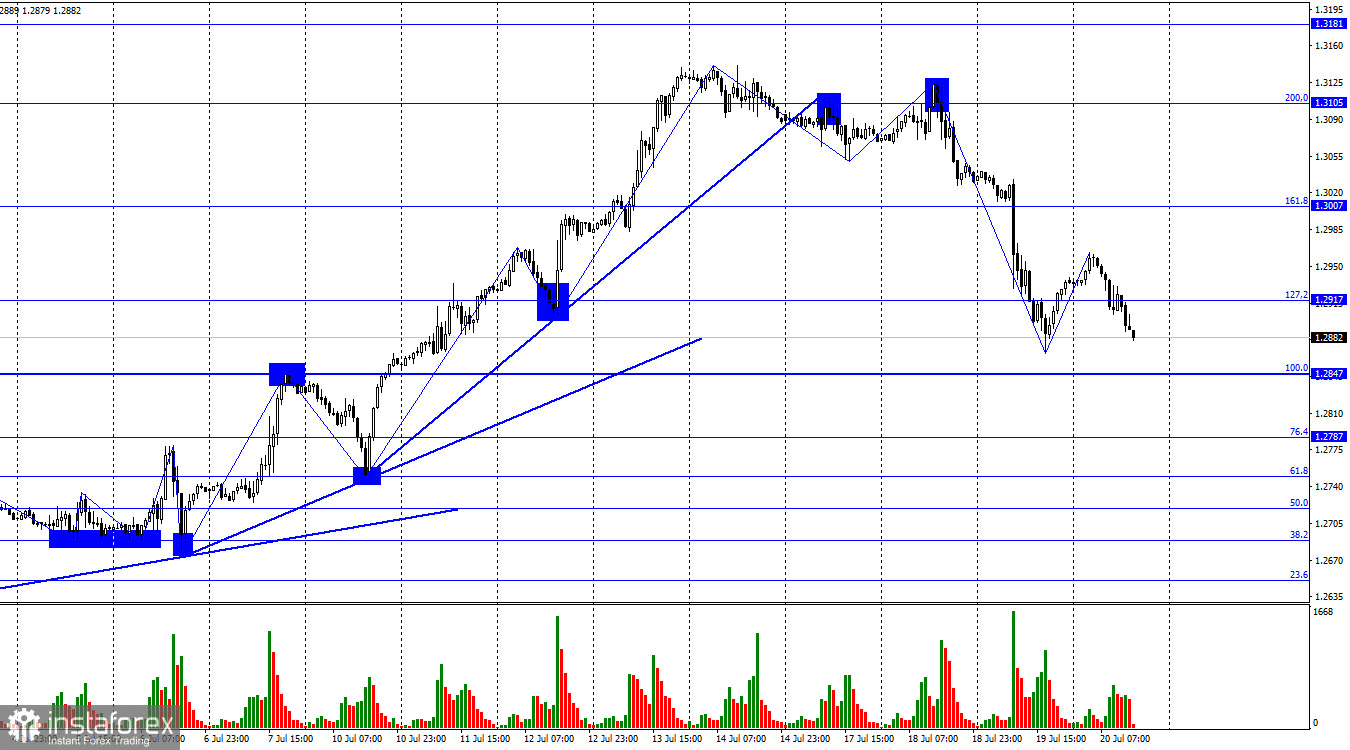

The waves are showing a clear bearish trend. This was evident even the day before yesterday when the low of the last downward wave was broken. Currently, a new downward wave is forming, which has already broken the low of the previous wave. This indicates that the British pound's decline is likely to continue. This is the most reasonable scenario, as in recent weeks, bulls have pushed the pair higher, and the British currency has risen even when there were no reasons for it. Moreover, this does not seem like a typical three-wave correction. There are already more waves, suggesting a potentially strong bearish trend.

Regarding British inflation, there have been no new reports from the UK today. The market began to sell the British pound early in the morning, so two reports from the US, which are usually released around the same time, are unlikely to impact the sentiment. The main point is that bulls have stopped buying when there is no reason to do so. The pound is now returning to trades that reflect the information background and align with it. However, before the balance is restored, the British pound may fall much lower.

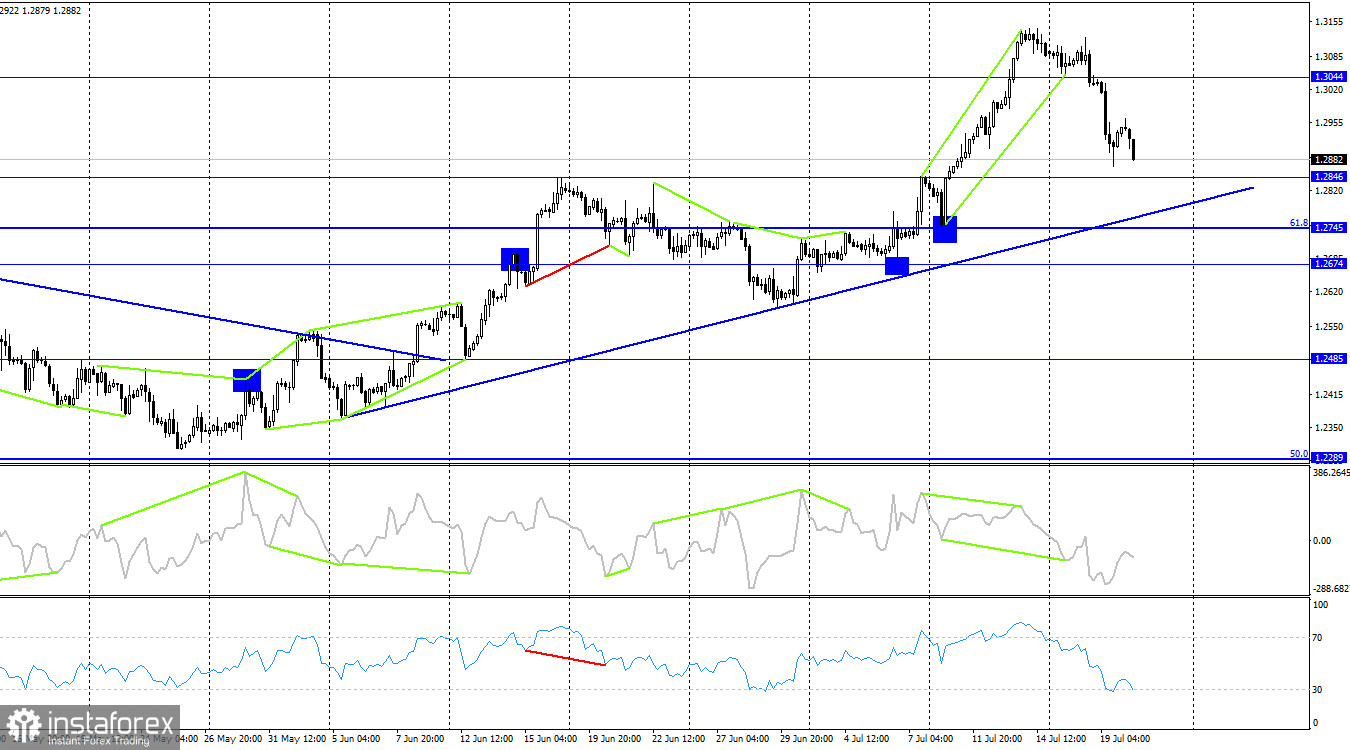

On the 4-hour chart, the pair has reversed in favor of the US currency and settled below the 1.3044 level. As a result, the decline may continue to the levels of 1.2846 and 1.2745. At the moment, there are no emerging divergences on any indicator. The ascending trendline maintains bullish sentiment, but closing below it will finally break the uptrend.

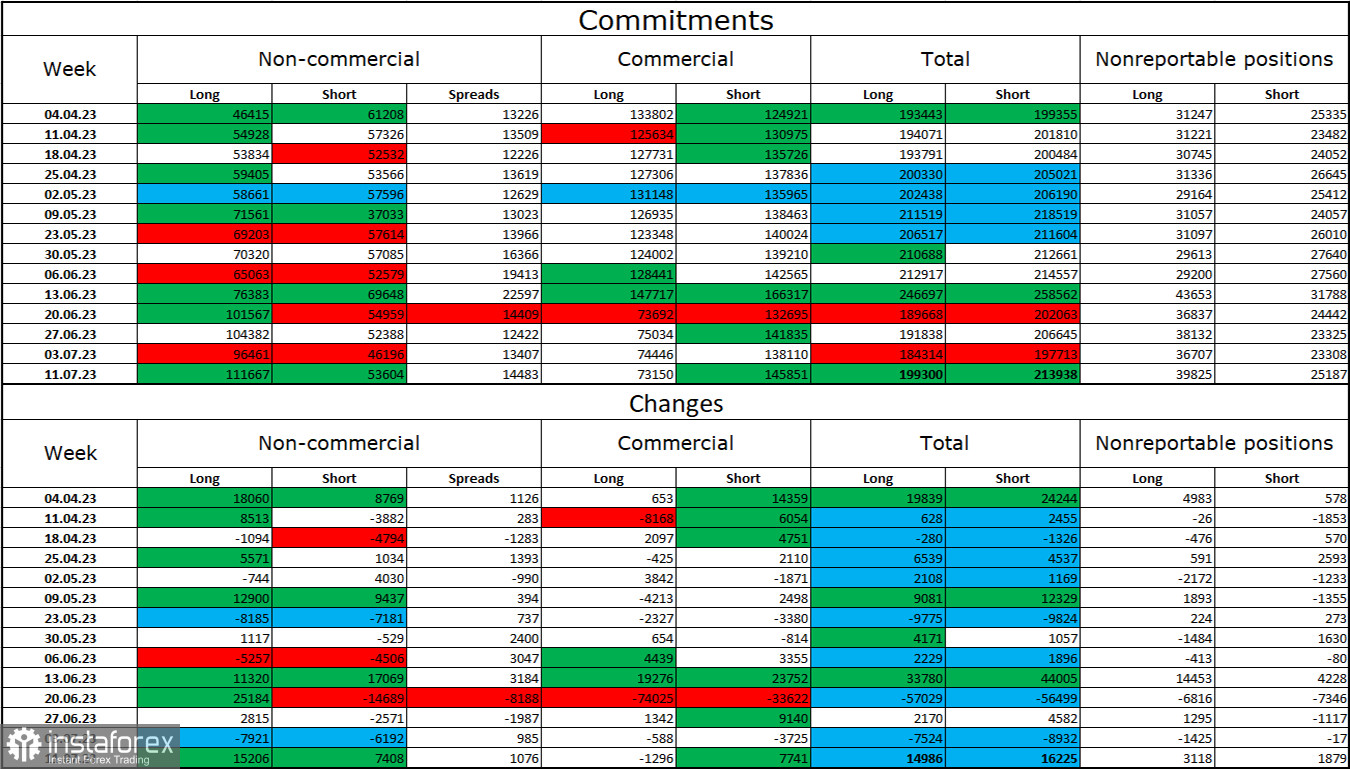

Commitments of Traders report:

The sentiment of non-commercial traders has become more bullish over the last reporting week. The number of long contracts held by speculators increased by 15,206, while the number of short contracts only rose by 7,408. The overall sentiment of major players remains bullish, with a twofold gap between the number of long and short contracts: 111,000 versus 53,000. The British pound has decent prospects for further growth, and the current information background mostly supports it rather than the US dollar. However, expecting a strong rise in the pound is becoming increasingly challenging. The market is not taking into account many supporting factors for the dollar, while the pound is rising solely on expectations of further rate hikes by the Bank of England.

News calendar for the US and the UK:

US - Unemployment Claims (12:30 UTC).

US - Philadelphia Fed Manufacturing Index (12:30 UTC).

Thursday's economic events calendar contains two less interesting entries. The influence of the information background for the rest of the day might be weak or absent, but yesterday's inflation report is still sufficient to maintain movement.

Forecast for GBP/USD and recommendations for traders:

You could sell the pound in case of a pullback on the hourly chart from the level of 1.3105. Then signs of a trend reversal appeared, and selling positions could be increased. Currently, keeping these positions open with targets at 1.2847 and 1.2787 is reasonable. I recommend very cautious buying of the pound, as the trend has changed to bearish. If there is a rebound from the levels of 1.2847 or 1.2787, aim for the nearest level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română