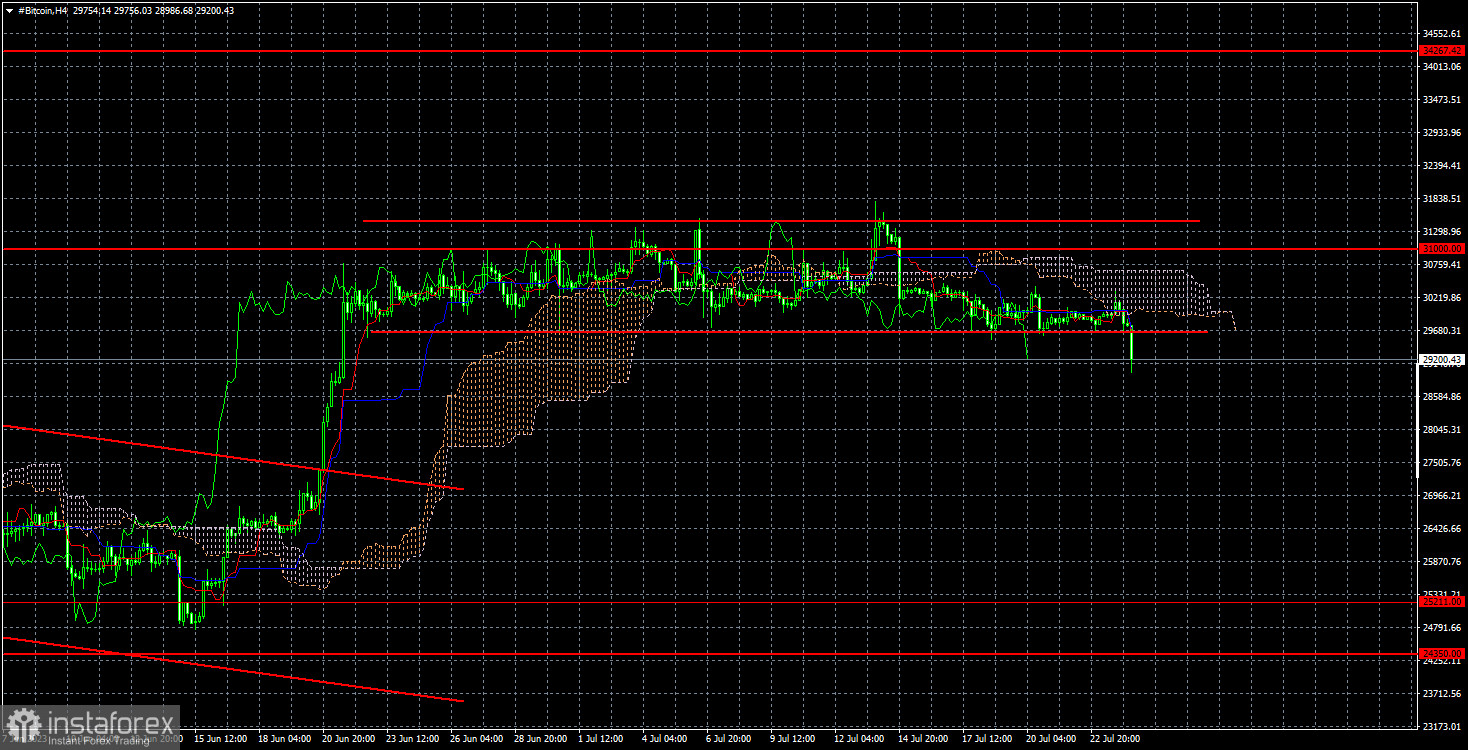

The last candle has not closed yet, so Bitcoin would need to rebound by $700-800 within the next half-hour to avoid the closure. However, we are doubtful that this will happen, and it is more probable that a new wave of cryptocurrency decline is beginning, as it has been anticipated to reach $100,000 for the past two years. In this case, the minimal target is $26,500, but a more realistic correction could lead to $24,350 or even lower. Nevertheless, we won't jump to conclusions; we will monitor the situation.

Meanwhile, as Bitcoin initiates a new downward rally while everyone awaits its growth, Bloomberg's strategists have once again mentioned the possibility of reaching $100,000 by the end of the year. This forecast has been heard for the past 2-3 years. This time, James Stewart voiced the prediction, stating that the approval of the Bitcoin ETF spot instrument will propel the leading cryptocurrency toward $100,000. Six or seven major crypto companies have applied to the SEC to launch this instrument. However, it is still uncertain whether the U.S. Securities and Exchange Commission will approve it, with Stewart estimating the probability at 50-50. It's worth noting that the SEC has been trying to hinder the cryptocurrency market, considering it a direct threat to the financial security of the U.S., though not openly stating so.

According to Stewart, many institutional investors want to invest in Bitcoin. Still, they cannot do so due to the low level of regulation by supervisory authorities and the weak legislative framework concerning cryptocurrencies and digital assets. The launch of the Bitcoin ETF on exchanges could resolve this problem. It is essential to remember that this is merely Stewart's opinion. Eric Balchunas, his Bloomberg colleague, also views the launch of the Bitcoin ETF as a strong growth factor for the leading cryptocurrency, referring to the opinion of another Bloomberg analyst, Elliott Stein.

The legal battle between the SEC and Grayscale over the latter's refusal to convert its Bitcoin Trust into a spot ETF is ongoing. As we can see, the SEC is suing anyone it can to prevent Bitcoin's integration into the U.S. financial system.

On the 4-hour timeframe, the cryptocurrency commenced a decline that could last several weeks. It is a favorable time for short positions. The target is $26,500, and then possibly $24,350. There are no signals for buying, but they may appear around the ascending trendline in the 24-hour timeframe or the range of $24,350 to $25,211. Nevertheless, reaching that area is still pending.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română