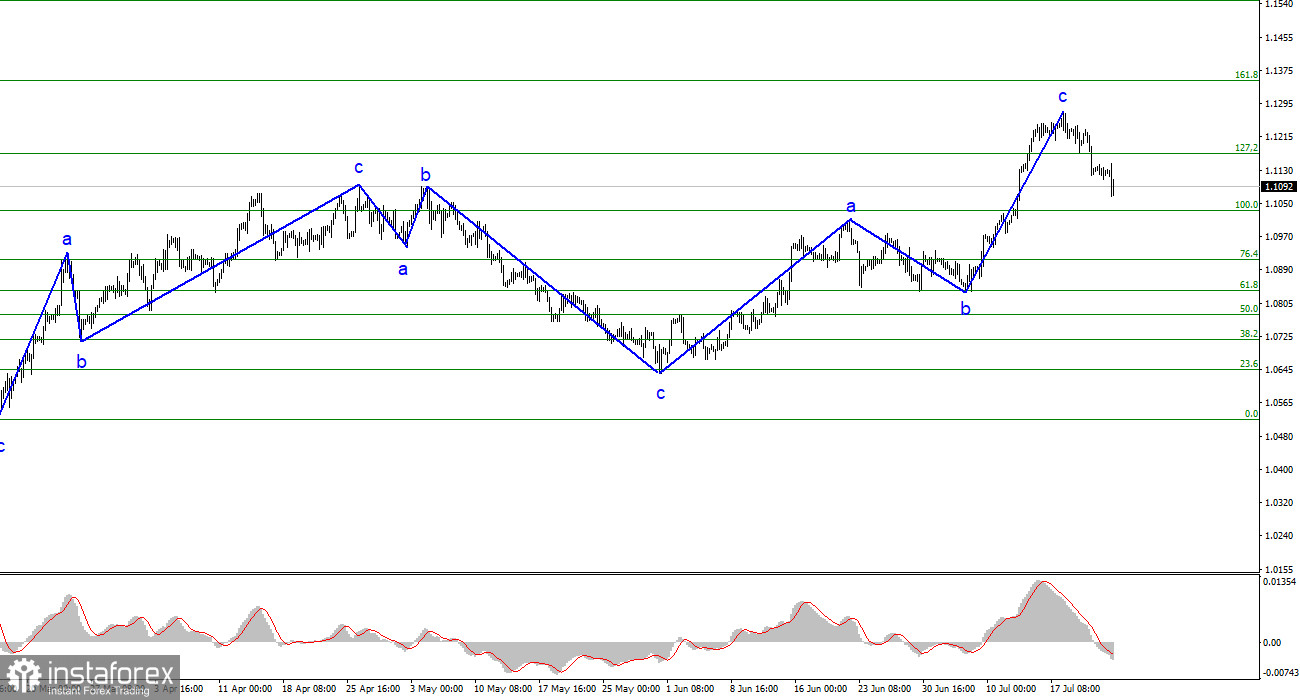

The trend segment that began on May 31 could take on an impulsive five-wave pattern, but it is challenging to assert this with confidence now. The news background needs more strength to sustain consistently high demand for the euro currency, and economic statistics still need to be improved. A successful attempt to break through the 1.1172 level, corresponding to 127.2% Fibonacci, indicates the market's readiness to sell with targets around the calculated 1.1034 level, equivalent to 100.0% Fibonacci.

Monday marked a negative start for the euro, with a decline of 40 basis points in the euro/dollar exchange rate. While it might seem like a small change, the euro currency's historical amplitude of movements is not high, making 40 points a significant shift. Disappointing statistics from the European Union triggered the decline. The morning brought six reports on business activity in Germany and the European Union, all indicating a decline in July and falling below the market's expectations.

The manufacturing sector has been below the 50.0 mark for over a year, which is unsurprising, given the European Central Bank's year-long practice of raising the key rate. This decline in business activity foreshadows a potential recession. When business activity drops, it adversely affects industrial production volumes and, in turn, GDP. Germany and the European Union have seen this indicator drop to concerning levels.

The services sector's business activity is also intriguing. In the European Union, it grew to 56 points in April but has since declined for three consecutive months, currently at only 51.1. In Germany, business activity in manufacturing has fallen below 40 points; in the services sector, it is 52. Based on this data, it is evident that economic growth in the European Union will continue to slow down, with GDP increasingly entering negative territory. This situation may compel the European Central Bank to finalize the process of tightening its monetary policy during upcoming meetings. Such a news background creates an excellent environment for considering a descending wave pattern.

Based on the analysis conducted, it can be deduced that the construction of the ascending wave pattern is complete. Targets around 1.0500-1.0600 are still considered realistic, making it advisable to sell the pair with these targets in mind. The a-b-c structure appears comprehensive and convincing, and the closure below the 1.1172 mark indirectly confirms the construction of the descending part of the trend. Therefore, I recommend selling the pair with targets around the 1.1034 mark. However, it is crucial to note that the decline should be much stronger if all three waves are indeed constructed.

On a larger wave scale, the wave pattern of the ascending part of the trend has acquired an extensive form, but it is likely completed. The observation of five upward waves, likely the structure of a-b-c-d-e, followed by four three-wave patterns, two downward and two upward, suggests that the pair is now transitioning to constructing another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română