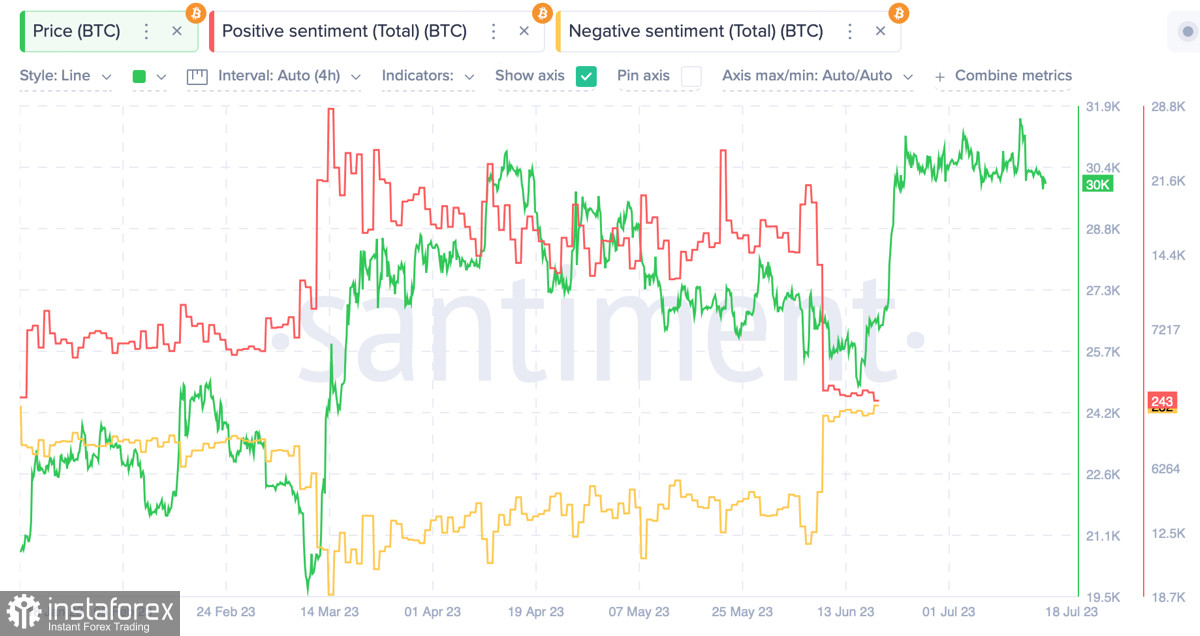

The end of last week marked a local trend reversal in the cryptocurrency market. On July 14, Bitcoin formed a "bearish engulfing" pattern, falsely breaking through the $31k level. As a result, bears took the initiative and began pushing the price towards local lows.

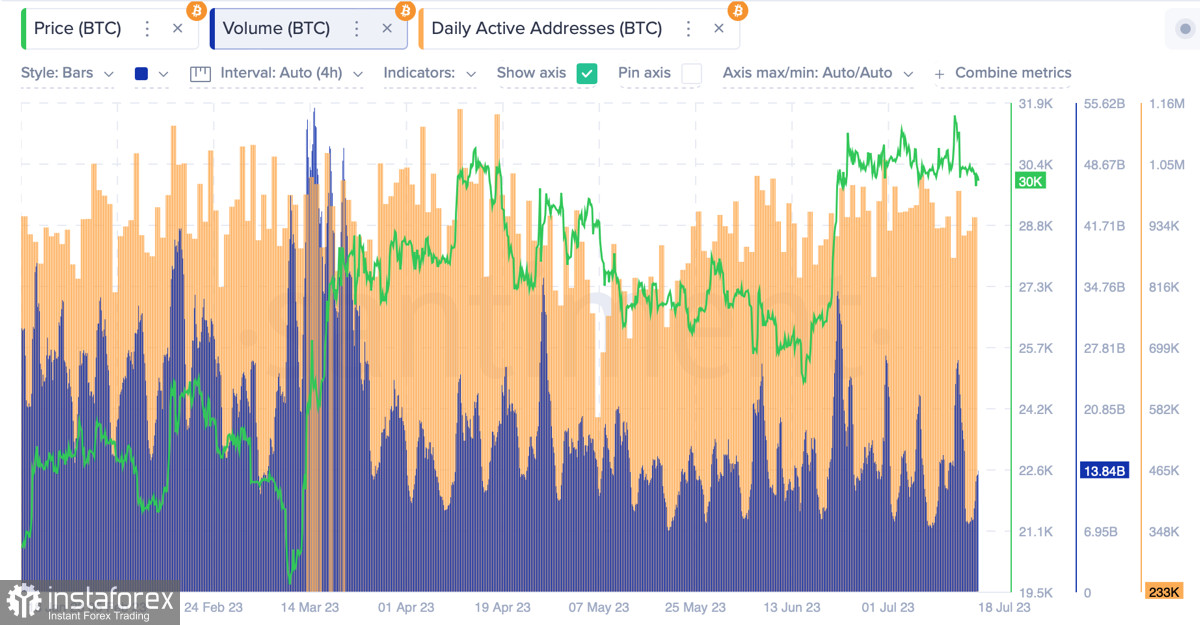

The new trading week started with a retest of the support level at $29.6k for the cryptocurrency, despite market and macroeconomic positivity. This is a worrisome signal indicating a significant decline in bullish volumes and strengthening of seller positions. However, should we expect a more substantial downward movement below $30k, considering the current market situation?

Stock market picks up volumes

Expecting a decline in the price of Bitcoin is reasonable as the primary focus of investors is shifting towards the stock market. Market players are mainly anticipating expectations and reallocating capital to stocks in the hope of positive changes in the financial reports of major companies. And as long as reports are being published by giants like JPMorgan, Citi, and BofA, it is difficult to resist the positivity, as banks are demonstrating significant profit growth.

Meanwhile, the correlation between BTC and stock indices has reached an annual low and continues to decline. Reports said that over the past seven days, the stock market has attracted over $3.3 trillion amid reports of strengthening deflationary trends. Market players have begun to believe in a soft landing, driving the growth of trading indices.

Parallel to the euphoria in the stock market, the SEC has approved the consideration of applications for spot BTC ETFs. It can be assumed that the decline in the price of Bitcoin may be associated with investors' concerns regarding the regulator's decision. Recently, SEC Chairman Gary Gensler expressed disappointment with the court's decision regarding Ripple, so there are low chances for BlackRock and other companies to obtain approval for an ETF.

BTC/USD Analysis

Despite all the positive news that has filled the market in July, Bitcoin continues to move within the range of $29.8k–$31.5k. Buyers confidently reject attempts to break below the current range, while sellers firmly prevent the price from trading above $31k.

However, yesterday there was a nominal break below the lower boundary—the $29.8k level. The price of Bitcoin dropped as low as $29.6k, indicating a weakening of bullish positions. Over the past seven days, BTC has set a local high and the July low. As of July 18, the asset shows more indications of a resumption of a downward movement.

The new trading day for BTC/USD began with a decline, and as of 10:00 UTC, the price of the asset is below $30k. Technical metrics also indicate a continuation of the downward movement. RSI and Stochastic are moving towards the oversold zone, and there are no indications of bull activation on lower timeframes.

On the 4-hour chart, we observe the formation of another bearish crossover on the Stochastic indicator. This indicates a worsening of the downward movement after an unsuccessful attempt by bulls to push the price above $30k. The nearest targets are the levels of $29.6k–$29.8k and deeper positions near $29.3k–$29.5k.

Conclusion

Bitcoin has been trading in the range of $29.8k–$31.5k from the end of June until today. The consolidation of price was preceded by a strong bullish surge from the $27.1k level, and therefore, if the $29.3k–$29.5k level is broken, the price will continue the downward movement towards $27k with little resistance. It should be noted that sellers have managed to take the initiative locally, so bulls are now defending the $29.3k–$29.5k levels.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română