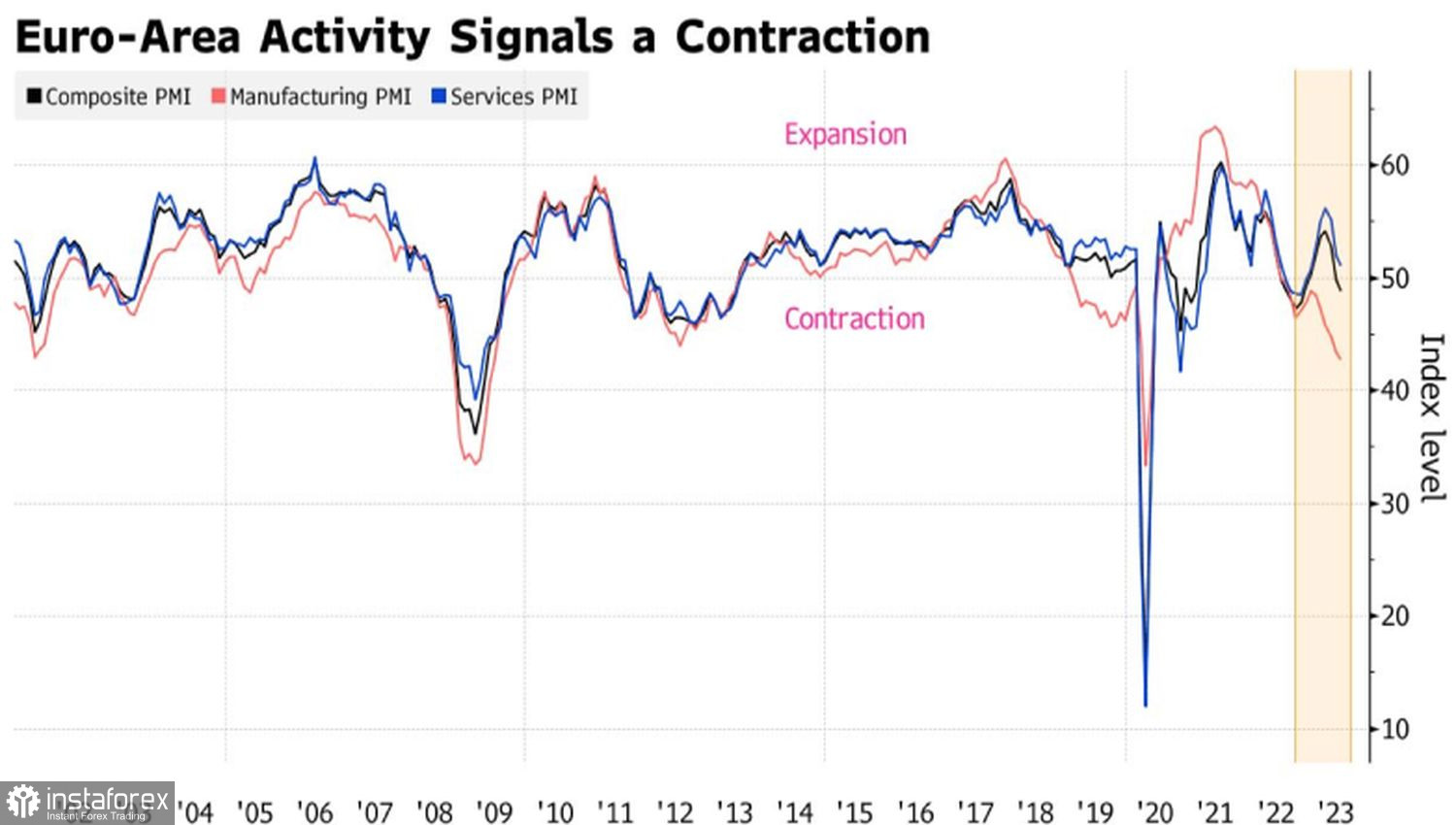

"The higher you rise, the harder you fall." Without support from the economy, it is difficult to count on the continuation of the upward trend in EUR/USD. Unfortunately, not everything is in order with the eurozone. The composite purchasing managers' index in the currency bloc fell from 49.9 to 48.9 in July, the lowest reading since November. Moreover, its actual value turned out to be worse than any economist forecast in the Bloomberg survey.

The main problem remains in the manufacturing sector, although business activity in the services sector is also slowing down. It is likely to continue doing so as the industry loses momentum. As a result, the eurozone will continue to balance on the brink of a recession. In such conditions, the "bulls" on EUR/USD will have to come down. The pair rose too high, and now it is paying the price for the euphoria.

Dynamics of business activity in the eurozone

The two leading economies of the eurozone—Germany and France—face the main difficulties. Germany's purchasing managers' index fell to its lowest level in 2023 and below the critical mark of 50. Its counterpart in France collapsed to a 32-month low. The currency bloc is sliding downhill, and traders are asking themselves a logical question: is the ECB about to start a 400 bps monetary policy tightening? The most aggressive move in its history. And will this lead Christine Lagarde to stop raising rates?

Currently, Bloomberg experts forecast borrowing costs to rise to 4%, but the futures market leans towards the cycle's completion in July. Investors will be waiting for hints on when exactly from the ECB's Governing Council meeting. According to Nordea, if the European Central Bank announces that core inflation will remain high, it will be a "hawkish" surprise and cause a rise in EUR/USD. If it maintains data dependency, there won't be any strong reaction from the main currency pair. Finally, a statement about progress in fighting inflation and uncertainty about further rate hikes can be seen as "dovish" dominance. In such a scenario, the euro will continue to fall.

ECB rate dynamics in different cycles

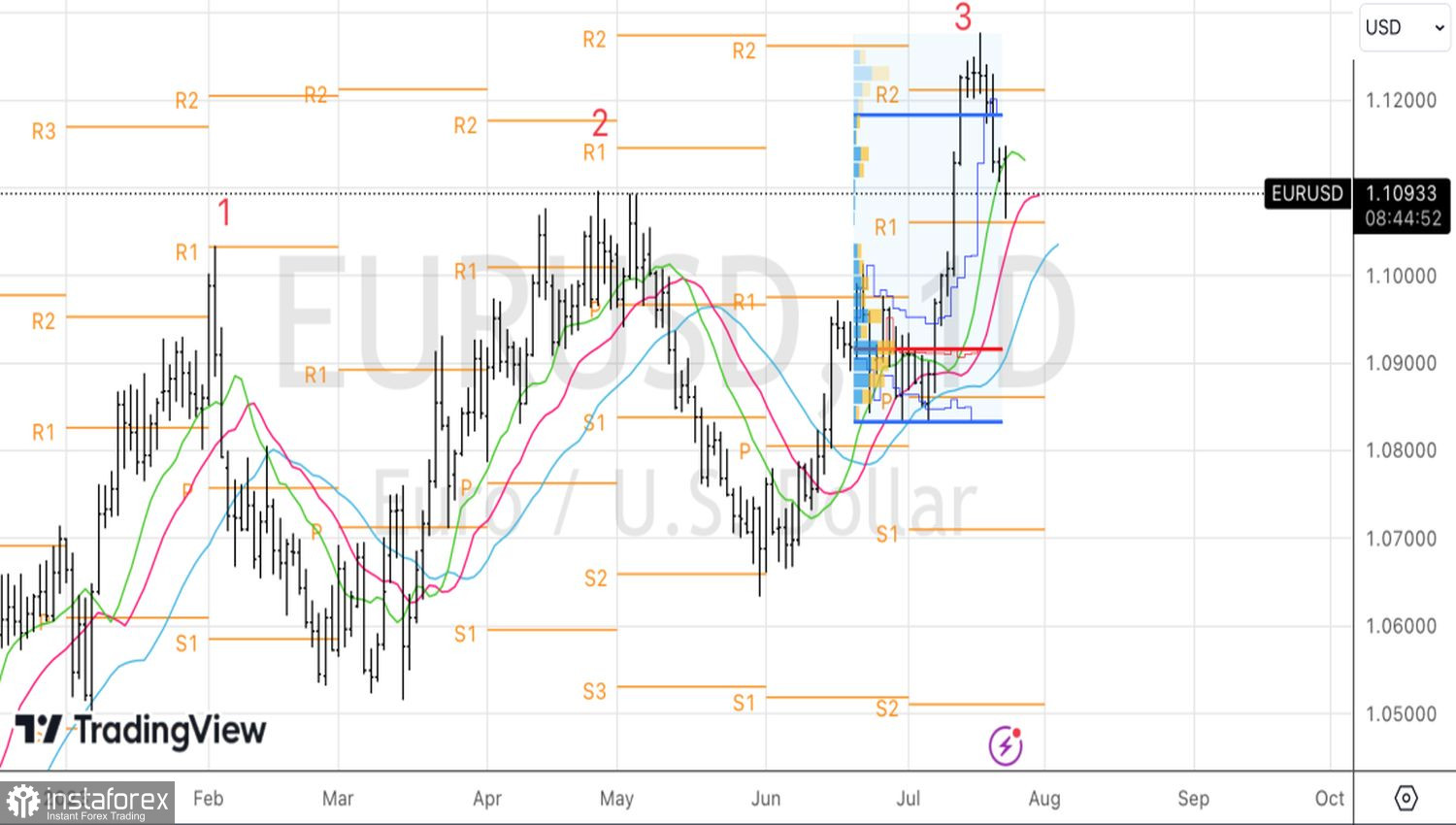

However, first, EUR/USD must pass the test of the Fed meeting. Will the American central bank abandon its June forecasts of a federal funds rate hike to 5.75% amid consumer price growth slowing down to 3%? Or will it continue with a "hawkish" rhetoric? The dynamics of U.S. Treasury bond yields and their spread with German debt obligations depend on this. According to ING, it is precisely the changes in spreads that determine the fate of the main currency pair. And they signal the resilience of the U.S. dollar.

Technically, on the daily chart, EUR/USD continues the Three Indians pattern implementation. The pair tested the first moving average. It will be possible to talk about its purchases in the case of a return above 1.1145 or on a rebound from 1.106. For now, we remain in the short positions formed from 1.12.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română