Analysis and tips on how to trade BTC

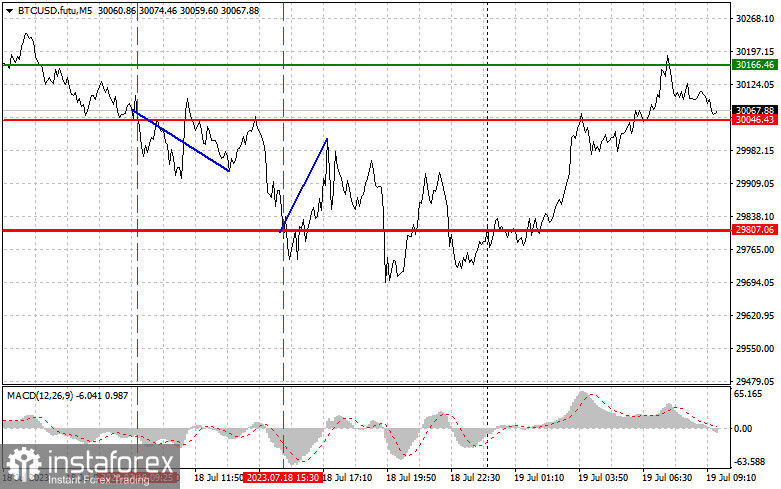

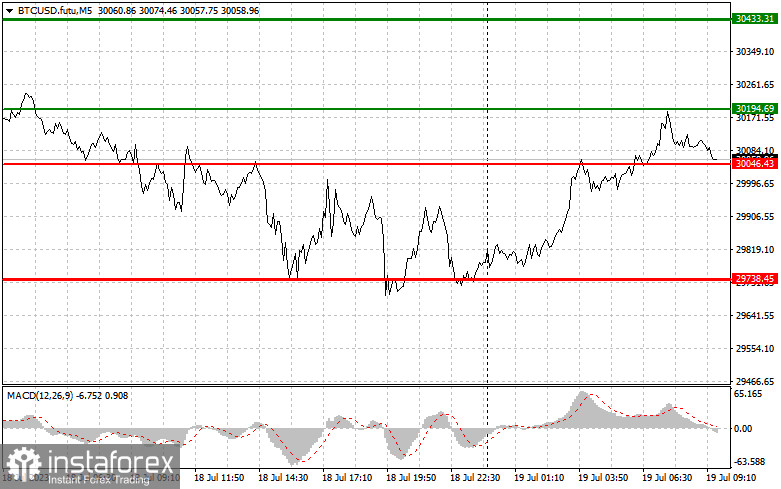

A test on the 30,046 level occurred when the MACD was in the sell zone, which confirmed the entry point to the short-term bearish market. As a result, BTC approached the 29,900 mark in the first half of the day. In the American session, the price rebounded to the area of 30,000 from 29,800.

Sellers are still unable to break the lower limit of the sideways channel due to the presence of buyers there. Increased buying activity around 29,700 confirms a continuation of a medium-term bullish market, which means the price may reach new yearly highs. The UK will see the release of its inflation report today. A decrease in inflationary pressures may boost demand for risk assets, including crypto. Today, I will trade according to Scenario 1.

Signal to buy

Scenario 1: I will buy BTC today after the price reaches 30,194 (green line of the chart), targeting 30,433 (thicker green line). I will close long positions in the area of 30,433 and open short ones. Growth will likely continue until quotes trade above the descending limit of the sideways channel. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: I will also buy BTC if the price tests the mark of 30,045 twice, with the MACD being in the oversold zone at that moment. This will limit the instrument's downside potential and lead to a bullish reversal in the market. The quote may go either to 30,194 or to 30,433.

Signal to sell

Scenario 1: I will sell BTC today after the price tests the mark of 30,046 (red line on the chart), which will cause a rapid fall in value. The bearish target is seen at 29,738 where I will close short positions and buy the instrument. BTC may feel pressure if a breakout through the lower limit of the wider sideways channel occurs. Important! Before selling the instrument, make sure the MACD is below zero and just starts moving down from this level

Scenario 2: I will also sell the instrument after the price tests the mark of 30,194 twice, with the MACD being in the overbought zone at that moment. This will limit the pair's upside potential and lead to a bearish reversal in the market. The quote may then go either to 30,046 or to 29,738.

Indicators on charts:

A thin green line indicates a buy entry point.

A thin green line indicates a point where you can set a Take Profit order or lock in profits manually because the price will unlikely go above this level.

A thin red line indicates a sell entry point.

A thick red line is the estimated price level where you should place a Take Profit order or close positions manually because the quote is unlikely to fall below this mark.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Important! Novice crypto traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure to always place a stop order to minimize losses. Without the order, you may quickly lose your entire deposit, especially if you do use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română