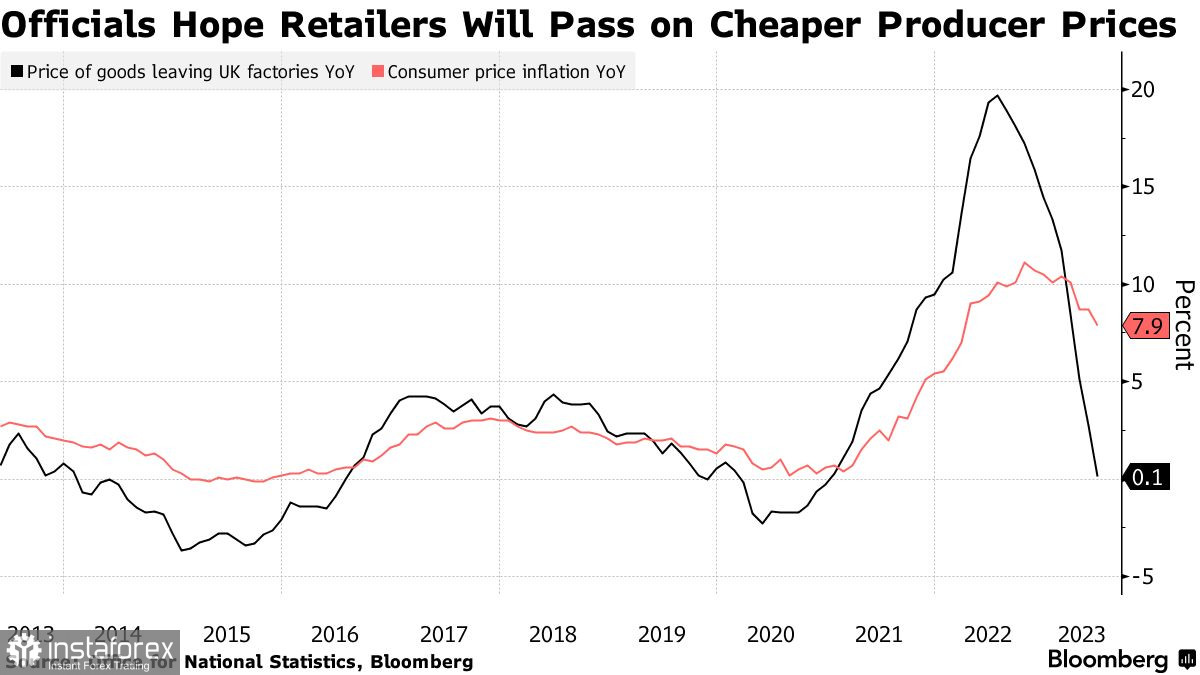

The British pound plummeted by over 100 pips in an instant after news broke that UK consumer and producer inflation dropped more than expected, reaching the lowest level in over a year. This is a sign that the era of high interest rates in the UK is gradually coming to an end.

According to data from the Office for National Statistics, inflation in Britain stood at 7.9% compared to the same period last year, marking a sharp decline from the 8.7% figure in May. This unexpected drop was the first in five months and was the lowest level since 2021. Economists had anticipated inflation to be at 2%.

The fact that inflation is lower than expected will fuel and strengthen the markets' belief that the worst is already behind and that the Bank of England no longer needs to push the economy into a recession to achieve a real victory over inflation. But take note that this is a monthly report, and there's a possibility that price pressures may grow during the hot summer period, in July or August. It is also worth noting that the BoE's target inflation level is around 2.0%, and inflation at 7.9% is clearly far from that.

As for core inflation, it has also decreased to 6.9% from 7.1%, indicating that the fastest series of interest rate hikes in three decades is starting to work. Speculation on how many more interest rate hikes to expect from the BoE to curb prices without harming the economy will likely unfold in the market today. Softer than expected UK inflation may lead to a reassessment of expectations regarding a 50-basis-point interest rate hike in August, to which the pound most likely reacted.

Most likely, the slowdown in core inflation in June will likely be enough for the BoE to proceed with a quarter point rate hike at its August meeting. However, the decision is likely to be very long in coming and it is possible that a number of officials will be against it, considering that core price pressures are easing very slowly.

According to the ONS, inflation slowed substantially due to the sharp decline in motor fuels and the fall in food prices. Food price inflation also fell, to 17.3% from 18.3% in May. Inflation in restaurant and hotel prices also dropped to 9.5% from 10.3% in May.

As for the technical picture of GBP/USD, the demand for the pound is rapidly decreasing. We can expect the pair to rise after it consolidates above the 1.3000 level, as a break above would strengthen hopes for further recovery towards 1.3050, followed by a more significant surge towards 1.3100. In case the pair falls, bears will try to take control below 1.2940. If they succeed, a break below this range would strike a blow to bullish positions and push GBP/USD towards a low like 1.2905, with the potential to reach 1.2845.

As for the current technical picture of EUR/USD, to maintain bullish control, the pair needs to break through 1.1250 and hold above this level. This would make it possible to move towards 1.1275 and 1.1310. From there, it can further rise to 1.1350, but achieving it without strong eurozone macro data would be quite challenging. In case the pair falls, we can only expect major buyers to take significant actions once the pair is around 1.1210. If they are not active at this level, it would be wise to wait for a retest of the 1.1170 low or consider opening long positions from 1.1130.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română