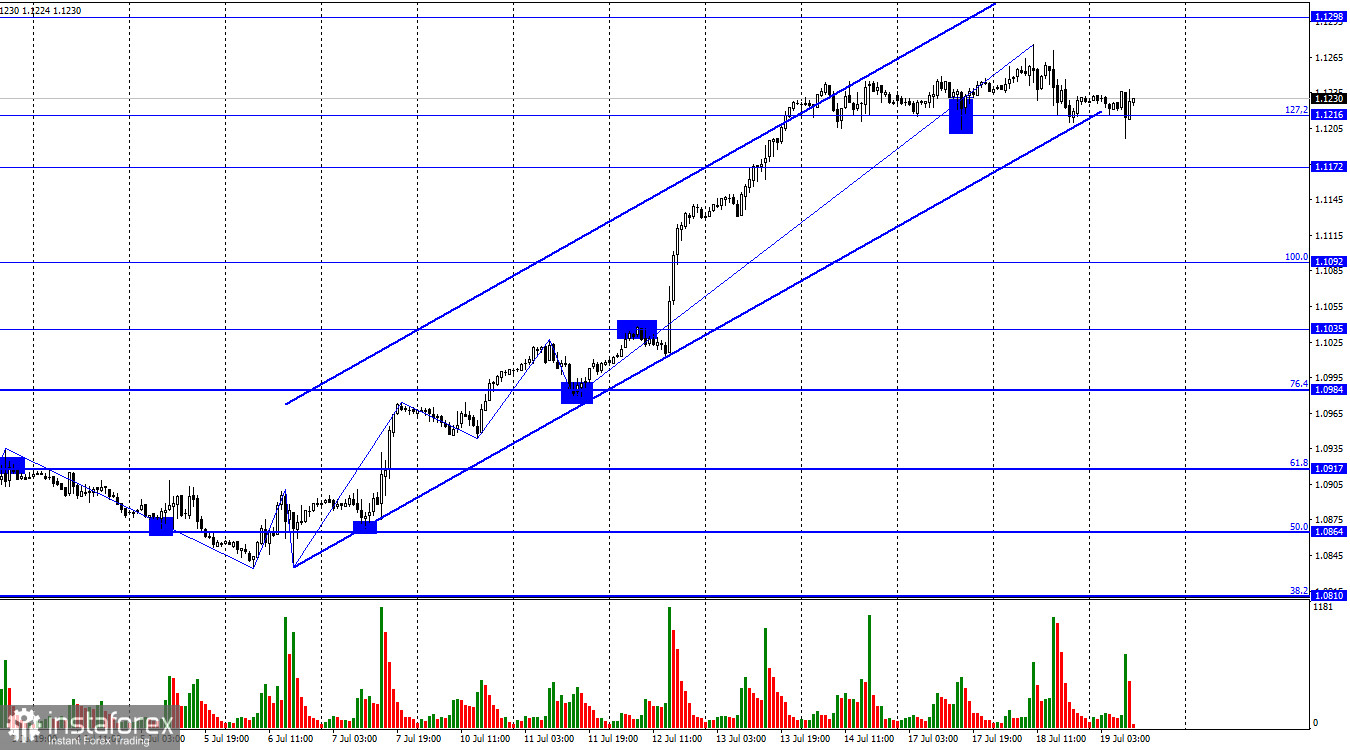

On Tuesday, the EUR/USD pair retraced to the corrective level of 127.2% (1.1216) but failed to settle below it. Consequently, each new rebound from this level increases the chances of a further upward movement of the euro toward the 1.1298 level. It is insignificant if the price remains below the ascending trend corridor without surpassing the 1.1216 level. However, a close below 1.1216 may initiate a decline targeting 1.1172 and 1.1092.

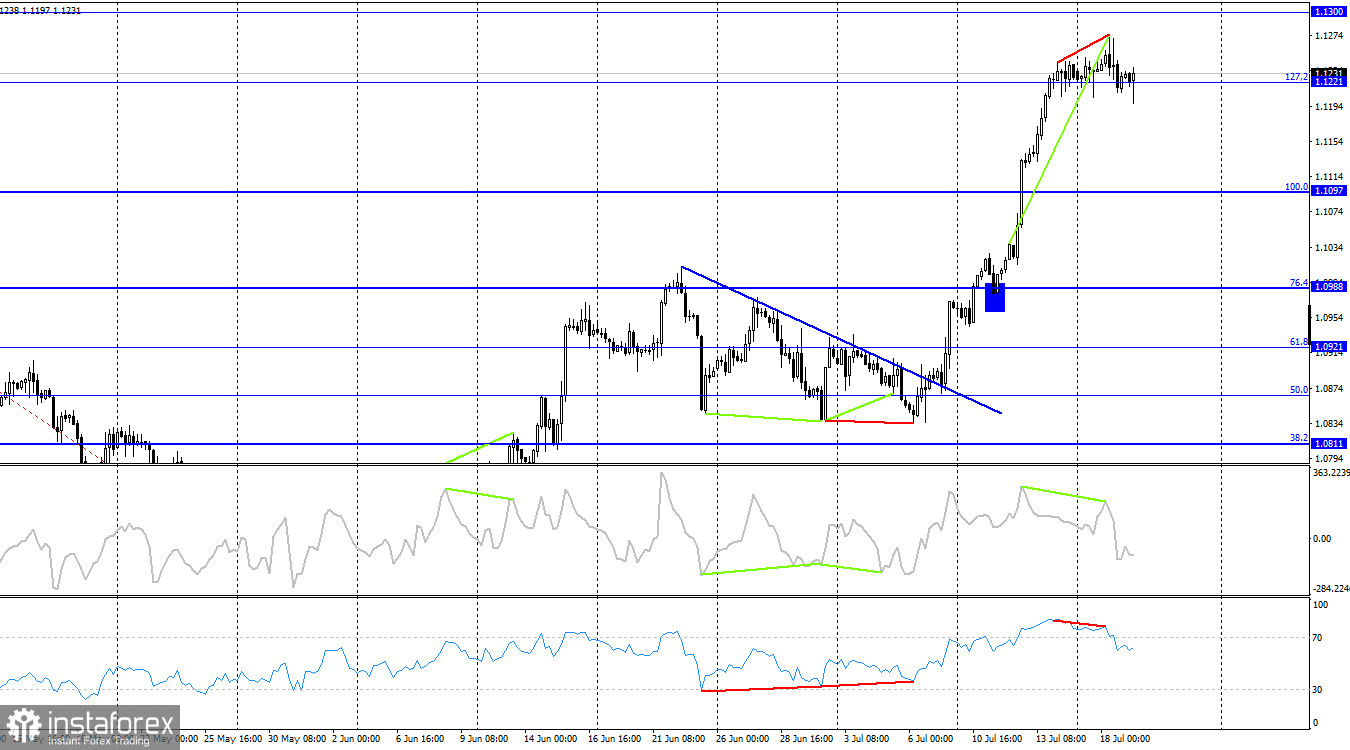

The waves continue to provide no new information. Yesterday, the six-day upward wave concluded. It is still being determined whether the current downward wave will continue, making defining it as a wave challenging. There are no signs indicating the end of the bullish trend. There has been no breakthrough of the recent low, and no new upward wave fails to surpass the previous peak. Thus, it is premature to conclude that bullish traders have withdrawn from the market.

Today, the inflation report for the European Union will be released. The consumer price index may slow to 5.5%, while the core inflation could rise to 5.4%. These values were already observed two weeks ago in the initial estimate. Regardless of the market's reaction to these reports today, these figures do not justify the ECB abandoning further interest rate hikes. Therefore, they have minimal impact on the overall prospects of the European currency. As long as the market shows strong demand for the euro based on the ECB's tightening expectations, it will likely continue, as no conflicting information has emerged in the past two weeks.

I anticipate a decline in the pair; however, the level of 1.1216 is proving to be a strong barrier. Without breaking through this level, there will be no downward movement.

On the 4-hour chart, the pair has settled above the Fibonacci level of 127.2% (1.1221), enabling it to continue upward toward the next corrective level of 161.8% (1.1380). As mentioned earlier, traders overlooked several reports and factors last week, yet the euro continues to rise without any graphical reversal signals. Two bearish divergences have formed in the RSI and CCI indicators, but a decline is unlikely to occur unless there is a close below the 1.1221 level.

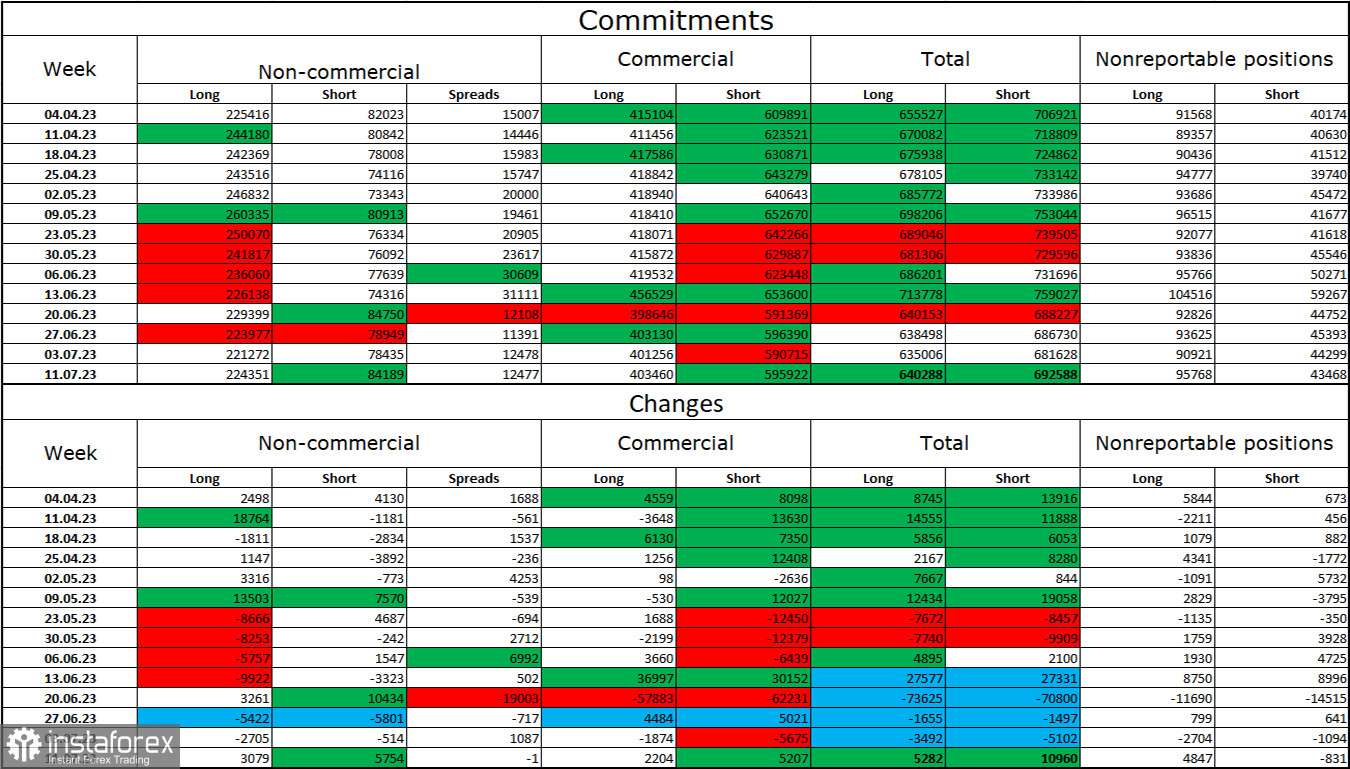

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 3,079 long contracts and 5,754 short contracts. The sentiment of large traders remains bullish but gradually weakening. The total number of long contracts held by speculators now stands at 224,000, while the number of short contracts is only 84,000. The bullish sentiment persists, but the situation will change in the opposite direction soon. The high value of open long contracts indicates that buyers may close them soon (or have already started) due to an excessive bias towards the bulls. Considering last week's strong rise, the current figures allow for a decline in the euro currency in the coming weeks. However, there are currently no graphical signals for selling.

News calendar for the US and the European Union:

European Union - Consumer Price Index (CPI) (09:00 UTC).

US - Building Permits (12:30 UTC).

On July 19, the economic calendar contains two less significant entries. The influence of the information background on traders' sentiment for the remaining part of the day may be weak. Corrections are still absent at the moment.

Forecast for EUR/USD and trading advice:

Selling is possible if the pair settles below the level of 1.1216 on the hourly chart, with targets at 1.1172 and 1.1092. The current trend is bullish, so I do not recommend expecting a significant decline in the pair. I advised buying the pair with a target of 1.1298 until a close below 1.1216. These positions can be kept open at the moment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română