EUR/USD demonstrated the largest weekly gain in a year, adding nearly 250 pips last week. The pair maintains a positive dynamic amid expectations of a narrowing interest rate differential between the Federal Reserve and the European Central Bank, which is justified by a higher level of inflation in the eurozone compared to the United States.

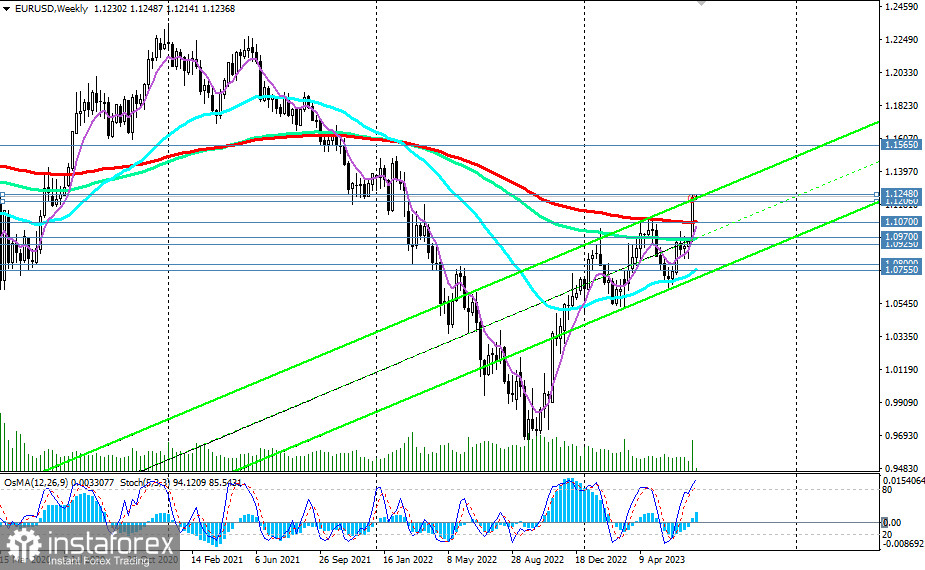

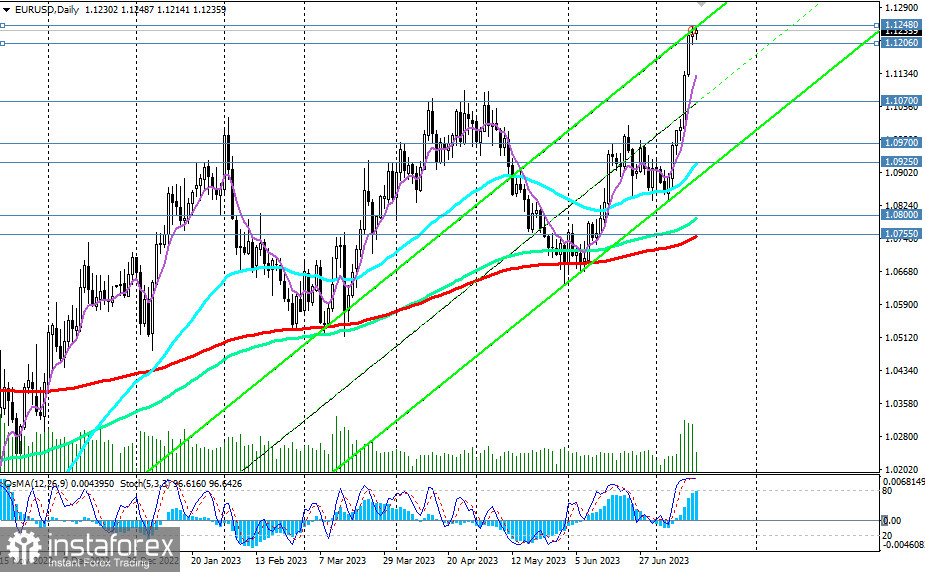

Last week, the price broke through the key long-term resistance level of 1.1070 (200 EMA on the weekly chart), thereby setting the stage for further growth towards the key resistance level of 1.1565 (200 EMA, 144 EMA on the monthly chart), separating the global bearish market of EUR/USD from the bullish one.

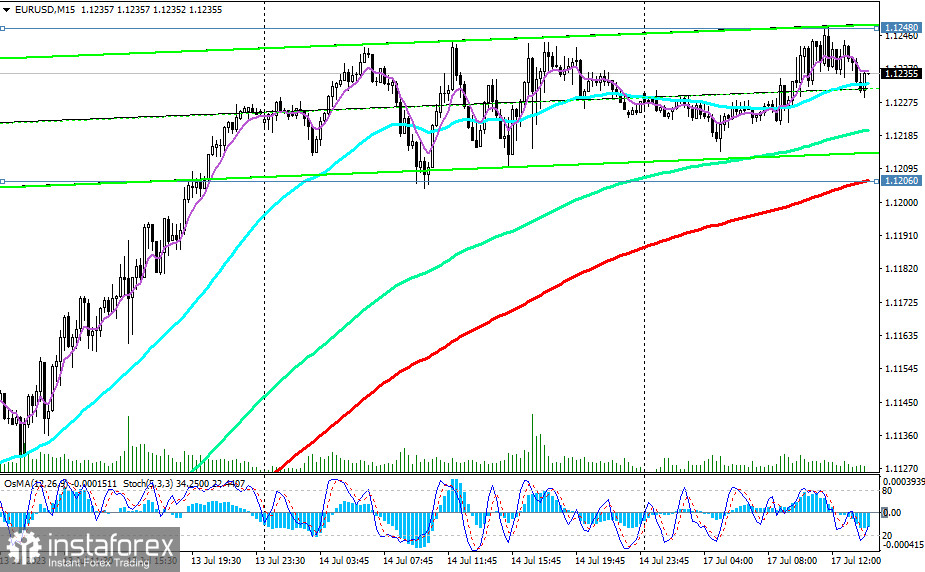

The breakout of today's local high at 1.1248 may serve as one of the signals for new long positions on EUR/USD with targets at 1.1500 and 1.1565.

In an alternative scenario, if EUR/USD breaks the support level of 1.1206 (the previous trading day's low and 200 EMA on the 15-minute chart), it will be the first "quick" signal for the resumption of short positions, and the price may decline towards the support levels of 1.1090 (local highs) and 1.1070 (200 EMA on the 1-hour chart), from which long positions can be built up with stops below the 1.1050 level.

In case of a further breakdown, EUR/USD will decline towards the support zone at levels of 1.0970 (144 EMA on the weekly chart) and 1.0925 (50 EMA and the lower line of the upward channel on the daily chart), from which new long positions may be formed, considering the current bullish trend of EUR/USD.

Only a break of the key support levels at 1.0800 (144 EMA on the daily chart) and 1.0755 (200 EMA on the daily chart, 50 EMA on the weekly chart) will indicate a resumption of the long-term bearish trend, while a break of the local support level at 1.0520 will definitively return EUR/USD to the zone of the global bearish market.

Support levels: 1.1206, 1.1200, 1.1090, 1.1070, 1.1000, 1.0970, 1.0925, 1.0800, 1.0755, 1.0700

Resistance levels: 1.1248, 1.1300, 1.1400, 1.1500, 1.1565, 1.1600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română