EUR/USD

EUR/USD

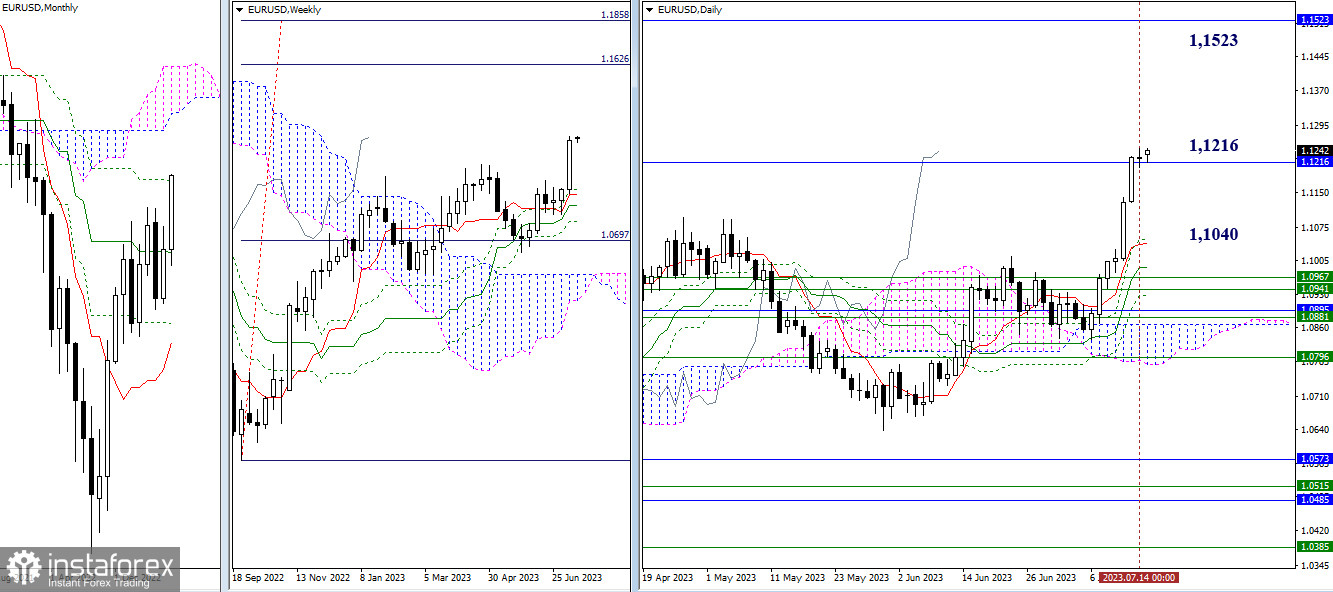

Higher timeframes

Last week, the bullish players executed an active and successful ascent. They reached the monthly resistance level (1.1216) and began testing it. A break of this level will eliminate the monthly death cross of the Ichimoku, which will open the way to the monthly cloud (1.1523 - 1.1734) and the target for breaking the weekly Ichimoku cloud (1.1626 - 1.1858). Currently, supports are far from the price chart. If a decline is realized today, the first support levels to meet bearish players will be the supports of the daily Ichimoku cross (Tenkan 1.1040 - Kijun 1.0989), reinforced by the weekly levels of 1.0967 - 1.0941.

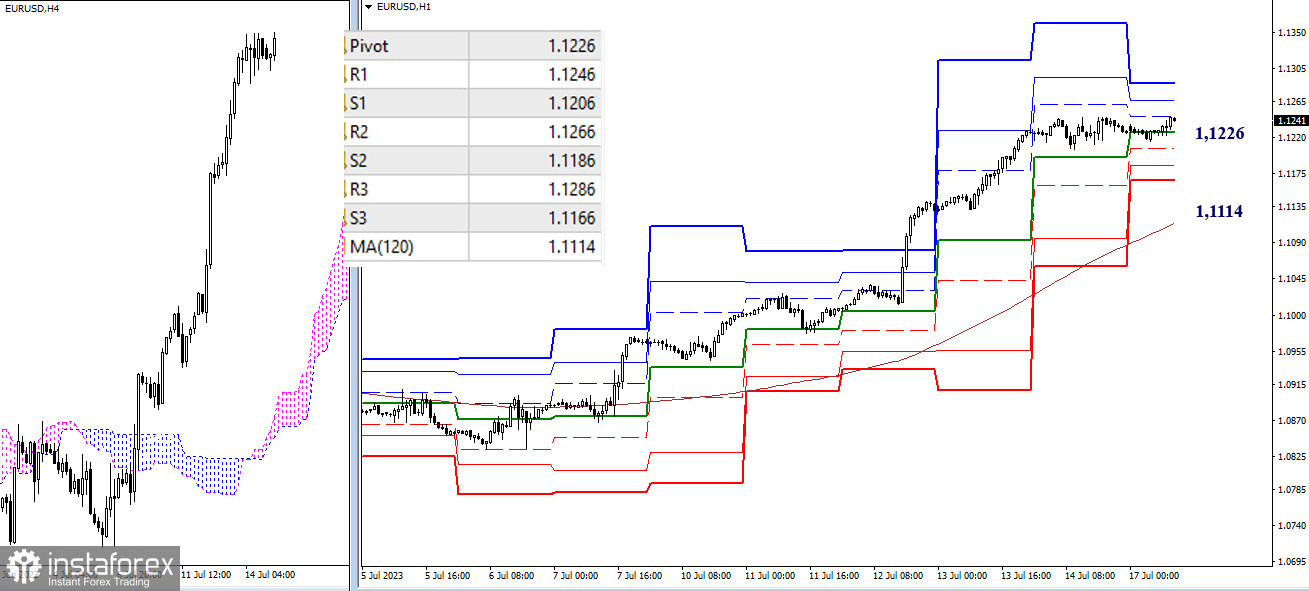

H4 - H1

After a slight slowdown on Friday, bullish players are aiming to continue the ascent, reaching a new high for the past week (1.1245). Intraday bullish targets for today can be noted at 1.1246 - 1.1266 - 1.1286 (resistance levels of classic pivot points). If market initiative shifts today, the decline will take place through the support levels of classic pivot points (1.1226 - 1.1206 - 1.1186 - 1.1166), and the main target for bearish players will be testing and breaking the key level that represents the current balance of power, which is the weekly long-term trend (1.1114).

***

GBP/USD

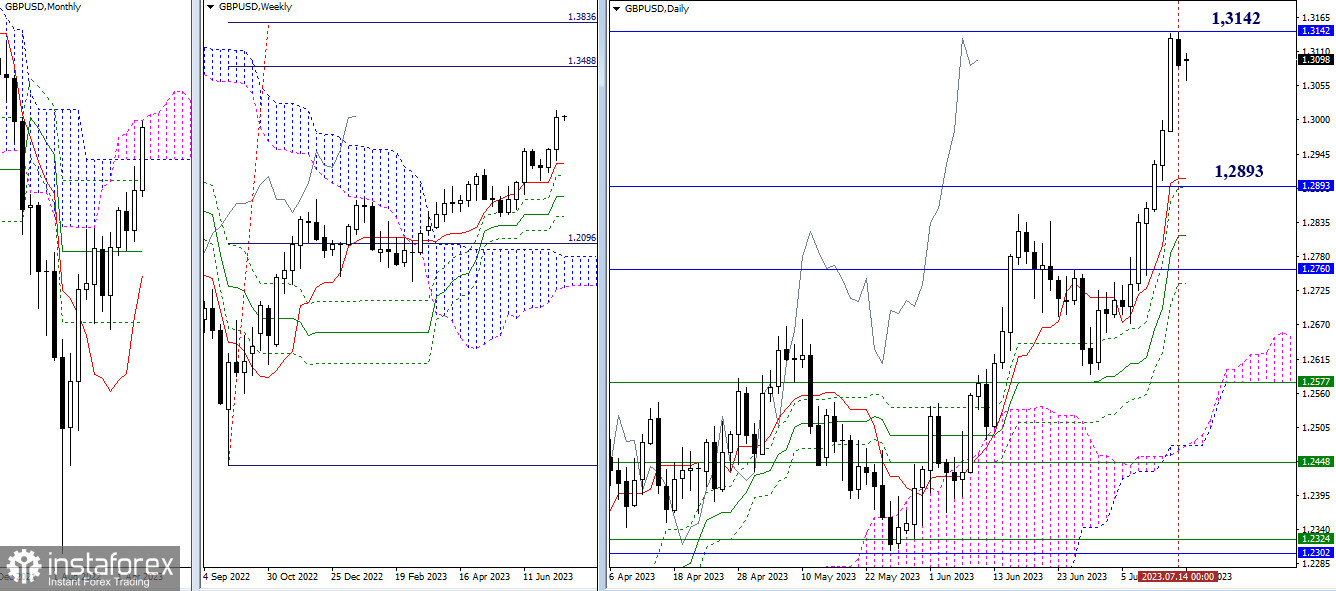

Higher timeframes:

Last week, bullish players reached the resistance of the upper boundary of the monthly cloud (1.3142). The result of testing this level is currently interesting and important, as it can determine further developments. In case of a breakout, the next bullish target will be the upward target for breaking the weekly Ichimoku cloud (1.3488 - 1.3836). However, if the Friday slowdown leads to a downward correction, the nearest reference point on the higher timeframes is the area of the lower boundary of the monthly Ichimoku cloud (1.2893) and the daily short-term trend (1.2907).

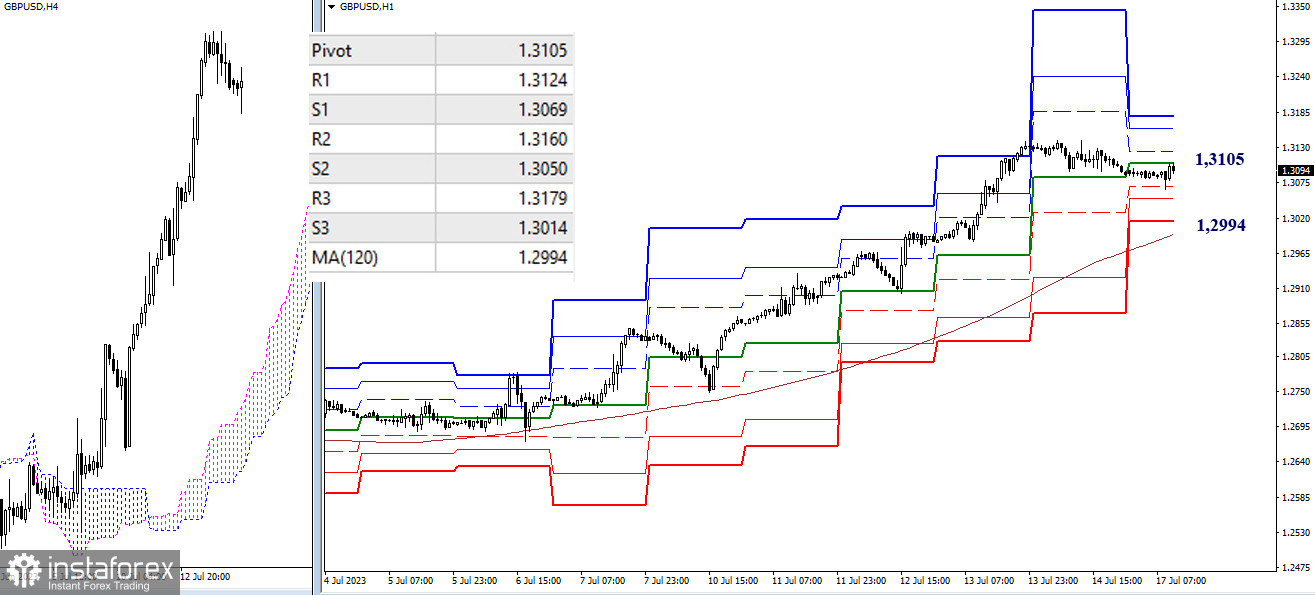

H4 - H1:

Currently, the main advantage on the lower timeframes belongs to the bullish players. However, the pair is in a corrective decline. Intraday movement targets for today can be marked for bullish players at 1.3105 - 1.3124 - 1.3160 - 1.3179 (classic pivot points) and for bearish players at 1.3069 - 1.3050 - 1.3014 - 1.2994 (classic pivot points + weekly long-term trend).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română