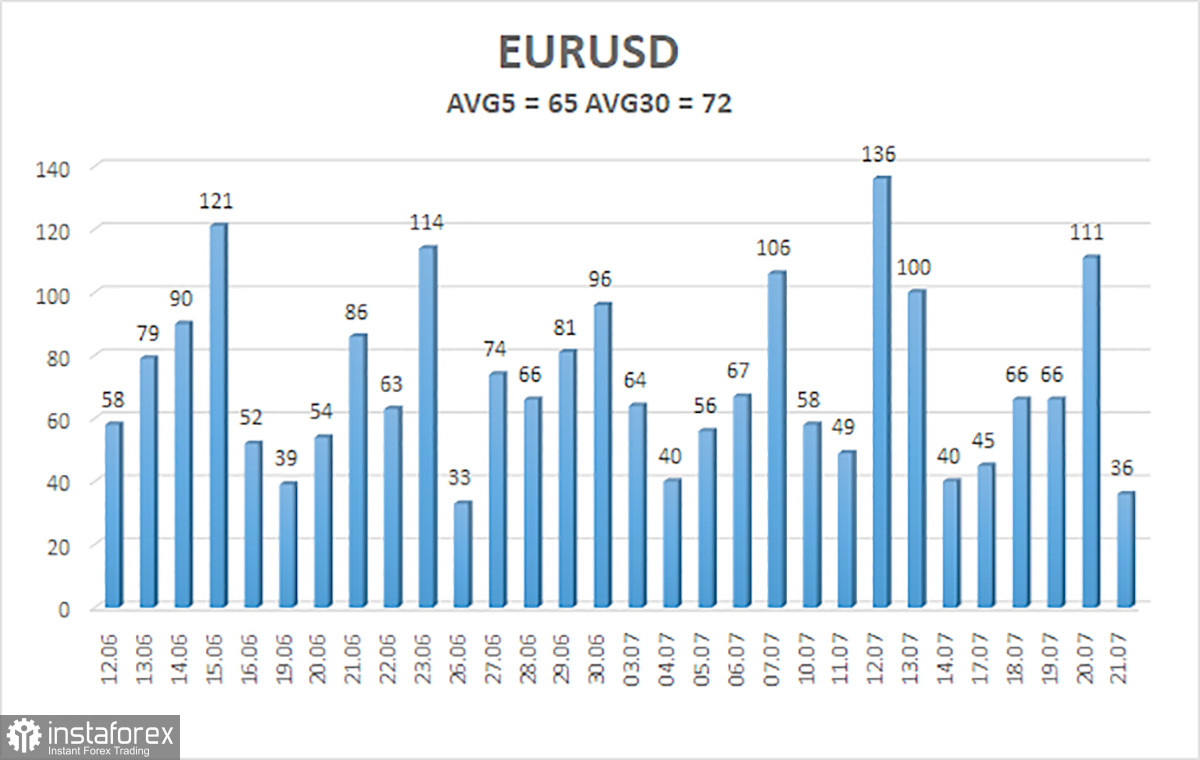

The EUR/USD pair continued to decline on Friday but volatility dropped sharply to almost zero. It fell by only 36 pips to touch the intraday low. With such volatility, spectaculars should keep positions open for at least a few days to make a profit. Thus, last week only on Thursday there was an opportunity to generate a profit as the pair had been moving a narrow range for the whole week. As the Heiken Ashi indicator did not rise, traders did not close short positions.

A new week has kicked off with the publication of PMI Indices. PMI indices are leading indicators. If they decline, it signals a contraction in industrial production, GDP, and other indicators. As the key level is 50.0, any value below it is considered negative. The more the index falls, the worse things are in the industry. There has been a negative trend in the services and manufacturing sector in the European Union for a long time. However, the service sector still hovered above 52 last month. The manufacturing sector is slowly approaching 40. By the end of July, the situation will hardly change.

Germany is facing the same problem. The PMI Manufacturing Index may dive to 40 this month, which is a negative sign for the economy. The EU economy continues to cool. It managed to avoid a recession amid the strong service sector and retail sales. Thus, fresh PMI macro stats are unlikely to impact the pair because the readings are expected to be in line with predictions. Otherwise, one needs to look in which direction there could be a deviation from the forecast values.

GDP for first quarter revised

According to Eurostat, the GDP figures for the first quarter have not been revised. The official GDP report showed a decrease of 0.1% for the second quarter in a row. However, this reading was revised upwards to 0.0% in quarterly terms. In fact, this revision has not changed anything. Hardly anyone can call the economy shrinking by 0.1% a recession, especially in annual terms. Nevertheless, the economy did not expand as well. It has been stagnating for several quarters in a row. As the ECB continues to tighten monetary policy, economic growth is projected to remain low. If things worsen markedly, the economy could decline by 0.2-0.4% per quarter which will bring it closer to the annual negative levels which can already be considered a recession.

Nevertheless, analysts note that the EU economy is coping well with aggressive tightening. If the ECB plans to raise the key rate above 5%, problems may arise. However, the regulator is likely to hike it one or two more times. A few months ago I talked about the end of the tightening cycle. I believe that the ECB will raise the key rate this week before taking a pause. Perhaps the regulator could undertake another rate increase in the autumn but many policymakers are against such a step.

If this scenario comes true, the euro will lose one of the main drivers. By the end of the year, the Fed may already begin to ease monetary policy, which is negative for the US currency. However, the latter has not been growing for 10 months.

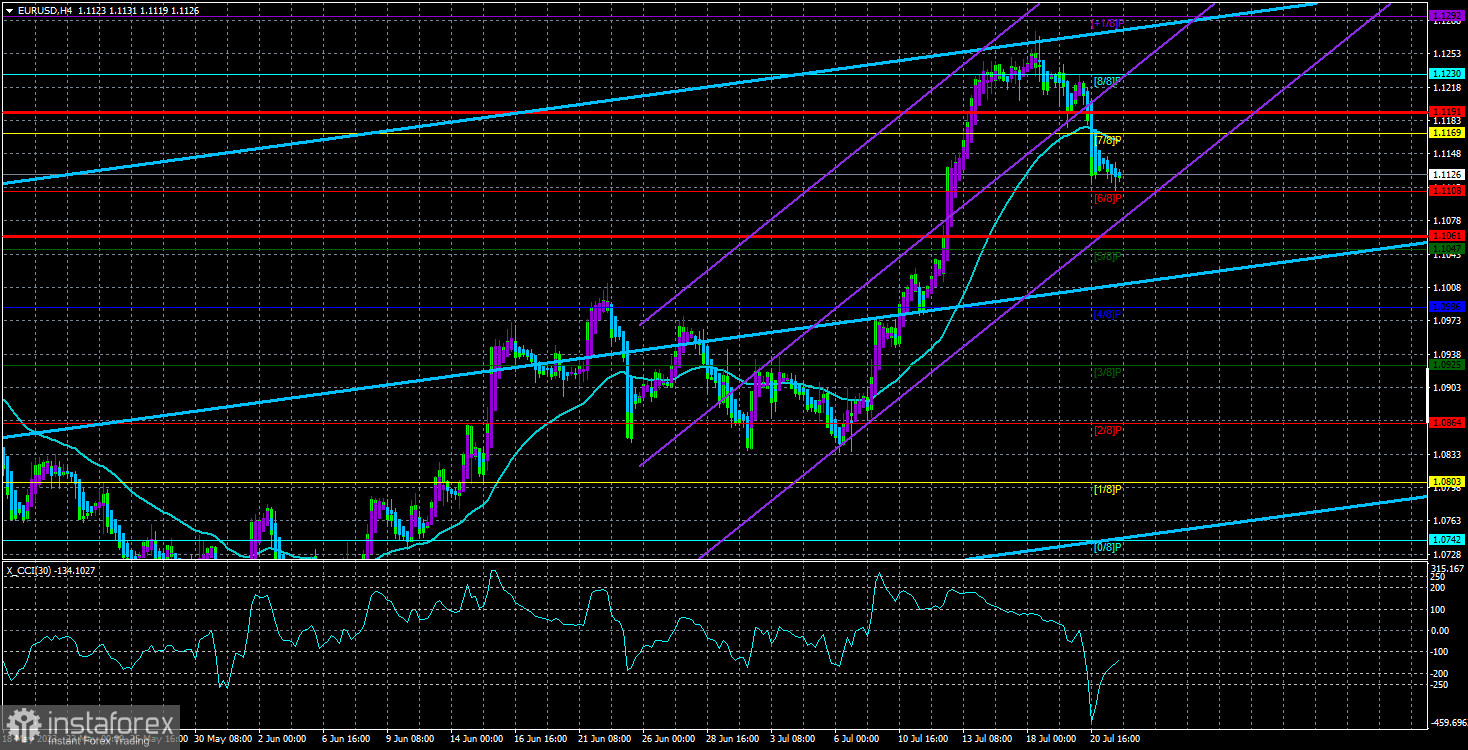

The average volatility of the euro/dollar pair over the last week totaled 65 pips. Thus, I expect the pair to move between the levels of 1.1061 and 1.1191 on Monday. The upward reversal of the Heiken Ashi indicator will signal an upward correction.

Support levels:

S1 – 1.1108

S2 – 1.1047

S3 – 1.0986

Resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The EUR/USD pair has started a downward correction. The question is how long it will last. At this time, I would advise you to open short positions at 1.1108 and 1.1061 until the Heiken Ashi indicator rises. It is better to open long positions when the price consolidates above the moving averages with targets of 1.1230 and 1.1292.

Description of chart:

Linear regression channels help to determine the current trend. If both channels are directed in the same direction, the trend is strong now.

Moving averages (20-period SMMA, smoothed) show the short-term trend and the prevailing trend.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel where the pair could move the next day based on current volatility indicators.

The CCI indicator. If it enters the oversold area (below -250) or the overbought area (above +250), it means a trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română