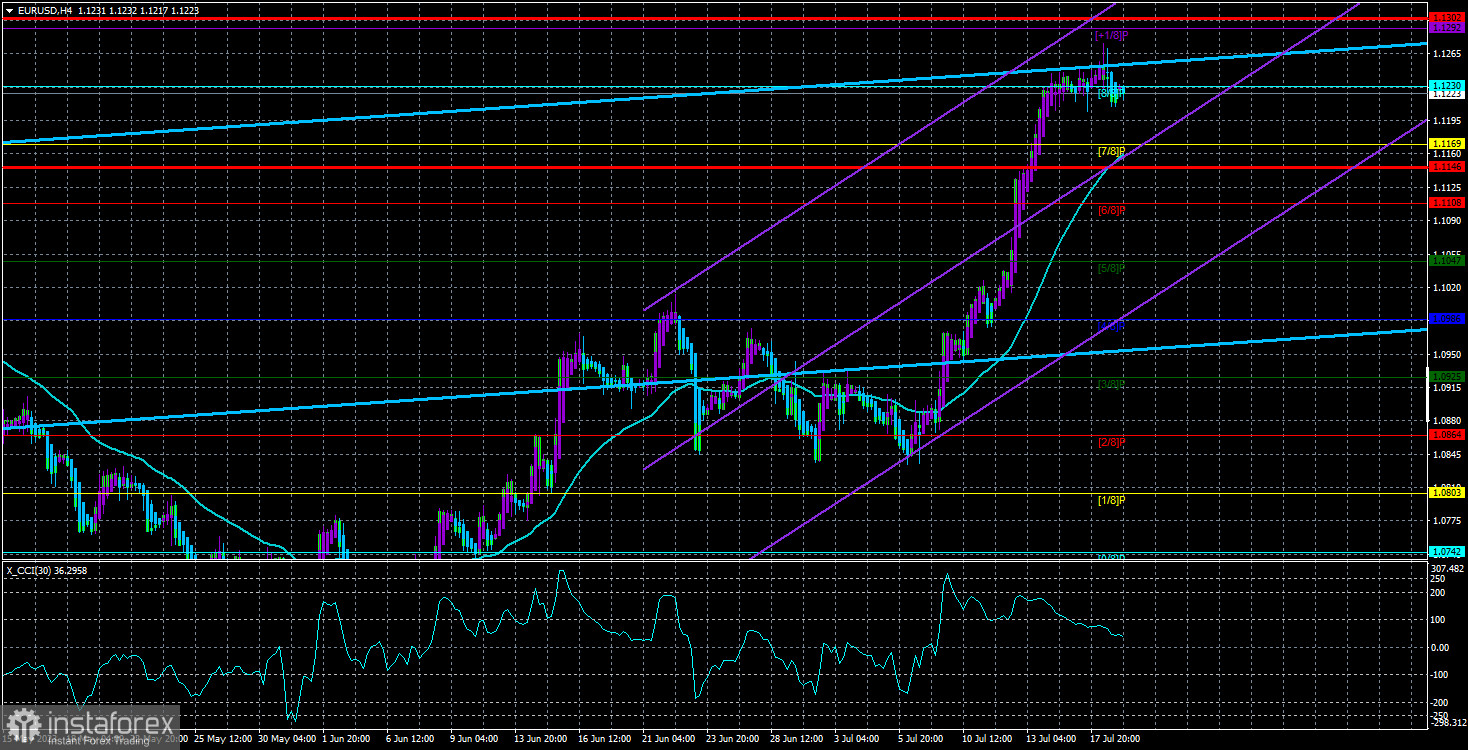

The EUR/USD pair remained in a narrow range on Monday and Tuesday. Maybe there will be some movements on the smallest time frames. On the 4H chart, it is visible that the pair is trading flat. As I have already mentioned, the sideways movement started at annual highs. It does not mean that a downward correction is now impossible. However, the probability totals 50%. The pair is extremely overbought, constantly rising without any reason. Even if there are some factors, they are not enough for such meteoric growth.

The EUR/USD pair remained in a narrow range on Monday and Tuesday. Maybe there will be some movements on the smallest time frames. On the 4H chart, it is visible that the pair is trading flat. As I have already mentioned, the sideways movement started at annual highs. It does not mean that a downward correction is now impossible. However, the probability totals 50%. The pair is extremely overbought, constantly rising without any reason. Even if there are some factors, they are not enough for such meteoric growth.

There are no signals about the start of a downward movement at this time. If the price manages to break through the moving averages, it could fall. However, if it remains in a narrow range, it will hardly decline. Last week, the CCI indicator entered the overbought area. This indicator rarely gives signals. Therefore, they are considered strong. After the formation of such a signal, the price did not slide. The subsequent divergence also did not lead to a decrease. It means that traders are now so willing to go long that no indicators could show a downward reversal of the pair.

Apart from that, market volatility has recently been rather low as the economic calendar has been empty. Yesterday, two US reports on industrial production and retail sales were released. Yet, they had no impact on the market sentiment. Today, the second estimate of EU CPI, US housing starts, and building permits are on tap.

Fed and ECB to hardly cause market volatility

It seems that investors are now waiting for the meetings of central banks, which will take place next week. Although the central banks hardly sunrise investors with their rate decisions as both banks are expected to hike rates by another 0.25%, speculators anticipate some shifts. Policy changes might be dangerous for traders. I believe that the bullish sentiment has not weakened. It means that traders could open new long positions at any time. There are almost no crucial macroeconomic reports this week.

Therefore, I assume that the pair could move either up or down with the same probability. There is no way to predict it. I would recommend opening new positions based on the situation. If the pair declines and consolidates below the moving averages, a correction could occur. It is hard to foresee how strong it might be. Given the current situation, the euro is likely to return to 1.0500. Yet, this is just a prediction.

There is also no sign of a downward movement on the 24H chart. On the contrary, all indicators are directed upwards. Thus, there are no signals for a correction.

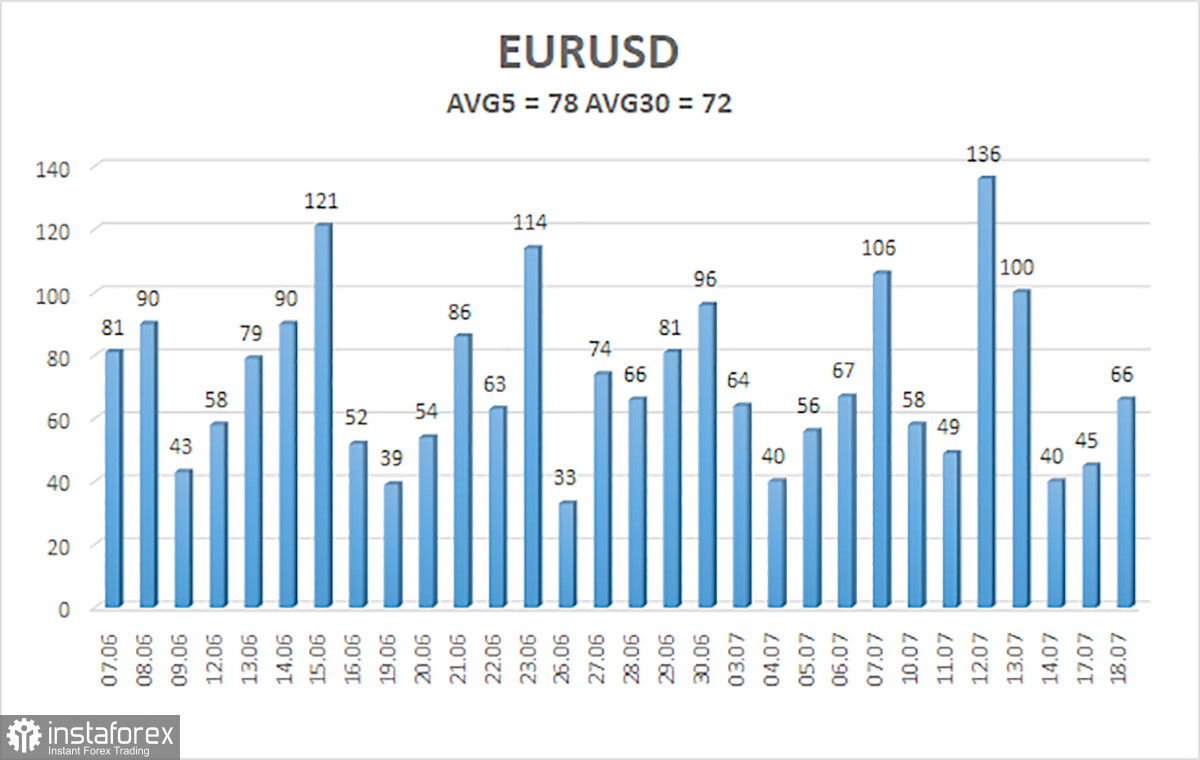

The average volatility of the euro/dollar pair over the last 5 trading days totaled 78 pips. Thus, I expect the pair to move between the levels of 1.1146 and 1.1302 on Wednesday. An upward reversal of the Heiken Ashi indicator will signal a possible resumption of the uptrend.

Support levels:

S1 – 1.1169

S2 – 1.1108

S3 – 1.1047

Resistance levels:

R1 – 1.1230

R2 – 1.1292

R3 – 1.1353

Trading recommendations:

The EUR/USD pair has been moving in a narrow range for three days. now, I would advise you to open long positions at the target levels of 1.1292 and 1.1302 in the case of an upward reversal of the Heiken Ashi indicator. You should go short if the price consolidates below the moving averages with the target levels of 1.1108 and 1.1047.

Description of chart:

Linear regression channels help to determine the current trend. If both channels are directed in the same direction, the trend is strong now.

Moving averages (20-period SMMA, smoothed) show the short-term trend and the prevailing trend.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel where the pair could move the next day based on current volatility indicators.

The CCI indicator. If it enters the oversold area (below -250) or the overbought area (above +250), it means a trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română