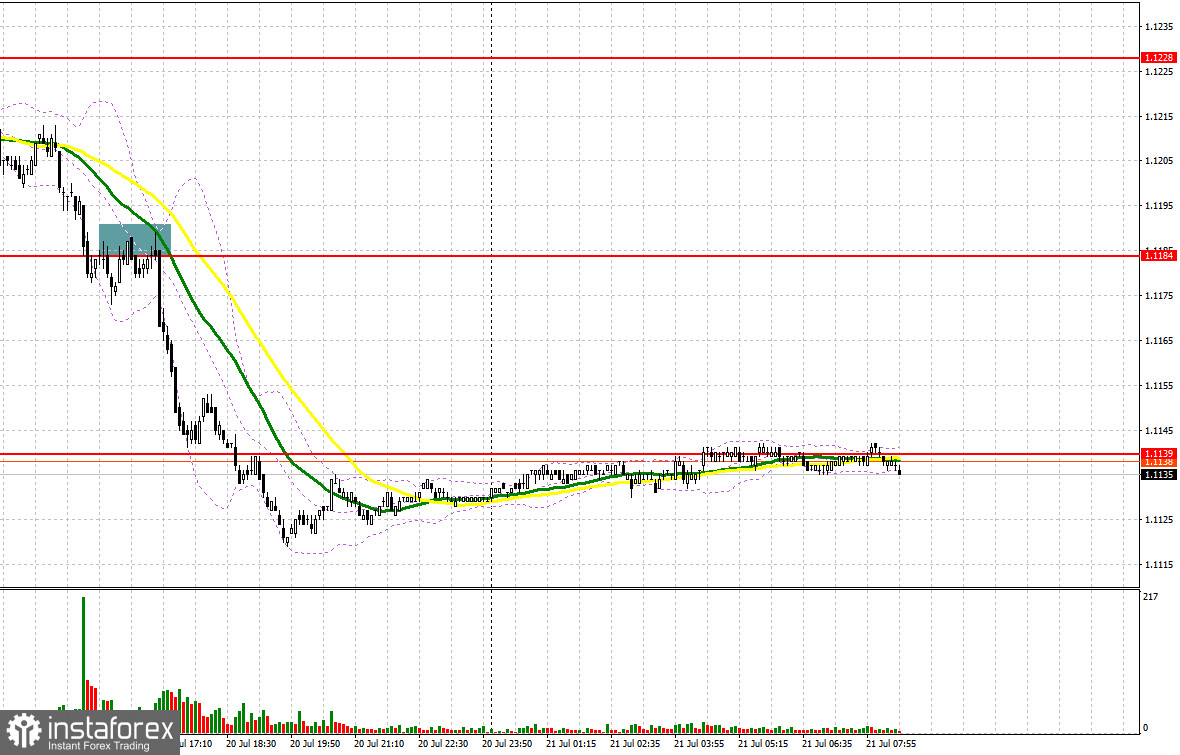

Yesterday, there was only one entry point. Let's look at the 5-minute chart and figure out what actually happened. In my morning forecast, I turned your attention to the level of 1.1228 and recommended making decisions with this level in focus. Considering the fact that the pair went through low volatility, we did not reach the levels I mentioned in my morning forecast. In the afternoon, a breakout and retest of 1.1184 gave a sell signal. As a result, the pair fell by more than 40 pips.

For long positions on EUR/USD:

Today, there is no economic data scheduled in the calendar, so I will rely on technical analysis. I am expecting a scenario where the pair will renew its weekly low in the first half of the day, followed by quick long positions on the euro during the US session right after that. Or it could be the opposite: with the euro rising in the first half of the day, and then a sharp fall in the second half.

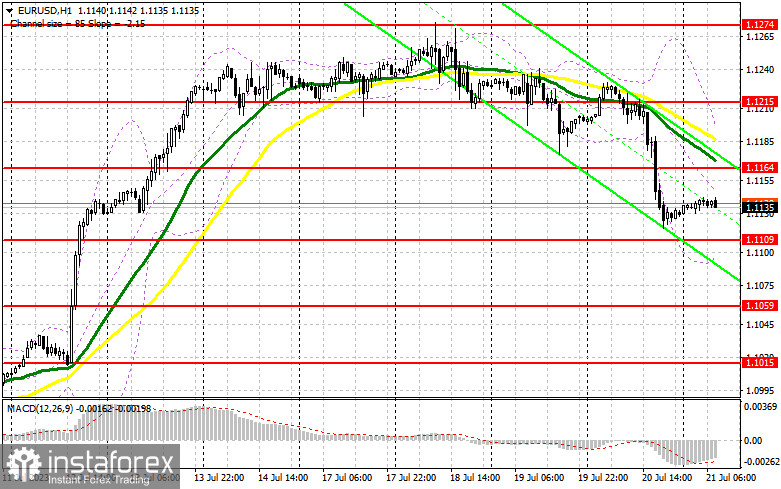

Bullish traders should defend the new support level at 1.1109. A decline and a false breakout of that level will provide a buy signal, in hopes of ending the bearish correction, leading to an upward move with the goal of updating the resistance level at 1.1164. The moving averages in that area favor the bears. A breakout and a downward retest of this level will increase demand for EUR and could pave the way for an attempt to return to the 1.1215 high. The most distant target remains around 1.1274, where I will take profits.

If EUR/USD declines and bulls fail to defend 1.1109, this will be bad for the buyers. Therefore, only a false breakout of the support level at 1.1059 may create entry points into long positions. You could buy EUR/USD at a bounce from the 1.1015 low, keeping in mind an upward intraday correction of 30-35 pips.

For short positions on EUR/USD:

Today presents an opportunity for the bears to build a downward correction, but be extremely careful with selling at weekly lows. To do so, they will need to focus on protecting the resistance level at 1.1164, formed yesterday. I will preferably act only after the pair increases and performs a false breakout of that level. Such a move will create a sell signal and might send EUR/USD down towards the new support level at 1.1109. I expect large buyers to emerge from that level. Should the pair break below the level and consolidate below this range, coupled with an upward retest, a sell signal might be generated, setting the stage for a direct move towards 1.1059. This would indicate a significant euro correction, potentially sparking the interest of bullish traders. The most distant target in this case will be around 1.1015, where I will take profits.

If EUR/USD rises during the European session and bears fail to protect 1.1164, which is possible, the bulls will regain control of the market. In this case, I would advise you to postpone short positions until a false breakout of the resistance level of 1.1215. You could sell EUR/USD at a bounce from 1.1274, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

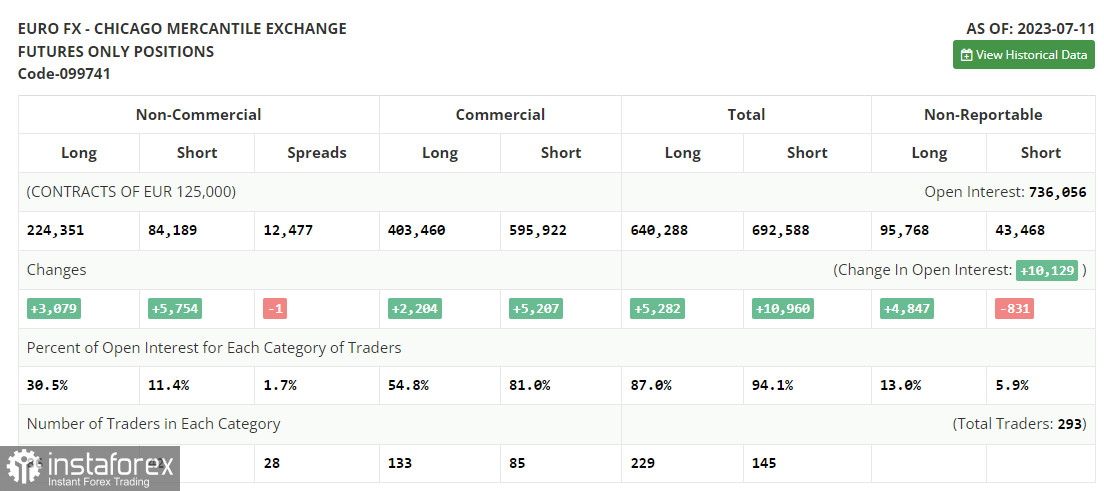

The Commitment of Traders (COT) report for July 11 showed that both long and short positions increased, maintaining the market balance in favor of euro bulls. The released inflation data in the US, indicating a sharp slowdown, particularly in core prices, significantly influenced euro bulls. As a result, EUR/USD broke yearly highs beyond the psychological 1.1000 level, which had remained untouched for nearly six months. The fact that the Federal Reserve no longer needs to raise interest rates makes the US dollar relatively weak. While the market remains bullish, buying euro on dips remains the optimal medium-term strategy in the current conditions. The COT report indicates that non-commercial long positions increased by 3,079 to 223,351, while non-commercial short positions jumped by 5,754 to 84,189. The overall non-commercial net position slightly decreased to 140,162 from 142,837. The weekly closing price rose to 1.1037 from 1.0953.

Indicator signals:

Moving averages:

Trading is taking place below the 30-day and 50-day moving averages, indicating a possible fall in the pair.

Note: The author considers the period and prices of the moving averages on the hourly chart (H1), which differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.1184 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română