Macro data in the US came mixed but missed expectations. Consequently, the pound edged down. Thus, US retail sales dropped to 1.5% from 2.0%, when economists had expected figures to fall to 1.1% from 1.6%. Yes, consumer spending is still declining, but the result came better than anticipated. After all, retail sales account for almost a fifth of the entire American economy. In other words, the economic state has improved slightly, and the US may avoid a recession. However, industrial production slid to -0.4%. Economists had expected production to come in at 0.5%, up from 0.2%. Previous results were revised down to 0.0%. Nevertheless, data on retail sales are usually more important as they reflect the state of the services sector, which is four-fifths of the American economy.

The sterling is likely to continue its fall today due to a slowdown in UK inflation to 8.3% from 8.7%. A decrease in inflation is usually seen as a negative factor for the forex market because it limits the upside potential for interest rates. Anyway, figures set to be released today could indicate that a pause in the Bank of England's tightening might be nearing.

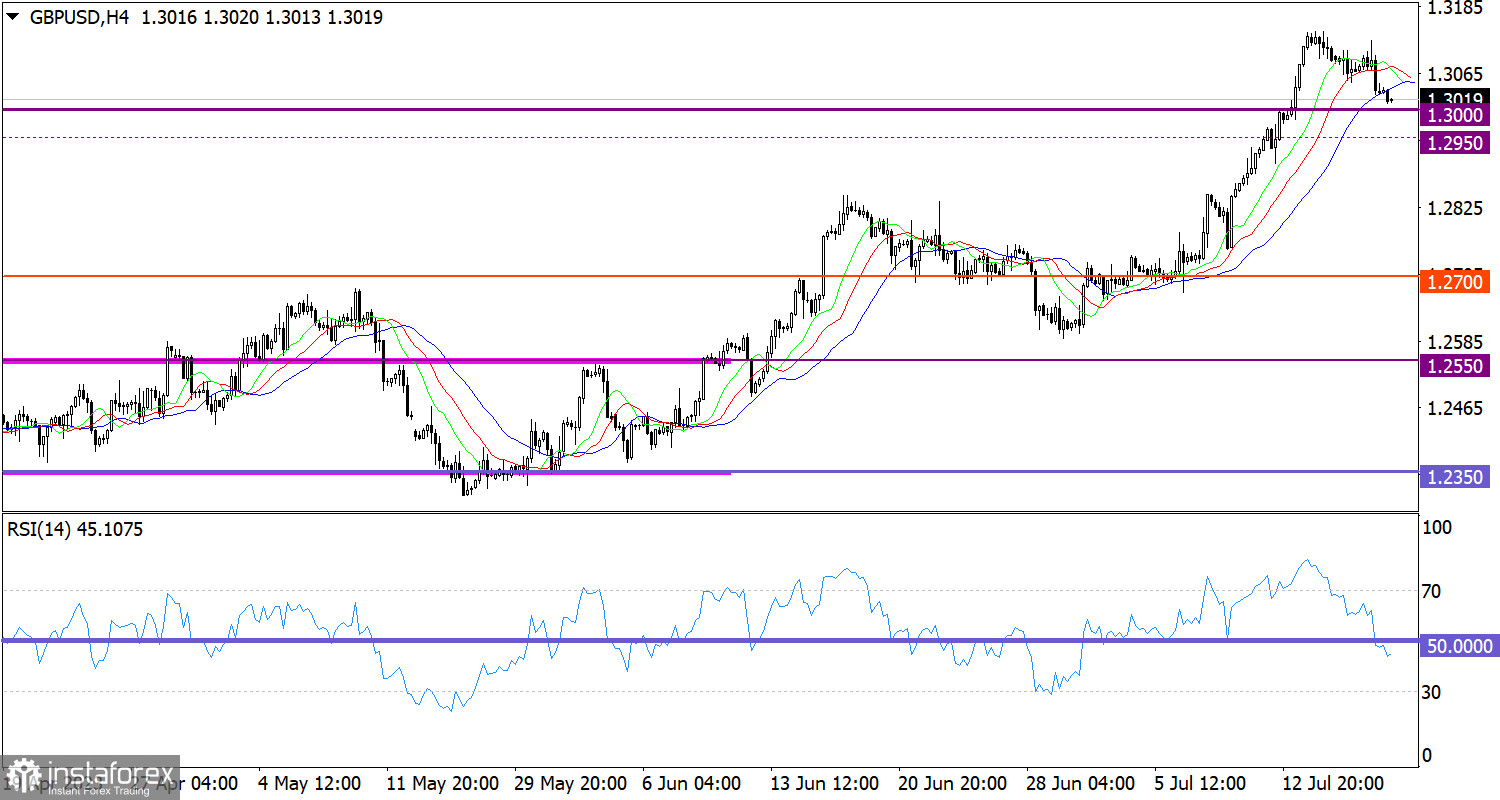

The pound/dollar pair has reached the psychological level of 1.3000.

On the 4-hour chart, the RSI has left the overbought zone and has crossed line 50. This technical signal indicates an increase in selling volumes.

Meanwhile, the Alligator's MAs are intertwined in the 4-hour chart, signaling a slowing of the uptrend.

Outlook

Quotes may go below 1.3000. An increase in selling volumes may take place after consolidation below 1.2950. Until then, quotes are likely to hover in the range of psychological levels of 1.2950/1.3000/1.3050.

In terms of complex indicator analysis, a correction is likely in the short term and intraday. Indicators also signal an uptrend in the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română