Long positions on GBP/USD:

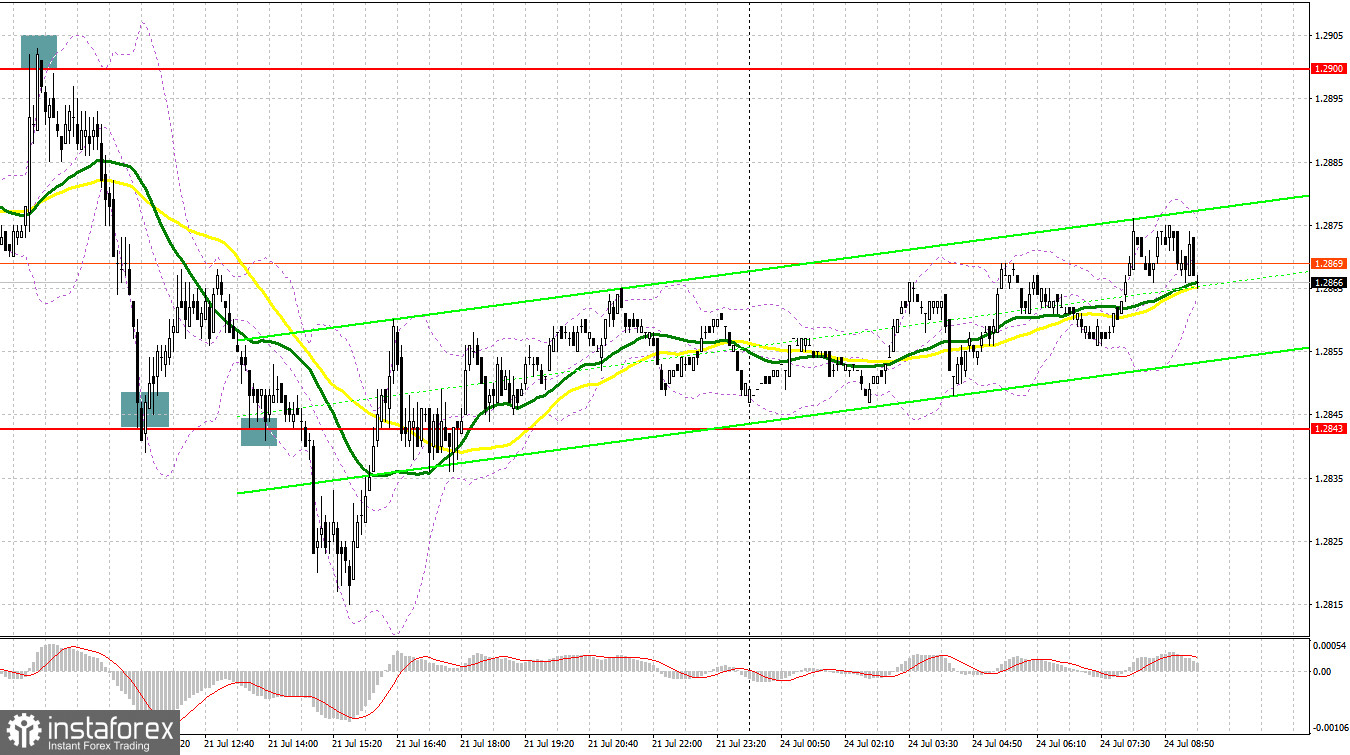

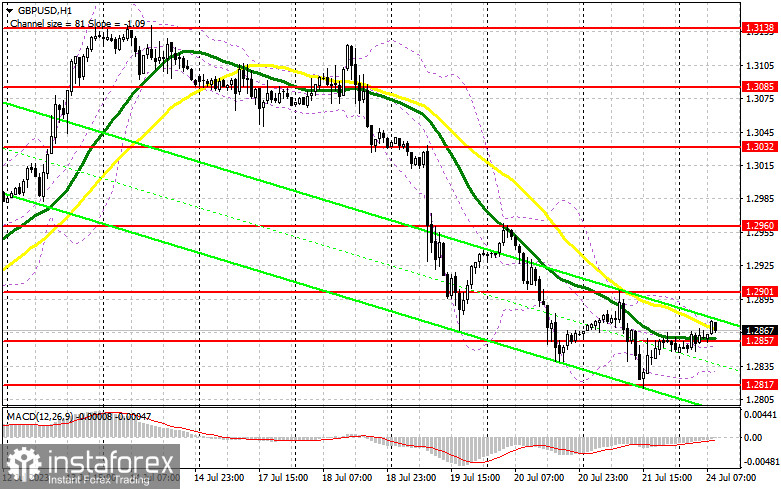

Today, there are quite important data releases for the UK, indicating economic activity. The manufacturing PMI is expected to decline, pushing the economy into a recession, while traders will focus on the services PMI as it represents a significant economic sector and remains above 50 points, indicating growth. A decrease in the composite PMI will put pressure on the pair. Hence, bulls will have to defend the midpoint of the new sideways channel at 1.2857, where the moving averages are located. A false breakout there will provide an entry point for long positions, capable of pushing upwards to the nearest resistance at 1.2901. Breaking and holding above this range will create an additional buying signal with a target of 1.2960, compensating for most of yesterday's losses. The next target will be located at the resistance of 1.3032, where traders may take profits.

In the scenario of a decline to 1.2857 and low activity from bulls, the pound may continue to fall within the descending correction, which could evolve into a bearish trend. In such a case, only defending the next area at 1.2817, along with a false breakout, is likely to provide a signal for opening long positions. I plan to buy the pound on a rebound only from 1.2754, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears remain active, and today's important task is to defend the resistance at 1.2901, which serves as the upper boundary of the short-term sideways channel. In the event of the pair's rise after strong PMI data from the UK, only a false breakout at this level may give a sell signal, continuing the downward correction towards 1.2857, increasing the pressure on the pair. Breaking and retesting the bottom of this range is likely to blow bulls' positions, offering the chance for a larger decline towards 1.2817. The next target remains at 1.2754, where profits can be taken.

In case of the rise and no significant activity at 1.2901, bears' confidence may waver, and bulls will likely return to the market, hoping that the UK economy can withstand the tough period of high interest rates. In that case, it would be better to postpone selling the pound until the test of the resistance at 1.2960. A false breakout there could provide an entry point for short positions. If there is no downward movement there, one may sell the pound on a rebound from 1.3032, allowing an intraday correction of 30-35 pips.

COT report:

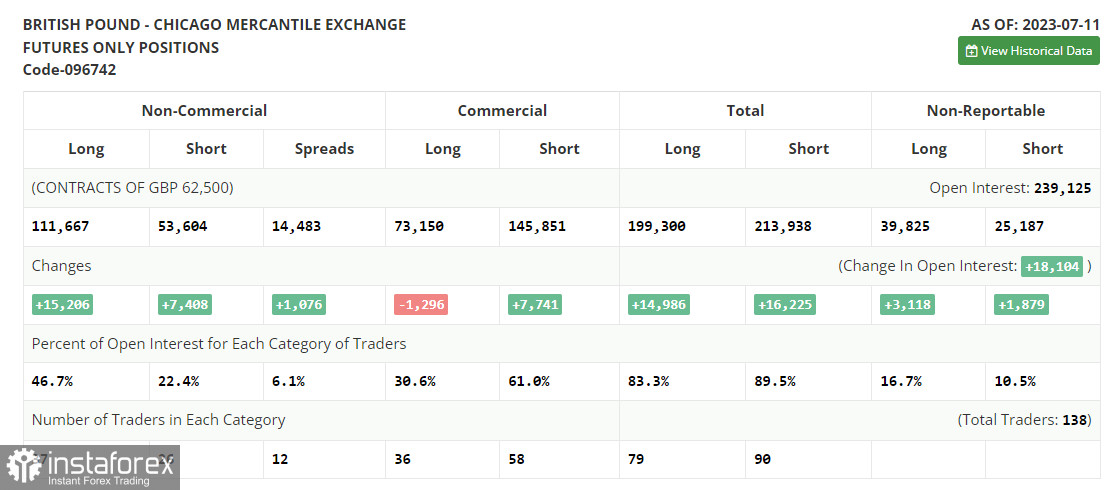

In the COT report for July 11, there was an increase in both long and short positions. However, bulls outnumbered bears by two to one, confirming the bullish market trend we have been observing throughout this month. Pound bulls definitely have all the chances to continue acting more aggressively. On the one hand, the Fed is satisfied with the rapid decline in inflation, reducing the likelihood of further rate hikes. On the other hand, the Bank of England, despite all the economic problems, will continue to maintain a high-interest rate policy due to serious inflation issues affecting households' living standards. The difference in policies will lead to a strengthening of the British pound and a weakening of the US dollar. The optimal strategy remains to buy the pound on dips. The last COT report shows that long non-commercial positions increased by 15,206 to 111,667, against 96,461, while short non-commercial positions rose only by 7,408 to 53,604, against 46,196. This led to another upward surge in non-commercial net positions to 58,063, against 50,265 a week earlier. The weekly price increased and reached 1.2932 against 1.2698.

Signals of indicators:

Moving Averages:

The pair is trading near the 30- and 50-day moving averages, indicating a sideways market trend.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary at 1.2840 will provide support.

Descriptions of indicators:

- Moving average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and are subject to certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between traders' short and long non-commercial positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română