Long-term perspective.

The GBP/USD currency pair dropped 260 points during the current week. The pound showed a decline in all five trading days, with the macroeconomic event that could have triggered the pair's decline during the week being only one – on Wednesday. On this day, the inflation report for the UK in June was published, showing a more significant slowdown than traders expected. It's unlikely that we can now say the Bank of England no longer needs to raise rates. Still, a more pronounced inflation slowdown is good news for the British regulator and slightly reduces the likelihood of an extended tightening of monetary policy. And so, the British pound experienced certain factors for its decline. But the situation is very unusual, and here's why.

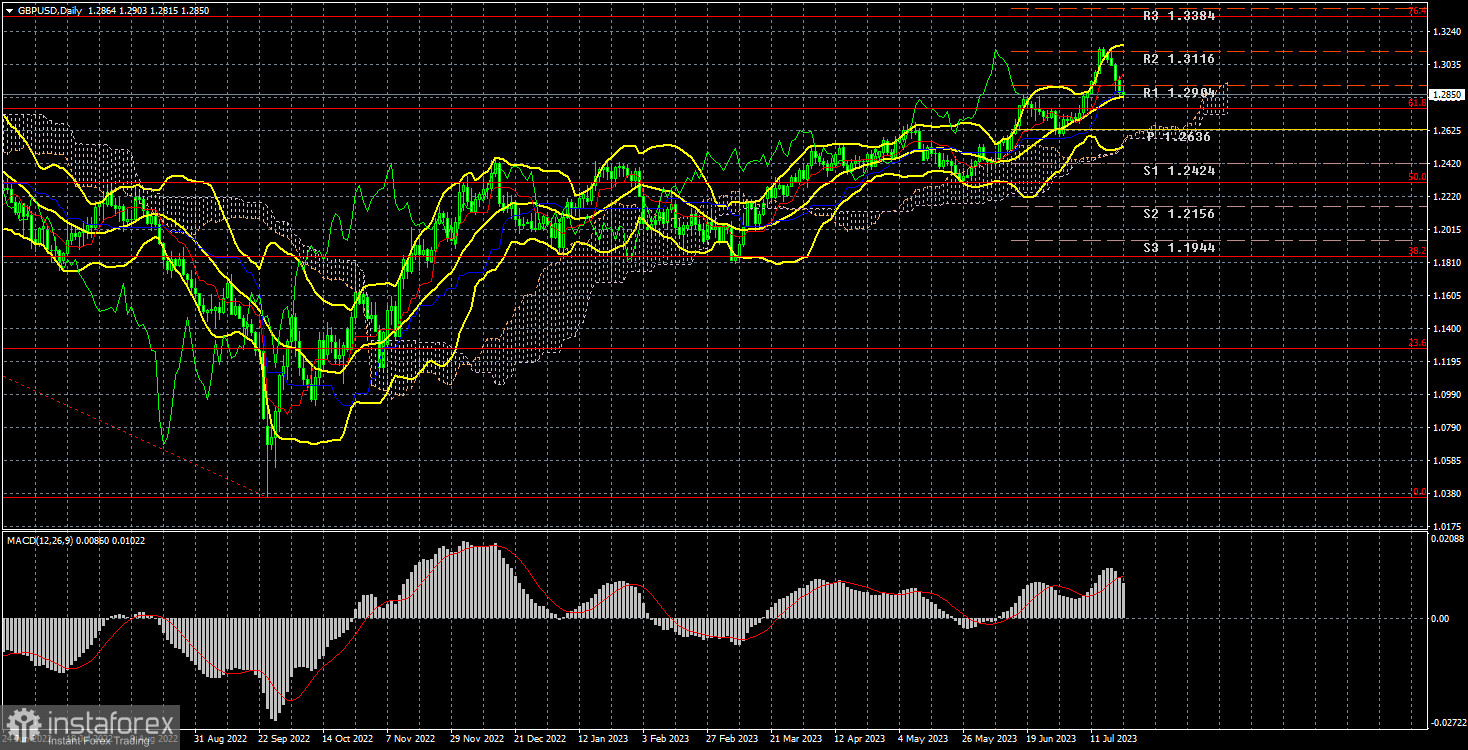

At the same time, the pound maintains an upward trend and a strong one at that. The price has not been able to solidify below the critical line, so everything we've witnessed so far is just a pullback. However, the pound is currently so overbought that it doesn't need macroeconomic or fundamental reasons for a decline. There appear to be enough factors supporting both growth and decline at the moment. Which of these factors will be more significant for the market?

We do not expect the pound's growth to continue in the medium term. However, it's important to note that this is just an assumption, not an action guide. One should strive to trade with the trend rather than trying to catch its end. There are no signs of the trend ending on the daily timeframe. On the 4-hour timeframe, such signs exist, but on that timeframe, we can only see a local trend, which would be considered a downward correction for the daily timeframe. If the pair consolidates below the Kijun-sen line, it will be possible to consider a more serious discussion of the decline of the British currency. If the Bank of England starts signaling the end of the tightening cycle of monetary policy, then a strong and prolonged pound decline can also be expected.

COT Analysis.

According to the latest report on the British pound, the "Non-commercial" group opened 23.6 thousand buy contracts and 17.9 thousand sell contracts. As a result, the net position of non-commercial traders increased again by 5.7 thousand contracts this week and continues to grow overall. The net position indicator, as has the British pound, has consistently risen over the last ten months. We are approaching the point where the net position has increased too much to expect further pair growth. A prolonged and significant decline of the pound should begin. COT reports suggest a slight strengthening of the British currency, but believing in it becomes increasingly challenging daily. It's difficult to say based on what the market can continue buying. However, there are currently no technical sell signals.

The British currency has risen by 2800 points from its absolute lows reached last year, which is significant. Without a strong downward correction, further growth would be completely illogical. However, more logic has been needed in the pair's movements for a long time now. The "Non-commercial" group currently holds 135.2 thousand contracts for buying and 71.5 thousand for selling. We remain skeptical of the long-term growth of the British currency, but the market continues to buy, and the pair keeps rising.

Fundamental Events Analysis.

There were a few important macroeconomic events in the UK this week; we already mentioned the inflation report. Besides that, data on retail sales were released, which turned out to be higher than forecasted but had no impact on the pair's movement. In the US, only secondary data was published in small quantities. On Tuesday, the retail sales report was released, which was slightly below expectations, followed by industrial production, which was significantly below expectations. On Thursday, there were jobless claims, which were lower than market expectations. However, all these reports also had no significant impact on the pair's movement. Therefore, at this time, we need to wait for the meetings of the ECB, FRS, and the Bank of England, which can help determine the further direction of movement for the two main pairs.

Trading plan for the week of July 24th to July 28th:

- The GBP/USD pair attempted to start a new correction but couldn't even consolidate below the critical line. Each new attempt to correct looks rather pitiful. The price is above all the Ichimoku indicator lines, so long positions can be considered. A rebound from the Kijun-sen line could trigger a new upward surge. The growth may be chaotic, weak, inertial, or illogical. The target is the Fibonacci level of 76.4% (1.3330).

- As for selling, there currently needs to be technical reasons for it. Therefore, one should wait for consolidation below the Kijun-sen line to open small shorts. Selling on such a strong trend is dangerous and simply foolish, but buying without understanding why the pound is rising and when its "fairy tale" will end is also a questionable pleasure. The situation is unconventional and clearly at an impasse.

Explanations for the illustrations:

Price support and resistance levels, Fibonacci levels - these are the targets when opening buy or sell positions. Take Profit levels can be placed near them.

Indicators: Ichimoku (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts - the net position size for each category of traders.

Indicator 2 on COT charts - the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română