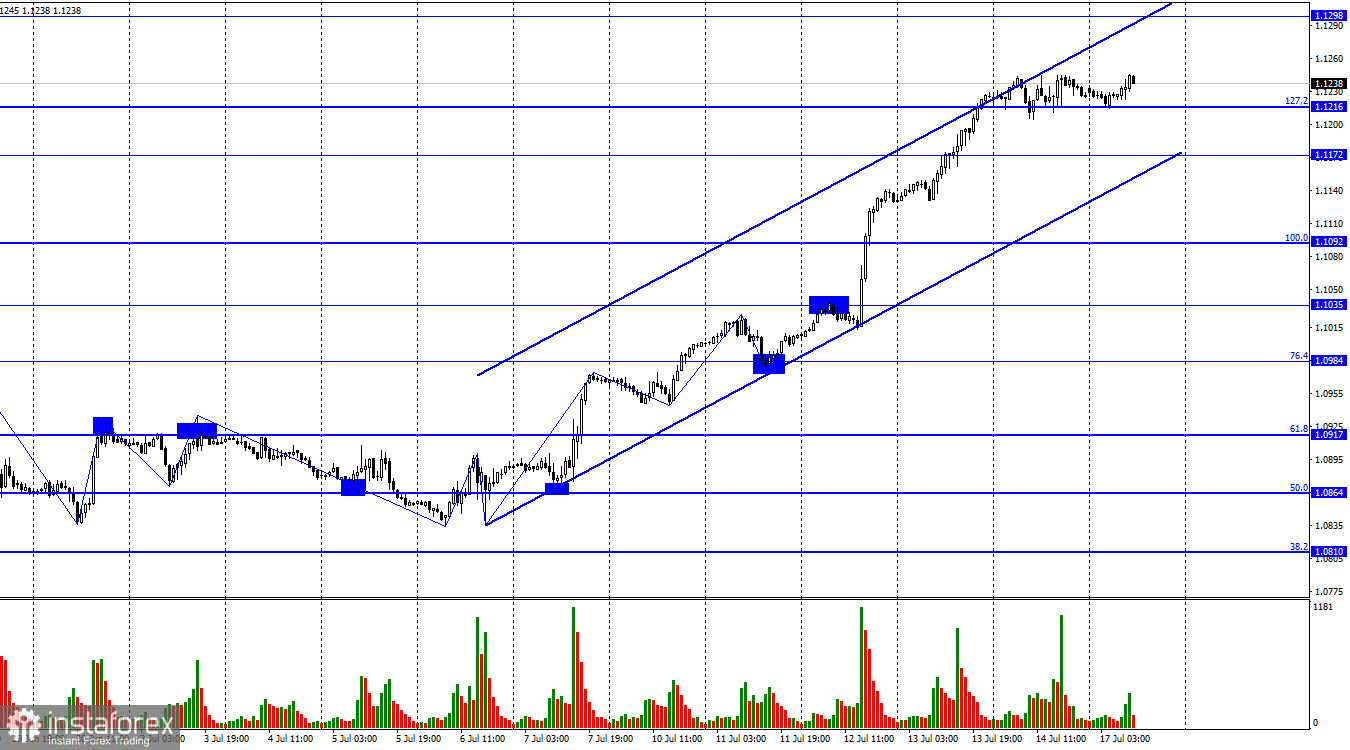

The EUR/USD pair remained above the 127.2% Fibonacci retracement level at 1.1216 on Friday, opening the way for further growth towards the next level at 1.1298. The ascending trend channel signals the bullish sentiment. Consolidation below 1.1216 may indicate a small decline while closing below the channel could shift the market sentiment to bearish.

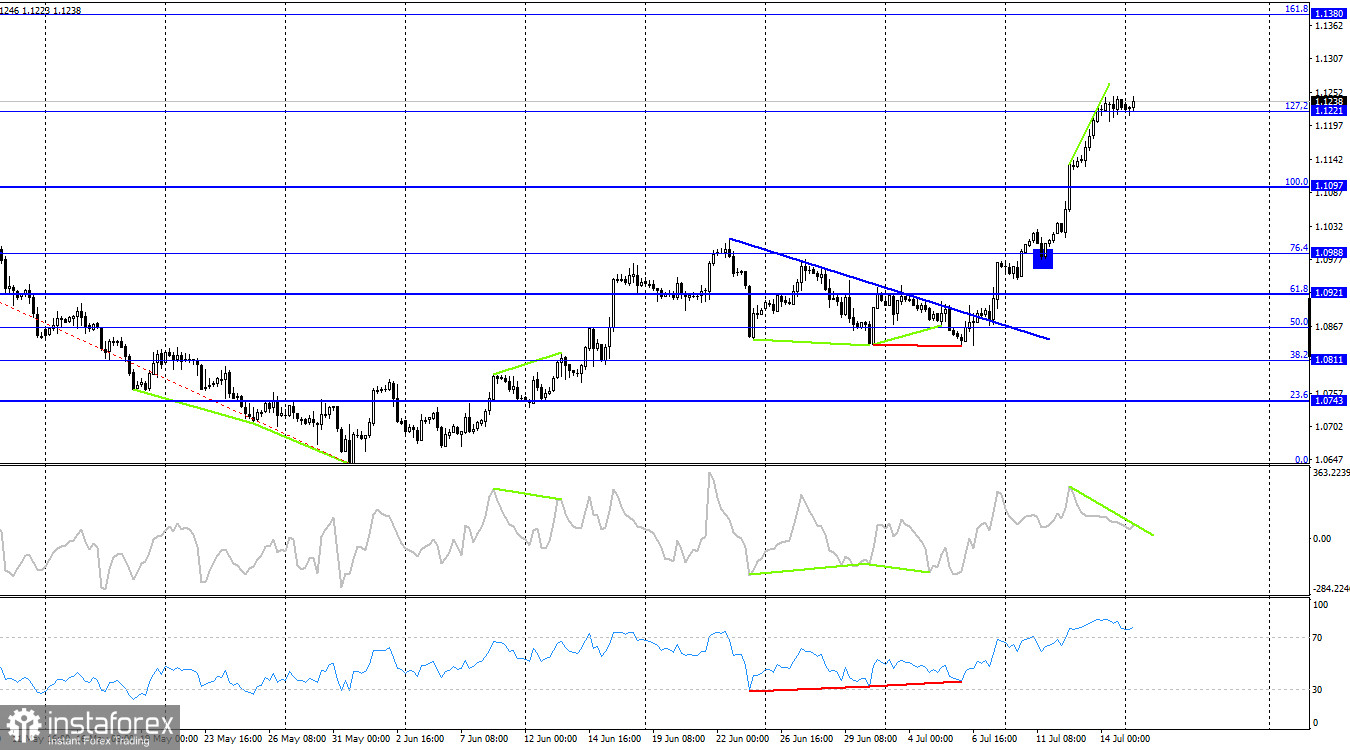

The wave analysis does not tell us anything new. An ascending wave has been forming since last Tuesday, and it is still not complete. The previous week can be called the "week of US inflation" as a sharp decline in the US dollar came after this report. The dollar opened the new week at its lowest level in a year. There are currently no reasons for ending a bullish trend, with no signs of even a slight downward wave needed for a correction or pullback.

On Friday, the report on consumer sentiment from the University of Michigan did not affect the bullish market. Despite the data turning out to be much better than expected, it did not provide any support for the dollar. On Monday, there is a scheduled speech by ECB President Christine Lagarde, but expectations are quite low. The market is sure about a 0.25% interest rate hike this month, and the regulator is unlikely to change its hawkish rhetoric.

Today, trading activity may remain very low. Throughout the week, there will be just a few economic reports.

On the 4-hour chart, the euro/dollar pair settled below the 127.2% Fibonacci level at 1.1221, with a prospect of reaching the next retracement level of 161.8% at 1.1380. Traders have downplayed many recent reports and factors but the euro keeps rising with no technical signs of a reversal. The CCI indicator shows an upcoming bearish divergence but there are currently no bears in the market.

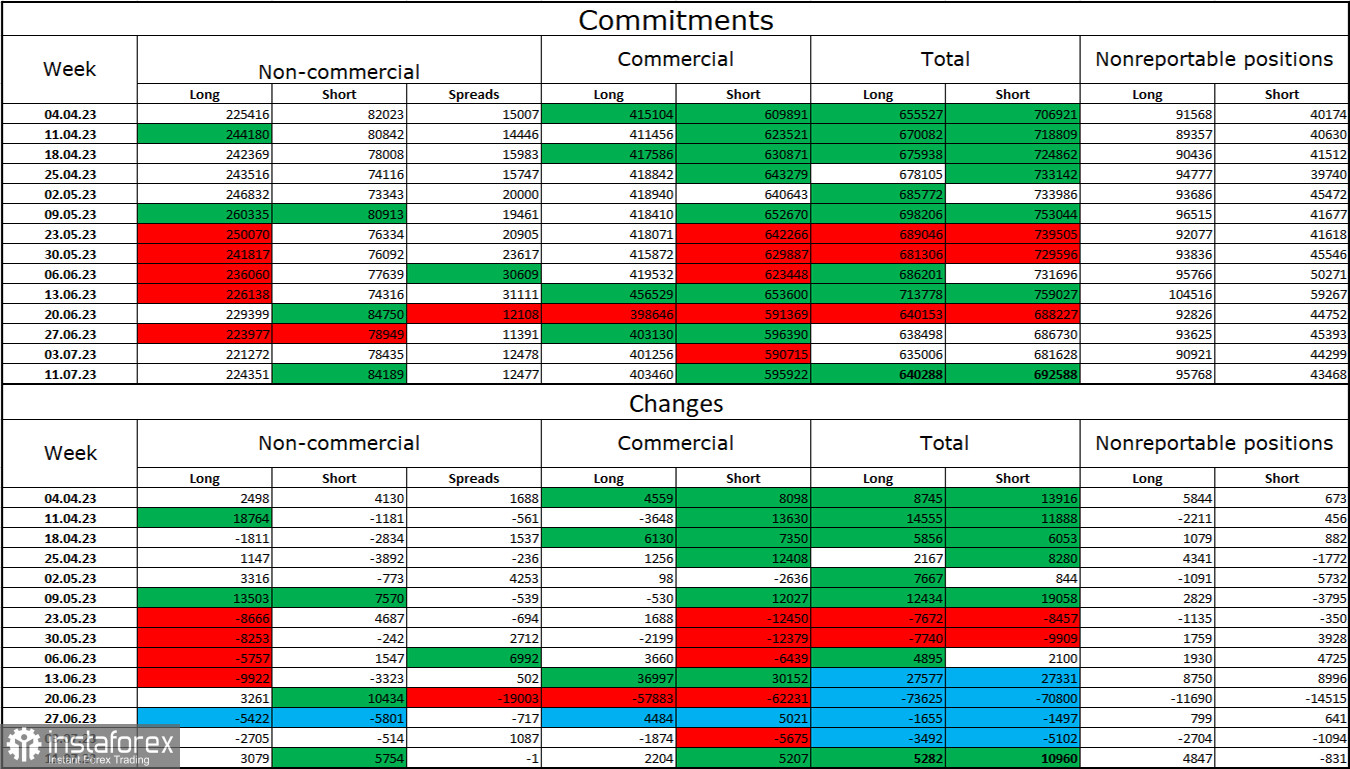

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 3,079 long contracts and 5,754 short contracts. The sentiment of large market players remains bullish but is gradually weakening. The total number of long contracts held by speculators stands at 224,000, while short contracts total 84,000. Although bulls prevail in the market, I believe that the situation will start to change in the opposite direction in the near future. The high volume of open long contracts indicates that buyers may start closing their positions soon (or have already started) due to an overbought status of the asset. I think the current figures allow for a decline in the euro in the coming weeks, especially considering the strong rally last week. However, there are no technical sell signals yet.

Economic calendar for US and EU:

EU - ECB President Christine Lagarde speaks (08:15 UTC)

On July 17, the economic calendar contains only one insignificant event. The impact of the news background on trader sentiment for the rest of the day may be weak. It is a good time for a correction but there are no signs of it yet.

EUR/USD forecast and trading tips:

Selling the pair can be possible after the price settles below the level of 1.1216 on the 1-hour chart with the targets at 1.1172 and 1.1092. The market is bullish, so the pair is unlikely to show a deep fall. I would recommend buying the pair after a rebound from 1.1092 on the H1 chart with the targets at 1.1172 and 1.1216. These targets have already been tested. You can consider opening new long positions with the target at 1.1298 until the price closes below 1.1216.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română