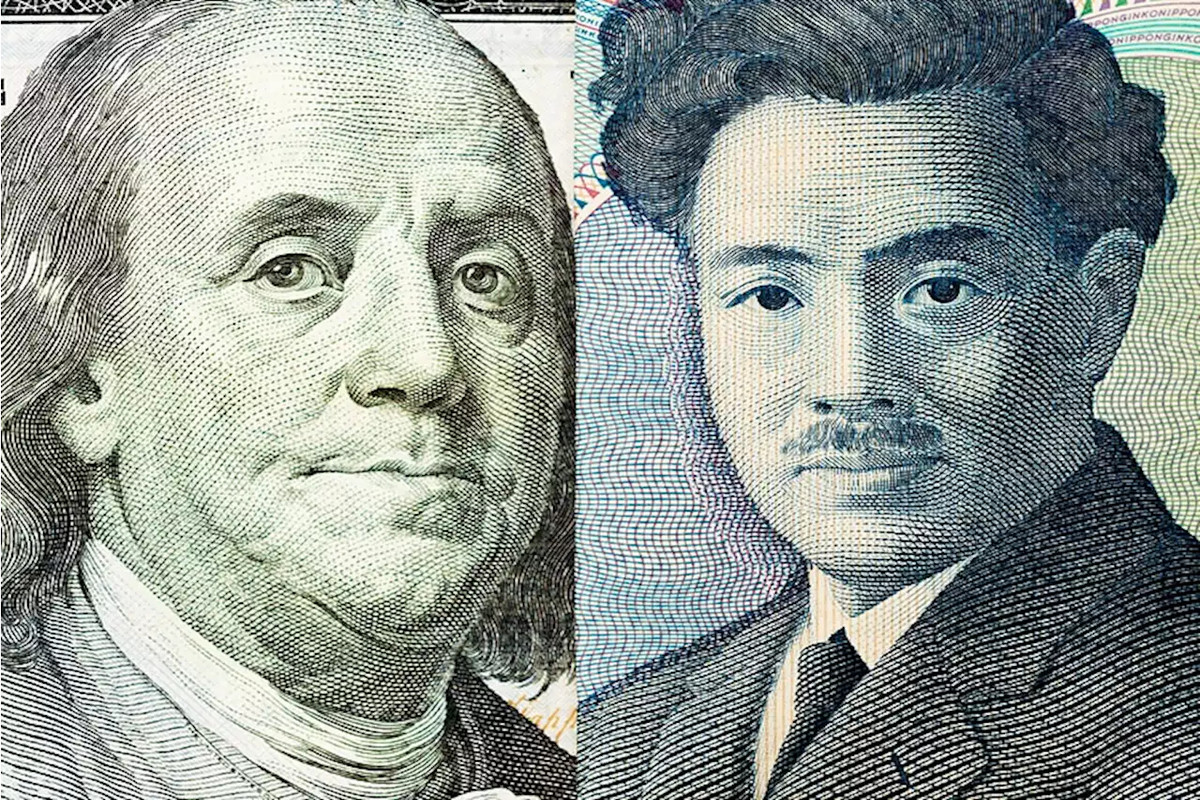

The US dollar continues to win back losses from the previous week. Yesterday, the USD/JPY pair strengthened by 0.5% and closed the session at the level of 139.6. What has breathed life into the greenback and does it have the potential for further recovery?

Yield Curve Control in focus

Last week, the US dollar experienced an extreme decline against the Japanese yen which was triggered by two factors:

- The weakening of hawkish expectations regarding the future course of the Federal Reserve monetary policy.

- Increased market speculation about possible changes in the policy of the Bank of Japan (BOJ).

The impact of the first factor is still strong. Investors believe that the expected rate hike next week will be the last one in the current tightening cycle of the American regulator.

Currently, most market participants believe that the strong deflationary trend observed in the United States will allow the Federal Reserve to pause its rate hiking cycle. These expectations weigh heavily on the US dollar.

Last week, when US inflation data turned out to be weaker than expected, the greenback dropped by more than 2% against its major competitors. The USD/JPY pair showed the sharpest downward trend as the yen received additional support from traders' increased hopes for a hawkish move by the Bank of Japan in July.

This move pertains to the correction of the yield curve control policy. The BOJ adjusted the YCC policy in December last year to improve the functioning of the local bond market.

Recent volatility in the yield of Japanese 10-year bonds and increased inflation expectations in Japan seemed to be convincing enough to expect another change in YCC.

A couple of days ago, traders were actively betting that the Bank of Japan would adjust the yield curve control mechanism at the meeting next week, which contributed to the rise of the yen.

However, last Tuesday, the Governor of the Bank of Japan, Kazuo Ueda, made it clear that the regulator intends to maintain all parameters of its monetary policy at the July meeting as it is uncertain about the state of inflation.

As a result, many economists have revised their expectations regarding the YCC correction. According to a recent Bloomberg survey, over 80% of experts believe that the Bank of Japan will not take a hawkish step in July.

In comparison, last month, almost a third of surveyed analysts stated that the central bank would change YCC at the July meeting.

Currently, most economists expect the Japanese regulator to conduct a correction of the yield curve control system in October. At the same time, 94% of respondents said that the BOJ will most likely continue to adhere to an ultra-loose policy even after the mechanism is changed or completely canceled.

Investors hope that tomorrow's report on consumer inflation in Japan for June will shed light on the central bank's plans regarding YCC. If we see a sharp rise in prices, this will enhance the hawkish sentiments in the market, which will support the yen.

Considering the rapid decline in energy prices, economists predict a moderate increase in overall annual inflation (from 3.2% to 3.3%). However, there is an opinion that its core component, which does not take into account the cost of energy, may show a more significant rise (from 3.2% to 3.5%).

Katsuhiko Sano believes that the stability of the core CPI will force the Bank of Japan to revise its inflation forecast for the current fiscal year upwards at the next meeting. However, the regulator is unlikely to play both cards simultaneously at this stage.

Japanese officials understand very well that a YCC correction will add fuel to the fire, intensifying expectations of a policy change. Therefore, they are unlikely to initiate even the slightest changes in their current course at this stage, shared Katsuhiko Sano.

If the Bank of Japan does not meet market expectations next week, it will trigger intense sell-offs in the yen, further aiding the USD/JPY pair in recovering from its recent lows.

USD/JPY technical analysis

Technical indicators suggest weakening bearish momentum and a clear shift in favor of the buyers. Despite the relative strength index (RSI) being below its middle line, it is tilted to the upside.

At the same time, the MACD histogram shows a decrease in red bars, also indicating the strengthening of the bullish sentiment. The fact that the quote is trading above the 100- and 200-day SMAs gives additional support to bulls.

The key levels to focus on are the resistance levels of 140.35, 141.00, and 142.10 and the support levels of 138.40, 137.80, and 137.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română