EUR/USD

Higher timeframes

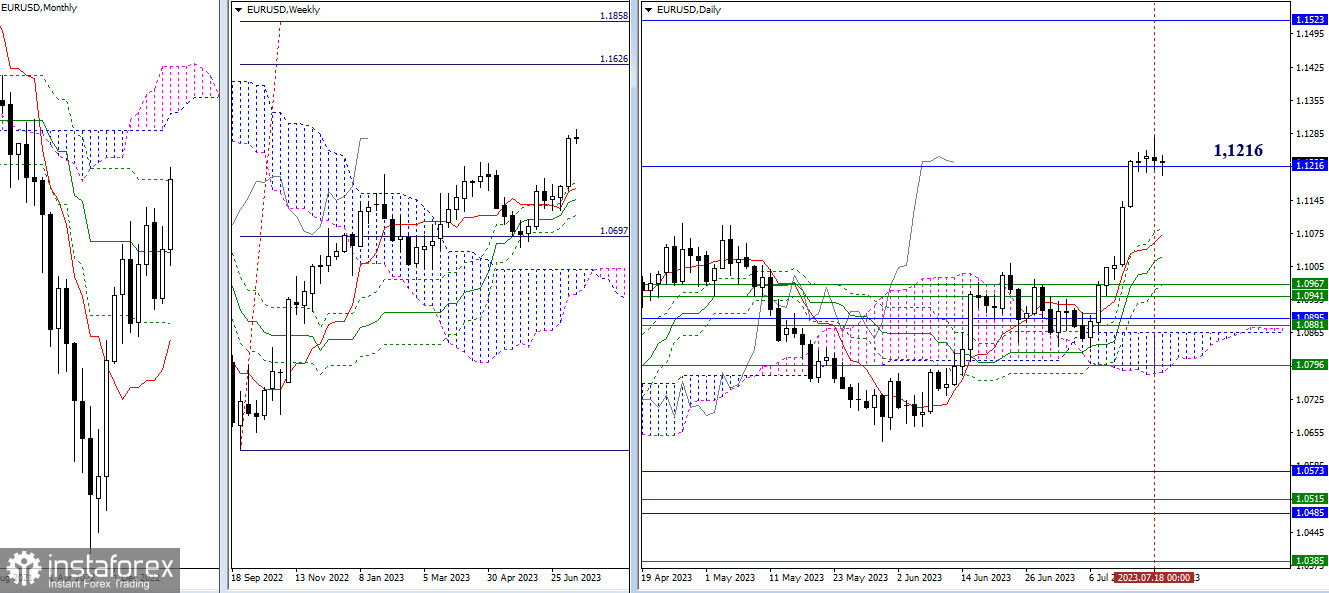

Yesterday, there were no significant changes in the situation. Despite the pair reaching new highs, uncertainty remains in the market, and the main influence is still exerted by the monthly level of attraction (1.1216). As there have been no changes, the target for today remains the same. For bullish players, it is the monthly cloud (1.1523 - 1.1734) and the target for a breakout of the weekly Ichimoku cloud (1.1626 - 1.1858). For bearish players, it is the support levels of the daily Ichimoku cross (Tenkan 1.1072 - Kijun 1.1025) and the weekly levels (1.0967 - 1.0941).

H4 - H1

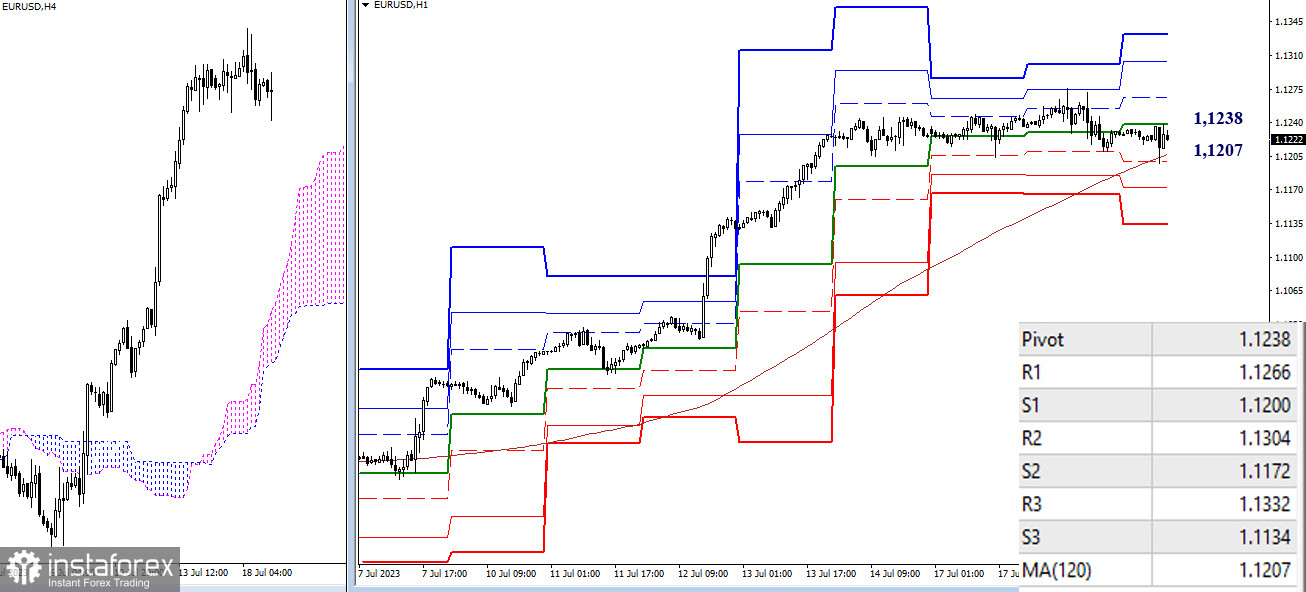

As of writing, the key level on lower timeframes, which is the weekly long-term trend (1.1207), is being tested. A break and reversal of the moving average can change the current balance of power. If bearish players firmly establish themselves below 1.1207, additional targets for downside movement within the day may be the support levels of the classic pivot points (1.1172 - 1.1134). If there is a rebound from 1.1207, and bullish players reclaim the central pivot point of the day (1.1238), then the next targets will be the resistance levels of the classic pivot points (1.1266 - 1.1304 - 1.1332).

***

GBP/USD

Higher timeframes

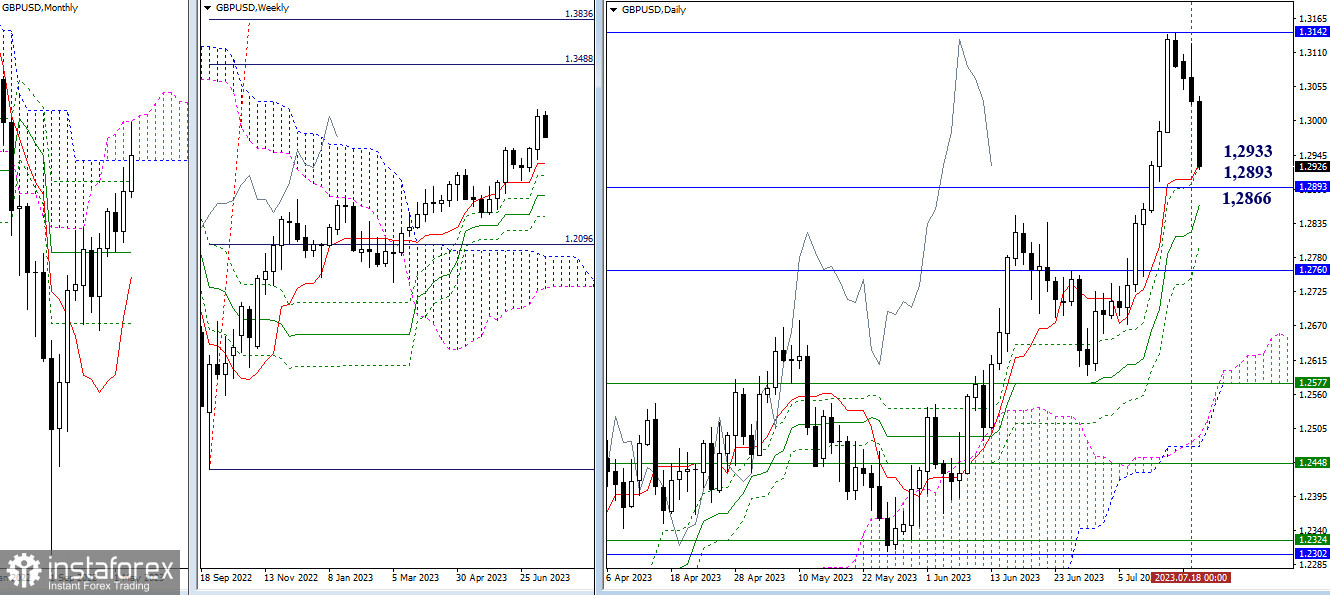

Yesterday, the strength of resistance at the upper boundary of the monthly cloud (1.3142) was able to halt the upward movement. The market has started to decline. It has now approached a significant zone of support for this area at 1.2933 - 1.2893 - 1.2866 (daily cross levels + lower boundary of the monthly cloud). A break below these supports and closing the trading week below them will form a rebound and may be a good basis for strengthening bearish sentiment.

H4 - H1

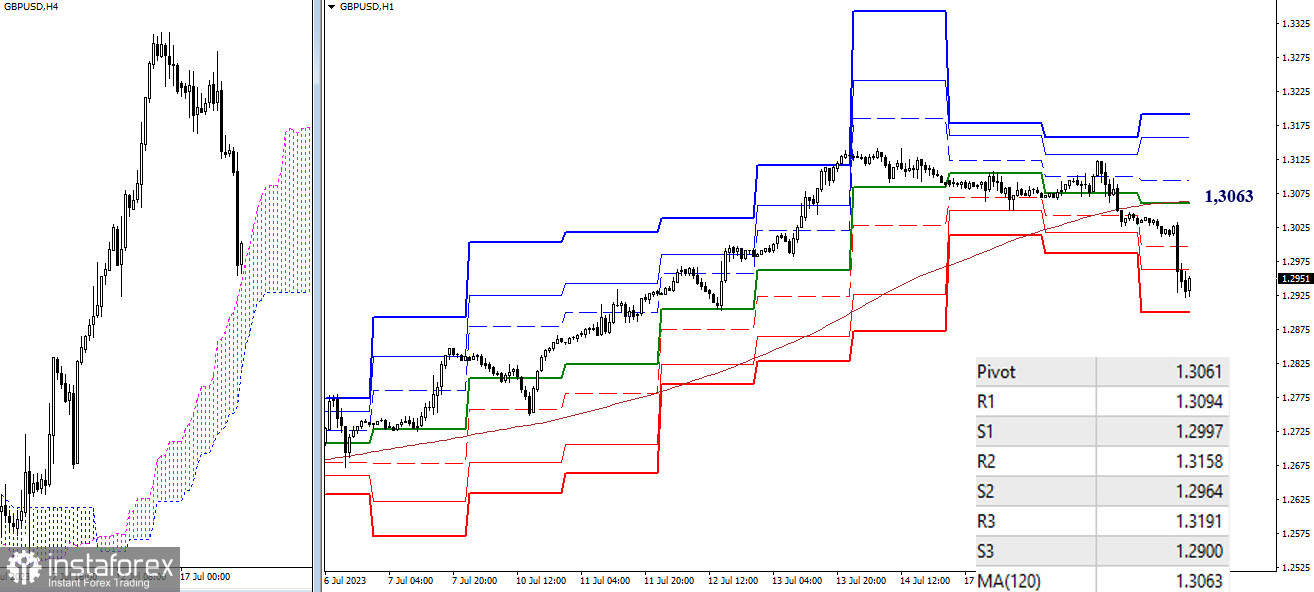

On lower timeframes, the main advantage belongs to bearish players. As the decline continues, they are already close to the final support of the lower timeframes at 1.2900 (S3 of the classic pivot points). Further downward targets can be considered at the levels of higher timeframes. If the decline ends, the key levels of the lower timeframes will be of greater importance within the day. Today, they converge around 1.3063 (central pivot point + weekly long-term trend).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română