The USD/JPY pair surged upwards today, gaining over 200 points within a short timeframe. The price dynamics were driven by a combination of factors: the strengthening of the American currency due to rising market risk aversion and the weakening of the yen caused by a contradictory inflation report. Additionally, the insights published by Reuters about the potential outcomes of the Bank of Japan's July meeting played a role in shaping market sentiment. With this fundamental background, USD/JPY buyers approached the resistance level at 142.00 (the upper Bollinger Bands line on the D1 timeframe). Although traders did not break this price barrier impulsively, the overall sentiment towards the pair remains bullish.

Contradictory release

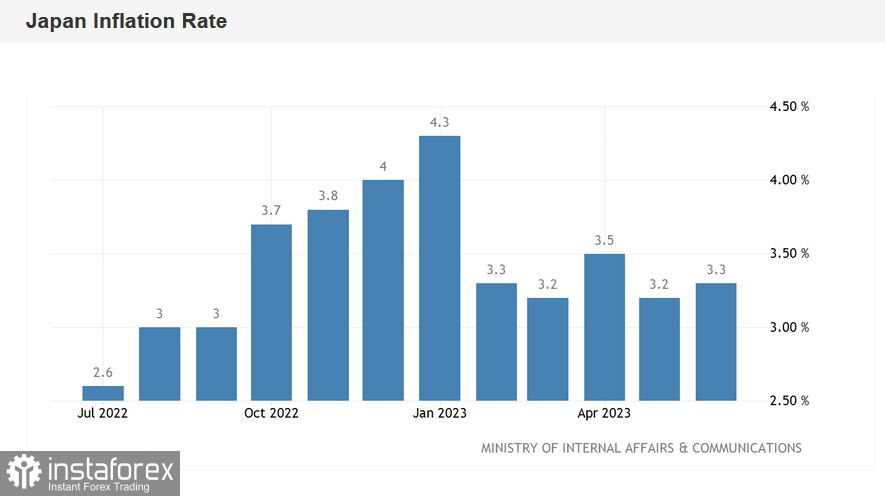

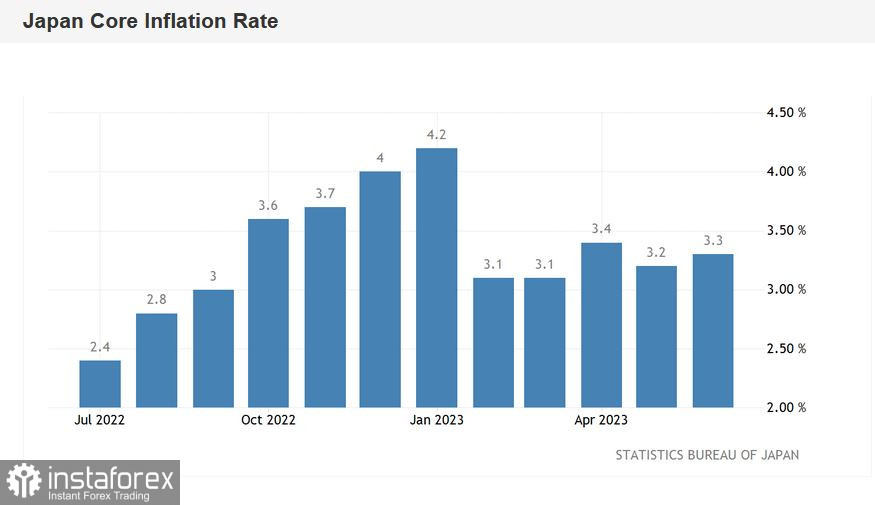

Let's delve into the inflation report that Japan published during the Asian session on Friday. It presented a mixed picture: on the one hand, it indicated a slight acceleration in inflation in June, but on the other hand, almost all of its components fell short of the forecasted values. For example, the overall consumer price index reached 3.3%, while the forecast projected a growth of 3.5%. This component stood at 3.2% in May, and in April, it was at 3.5%. Thus, today's data confirmed an increase in the indicator, but this growth was more modest compared to most experts' predictions.

The core consumer price index, which excludes fresh food (a crucial indicator monitored by the country's central bank), also increased by 3.3% in annual terms last month. The indicator's growth slightly accelerated from the May value of 3.2%. The core CPI has remained above the Bank of Japan's two percent target level for 15 consecutive months.

The report's breakdown shows that food prices in Japan rose by 8.4% in June, real estate costs increased by 1.1%, transportation services became more expensive by 2.2%, furniture and household goods rose by 8.6%, and clothing rose by nearly 4%. However, in some areas, inflation is slowing down. For instance, utility services have been getting cheaper for the fifth consecutive month, with the indicator showing a decline of 6.6% in June (including a 12.4% drop in electricity costs).

Yen under pressure

Despite the actual increase in inflation, the yen did not benefit from today's release. On the contrary, the USD/JPY pair surged from 139.70 to 141.96 within a few hours. As mentioned earlier, this price movement was influenced by various factors.

First, the inflation report did not reveal any significant breakthrough, indicating that it is essentially inconsequential in the context of the upcoming Bank of Japan meeting, and it will not result in any tightening of the central bank's rhetoric or alterations to monetary policy parameters in response to today's release.

This supposition is supported by the insights from Reuters, leading us to the second point.

As per the information disclosed by Reuters, the Japanese regulator will maintain its yield curve control (YCC) strategy following the July meeting scheduled for next week. One of the sources from the agency mentioned that despite the rise in inflation, the central bank's main concern is whether this growth will be sustainable. According to the source, this factor depends significantly on the next year's corporate profits and wage forecasts. The insider indicated that the Bank of Japan's leadership is firmly inclined to stick with the YCC management strategy.

The information published by Reuters exerted considerable pressure on the Japanese currency. The yen weakened not only against the dollar but also against major cross pairs. Interestingly, buyers of USD/JPY ignored Japan's Vice Finance Minister Masato Kanda (who serves as the chief currency diplomat) when he intervened verbally, commenting on the fluctuations in the national currency's exchange rate. He asserted that excessive movements in the foreign exchange market are "undesirable," and his ministry is "closely monitoring" the dynamics of the yen.

Normally, traders respond strongly to such rhetoric, but this time, the USD/JPY pair maintains its bullish sentiment, reflecting the overall weakening of the Japanese currency.

Conclusions:

The established fundamental background supports further price growth. The pair is within an ascending channel, demonstrating a strong bullish trend, as confirmed by the Ichimoku indicator, which formed a robust "Parade of Lines" signal on the D1 timeframe.

The price is also testing the middle line of the Bollinger Bands indicator, which is within an expanded channel. The bullish trend is further validated by the MACD oscillator in the oversold region. The nearest support level is the Kijun-sen line, corresponding to the 141.10 mark. The main support lies at 139.50 (the upper boundary of the Kumo cloud, coinciding with the Tenkan-sen line on the same timeframe). The key northern target in the medium-term perspective is the 145.10 level - the highest point of the current year and, simultaneously, the upper Bollinger Bands line on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română