The main item of the week is the UK inflation report. Just a reminder, inflation decreased from 8.7% YoY to 7.9% and has been falling for 8 months in general. Although it has not moved far from its peak value, an 8-month decline represents a strong trend. It is likely that the consumer price index will continue to slow down. The Bank of England is doing everything possible to win the battle against inflation, and finally, the results of its efforts are truly visible. In recent months, the market may have doubted the victory of the British regulator, as there were periods over the last 8 months when inflation was rising again, and there were times when it simply did not decrease.

The last 50 bps rate hike was a strong and unexpected decision by the BoE. There is no doubt that the decline will continue in the coming months, as it takes several months for monetary tightening to fully "unfold" in the economic processes. In just two weeks, the central bank may raise the rate by another 25 bps, which will also put pressure on inflation.

Core inflation is also of great importance. Britain's high rate of inflation fell by more than expected in June and was its slowest in over a year. In the European Union, for example, core inflation rose again in June. Thus, the market is now changing its strategy, and in this new strategy, the British pound no longer looks like an ideal currency for investment. At least, one would like to believe that.

After the inflation report, the UK Chancellor of the Exchequer stated that the central bank can win the battle against inflation. He called on everyone not to expect a quick and easy victory. He said that there is still a long way to go to reduce inflation towards the 2% target. However, hardly anyone expected the victory to be quick and easy. "The Bank of England has made difficult but right decisions in response to an unprecedentedly high price growth. Now we are seeing the fruits of these decisions," Hunt said.

In my opinion, the market is currently at a turning point. Even the next few interest rate hikes may already be priced in. If this is indeed the case, there is no reason for the market to maintain high demand for the pound. The pound's fall by more than 150 points on Wednesday is considered strong and sharp. I believe that this is because buyers are leaving their positions. If that is the case, the pair will continue to fall. Now there's a high probability of forming a new bearish trend segment.

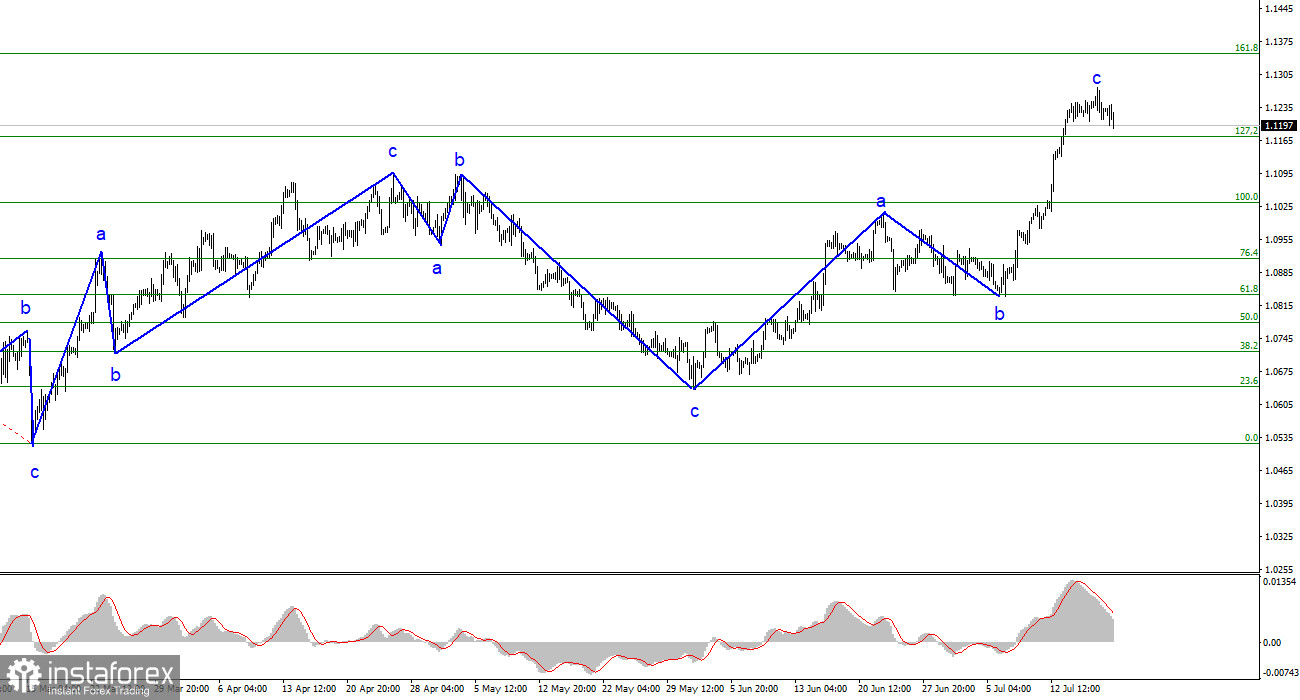

Based on the analysis, I conclude that an upward set of waves is currently being built, but it can end at any moment. I believe that targets around 1.0500-1.0600 are quite realistic, and I advise selling the instrument with these targets. We presume that the a-b-c structure has ended, but we need some signals to confirm this. Nevertheless, you may sell now but be cautious. As before, the bearish potential is in the area of 5-6 figures. I consider it quite risky to buy now.

The wave pattern of the GBP/USD pair suggests the formation of an upward set of waves. At this time it is important to understand what we are observing. The construction of the fourth wave in the ascending section or the construction of the first wave in a new descending one? It will become clear as the pound moves in one direction or the other. Since the attempt to break through the 1.3084 mark (from top to bottom) was successful, traders can open short positions, as I mentioned in the previous reviews. Now the first target is 1.2840. Most likely, the pair will reach this mark. The descending wave should turn out to be at least three-wave, which means that the fall will not end today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română