USD/JPY:

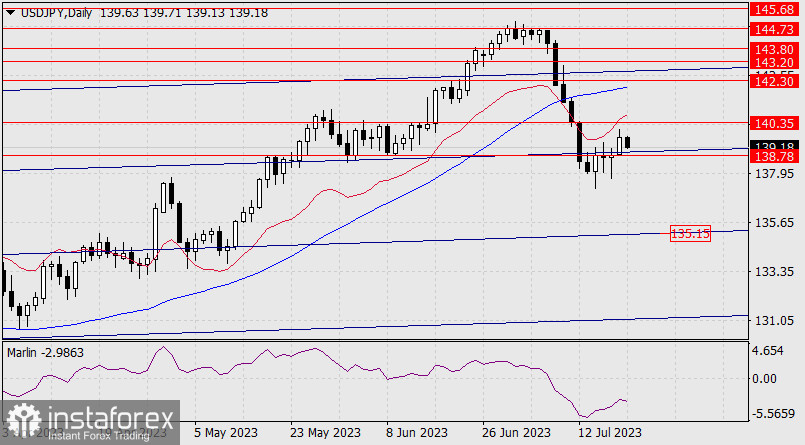

Yesterday's rapid rise of the USD/JPY pair by more than 80 points was suspiciously covered by a black candlestick this morning. This was aided by the morning release of Japan's balance of trade data for June. Trade balance showed a £43.0 billion surplus versus £1.382 trillion in May.

However, the price's consolidation below 138.78 paves the way to the target support level at 135.15. It consolidated below this mark on July 13th, which turned out to be false; the second attempt may be more reliable. The Marlin oscillator has left the oversold territory and is now entering a new wave of decline. Retesting the 140.35 mark will not change the overall bearish picture. Consolidating above this resistance level will allow the price to rise towards 142.30.

On the four-hour chart, the MACD line became the focus - it prevented the price from extending its growth yesterday. The Marlin oscillator is decreasing, indicating a short-term downtrend. We are waiting for the price to settle below the level of 138.78 on the 4H-chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română