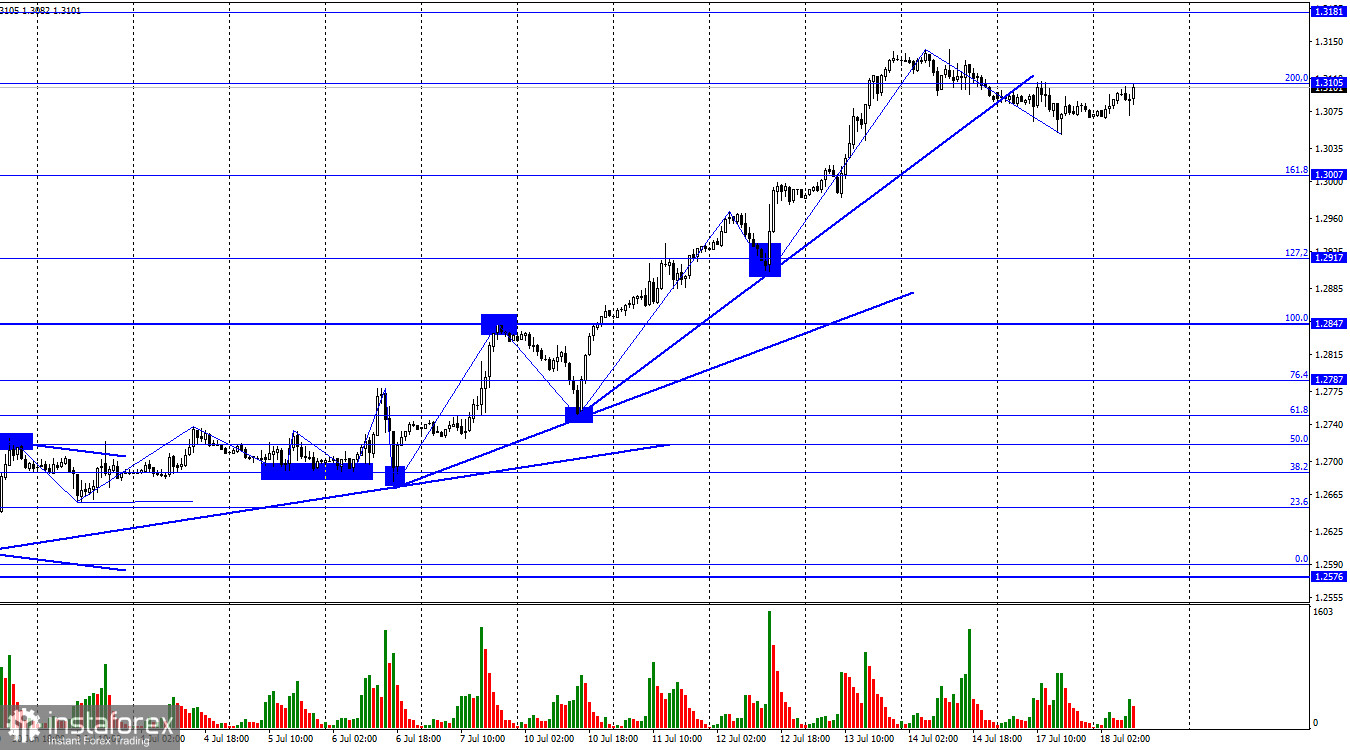

Hello, dear traders! On the hourly chart, GBP/USD consolidated below the 200% retracement level of 1.3105 on Monday. Yet, it was a brief movement. Now the pair has returned to 1.3105. Consolidation above the mark will indicate the resumption of an uptrend to the level of 1.3181. A pullback from it may trigger a fall to the 161.8% Fibonacci level of 1.3007.

In terms of wave analysis, the situation has not practically changed. A bearish wave formed on Friday and Monday, and it does not influence the uptrend somehow. All in all, corrective waves are common for the market. They do not illustrate reversals. If the following bullish wave does not break the high of June 14th, the pair may drop and even enter a downtrend. However, currently, the are no reversal signs.

The British pound is still strong, regardless of the fundamental backdrop. Over the past two weeks, there were a lot of questions about the pair's movement, which is not in line with fundamentals. No news, no correction. The pair has not closed above the 1.3105 mark yet. Therefore, I assume, the price may go down slightly this week.

Tomorrow, the UK will see the release of its inflation data. The reaction of the market to this report is hard to predict. If inflation slows more than anticipated, this could trigger a fall in GBP. Otherwise, the pound could strengthen even more.

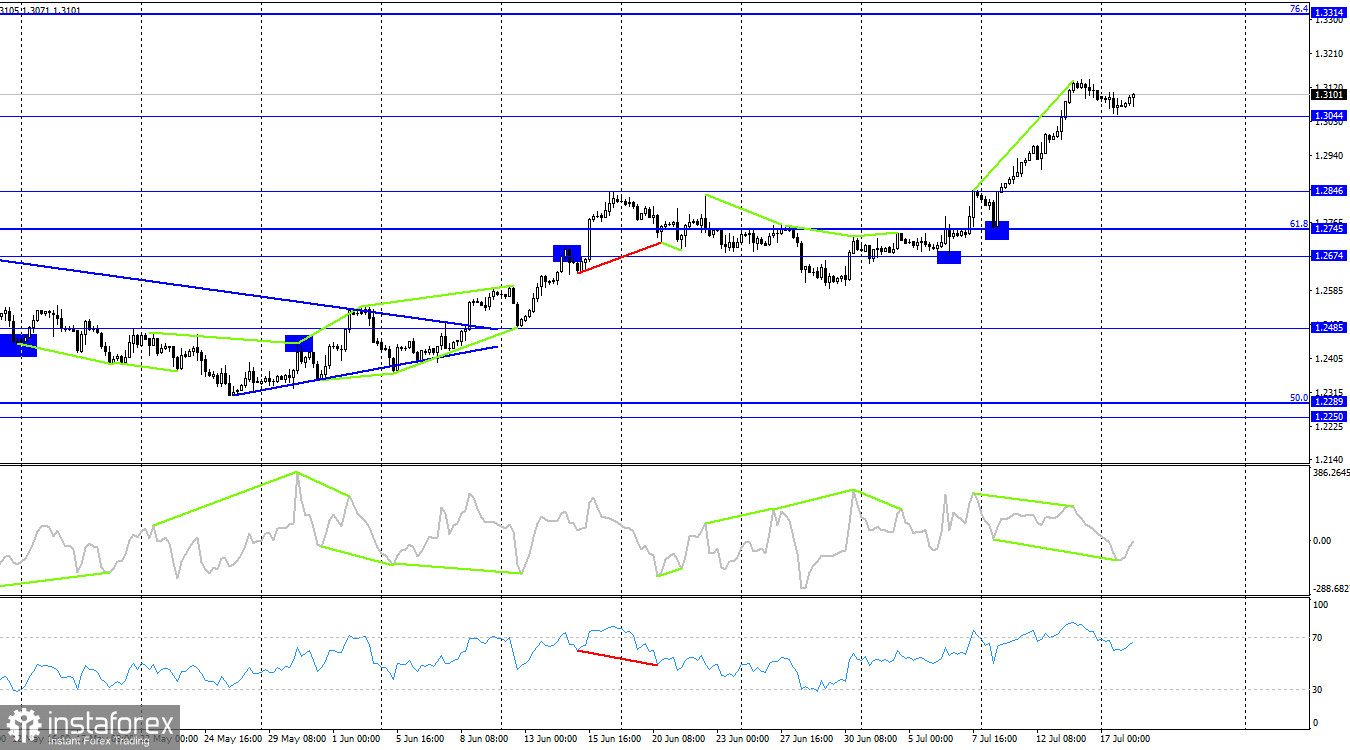

On the H4 chart, the pair consolidated above 1.3044. We may see a bullish continuation toward the 76.4% retracement level of 1.3314. The CCI shows both a bearish divergence and a bullish divergence. Therefore, the pair will highly likely be in the uptrend. Consolidation below 1.3044, may indicate a further drop in value.

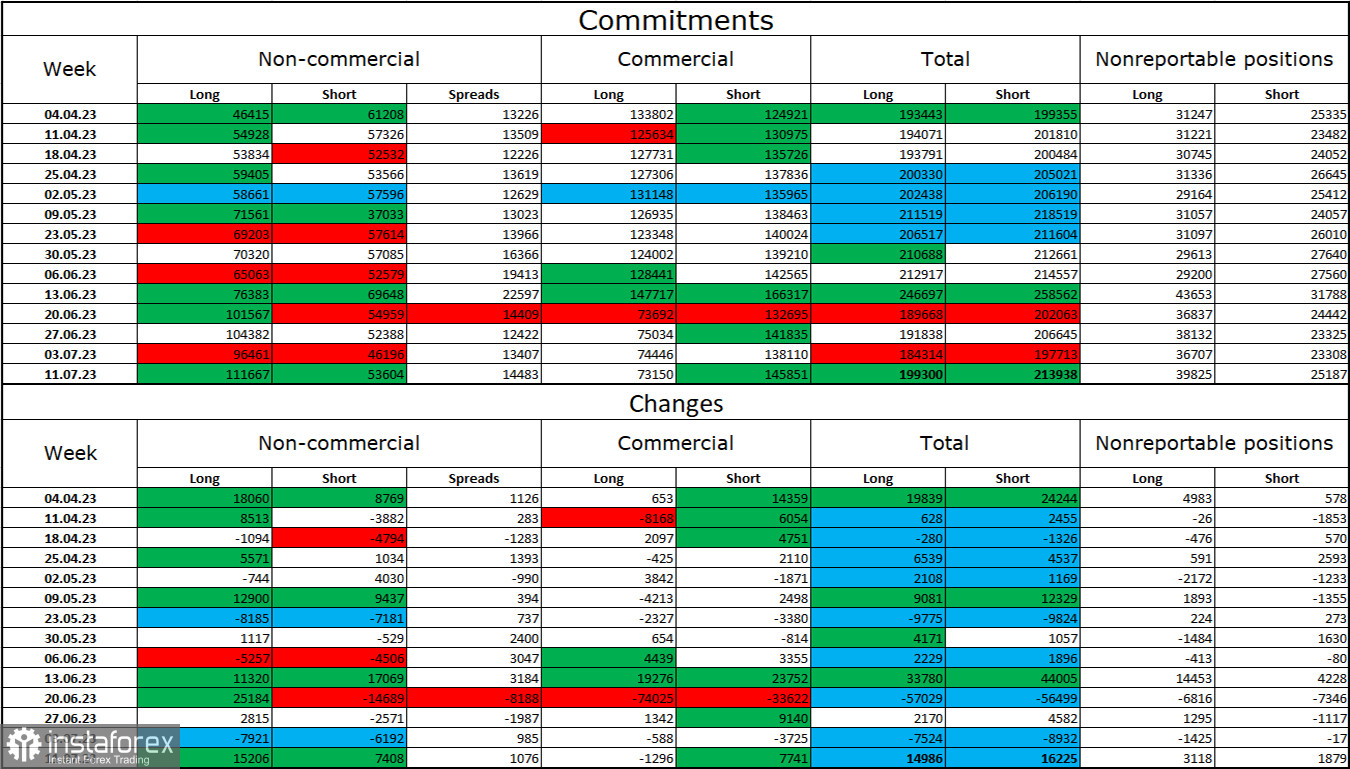

Commitments of Traders (COT):

The sentiment of non-commercial traders has become more bullish over the reporting week. The number of long positions increased by 15,206 and that of short positions rose by just 7,408. Overall, sentiment remains bullish, with a wide gap between the number of long and short positions: 111,000 vs 53,000 respectively. The pound sterling has enough growth potential and the fundamental backdrop is favorable for it rather than for the US dollar. Nevertheless, we do not bet on a steep increase in the sterling in the near term because the market does not take into account numerous factors supporting the greenback. Meanwhile, the pound grows only on expectations of new rate hikes by the Bank of England.

Macroeconomic calendar:

US: Retail Sales, Industrial Production

On Tuesday, the macroeconomic calendar contains two interesting reports. The fundamental backdrop may have little influence on trader sentiment in the second half of the day.

Outlook for GBP/USD:

We may sell the instrument in case of a bounce off 1.3105 on the H1 chart. If there are reversal signs, we may consider other options. We may also buy the instrument when the price closes above 1.3105 on the H1 chart, targeting 1.3181. Still, mind to be cautious, as the pound is rising regardless of the fundamental backdrop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română