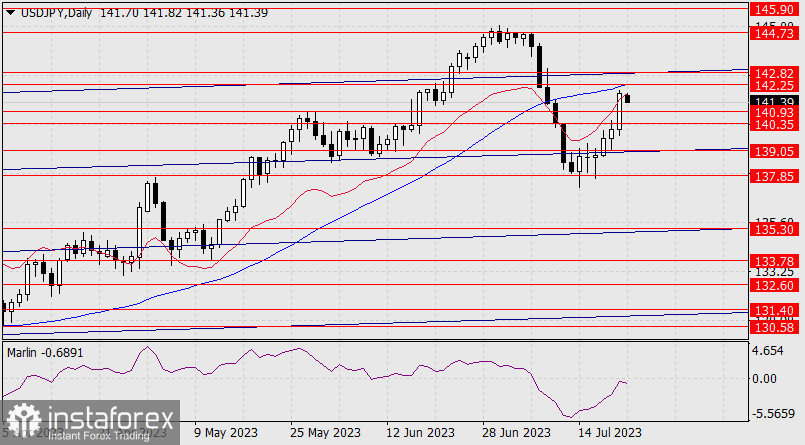

USD/JPY:

On Friday, the dollar sharply grew by more than 170 pips. However, the price did not reach the target resistance level at 142.25 (the high of November 21, 2022) and the MACD line, which coincides with this level. Furthermore, the Marlin oscillator did not reach the border of the growth territory.

It is possible that the market may still test these resistance levels or even move higher towards the embedded price channel line at 142.82. Afterward, it may continue to rise if it consolidates above 142.82 or possibly reverse into a medium-term decline, aiming for around 135.30. If the dollar intends to continue rising, it also has the possibility to extend it from the support range at 140.35/93. Falling below the lower band of this range (140.35) would strengthen the bearish sentiment towards the nearest target at 139.05.

On the four-hour chart, the general trend is bullish. The Marlin oscillator is trying to relieve pressure near the overbought territory and possibly facilitate a subsequent synchronous upward reversal with the price. Under this scenario, the price would aim for either 140.93 or 140.35.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română