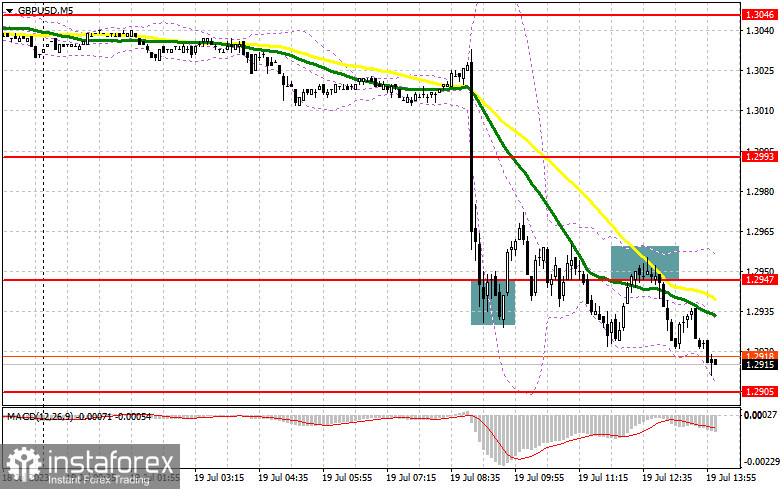

In my morning forecast, I emphasized the level of 1.2947 and recommended making entry decisions based on it. Let's examine the 5-minute chart and analyze the events. The pound experienced a significant drop during the first half of the day, and the false breakthrough at 1.2947 indicated a buying opportunity. However, the upward movement was limited to around 20 points before the pressure on the pair resumed. The breakthrough and subsequent retest of 1.2947 provided an excellent selling signal, continuing the bearish market trend and resulting in a decline of over 40 points when writing this article.

To initiate long positions on GBP/USD, the following conditions are required:

The substantial deceleration in price growth in the UK led to an immediate sell-off of the British pound, as we anticipated in the first half of the day. It is unlikely that buyers will emerge for GBP/USD today, so exercise extreme caution with long positions and do not anticipate significant upward movements. Disappointing data on the volume of issued building permits and the number of new foundation layings in the US, combined with the decline and false breakthrough around 1.2905, could serve as a favorable buying signal for the pound's recovery in the second half of the day. In such a scenario, the target would be the newly formed resistance level at 1.2970, established during the European session. A breakthrough and consolidation above this range would provide an additional buying signal, with a target of 1.3032. The ultimate target would be 1.3085, where I would take profits.

If GBP/USD experiences a decline during the American session due to strong statistics and the absence of buyers at 1.2905, which is quite likely, especially in light of today's inflation data in the UK, pressure on the pound will persist. In such a case, only defending the next support area at 1.2845 and a false breakthrough there would indicate an opportunity to open long positions. I plan to buy GBP/USD only on a rebound from 1.2799, with a 30-35 point correction target within the day.

To initiate short positions on GBP/USD, the following conditions are required:

Sellers currently have full market control, but selling at the lows should be cautiously approached. It is advisable to await the release of US construction data and observe the market's reaction. The rise and false breakthrough around the newly formed resistance at 1.2970 would serve as an ideal signal to enter the market, continuing the bearish market correction and paving the way toward 1.2905. A breakthrough and subsequent retest of this range from bottom to top would significantly blow buyer positions, pushing GBP/USD towards 1.2845. The ultimate target remains at the minimum of 1.2799, where I would take profits.

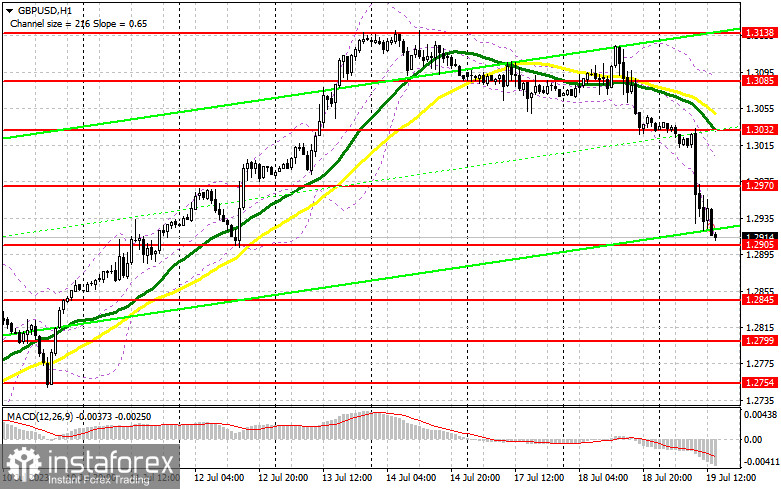

If GBP/USD were to rise and show no activity around 1.2970 in the second half of the day, buyers would partially recover their losses but not regain control. In such a scenario, I would delay selling until a test of the resistance at 1.3032, where the moving averages are located, favoring sellers. A false breakthrough at that level would provide an entry point for short positions. If there is no downward movement, I will sell the pound immediately on a rebound from 1.3085, but only expect a pair correction down by 30-35 points within the day.

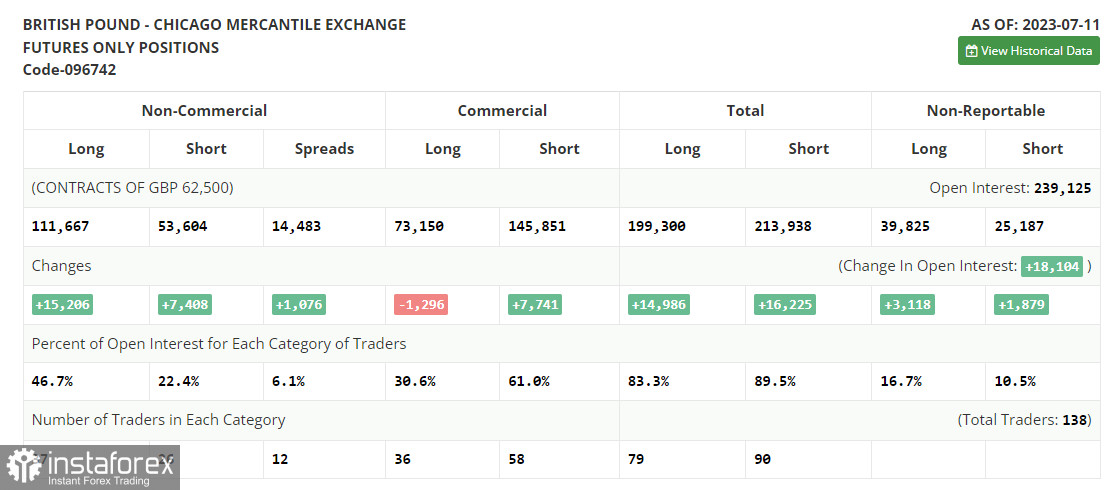

The COT report (Commitment of Traders) for July 11 indicated an increase in both long and short positions. However, buyers outnumbered sellers by a factor of two, confirming the bullish market trend witnessed throughout this month. Pound buyers have a definite opportunity to act more aggressively. On the one hand, the Federal Reserve is content with the rapid decline in inflation, which reduces the likelihood of further interest rate hikes. On the other hand, despite the economic challenges, the Bank of England will continue pursuing a high-interest rate policy due to significant inflation issues impacting household living standards. The disparity in policies will strengthen the pound and weaken the US dollar. The optimal strategy remains to buy the pound on declines. According to the latest COT report, non-commercial long positions increased by 15,206 to 111,667, compared to 96,461, while non-commercial short positions only rose by 7,408 to 53,604, compared to 46,196. This resulted in another significant increase in the non-commercial net position to 58,063, up from 50,265 the previous week. The weekly price rose and reached 1.2932, as opposed to 1.2698.

Indicator signals:

Moving Averages

Trading is taking place below the 30-day and 50-day moving averages, indicating further decline in the pair.

Note: The period and prices of the moving averages discussed by the author are based on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator, around 1.2900, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period: 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period: 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA: 12, Slow EMA: 26, SMA: 9.

• Bollinger Bands. Period: 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Non-commercial long positions represent the total long open positions of non-commercial traders.

• Non-commercial short positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română