The EUR/USD currency pair today marked itself at the level of 1.1245, which is the strongest result since February 2022. And although traders could not maintain the achieved heights, the sentiment for the pair remains bullish. Against the backdrop of a declining greenback, the euro feels quite confident, especially after Thursday's publication of the ECB minutes, which reflected the hawkish position of the European regulator members.

Buyers of EUR/USD are benefiting from the current situation: the dollar is weakening, while the euro is strengthening. In a sense, this is a perfect storm on the waves of which the pair has reached 17-month price highs.

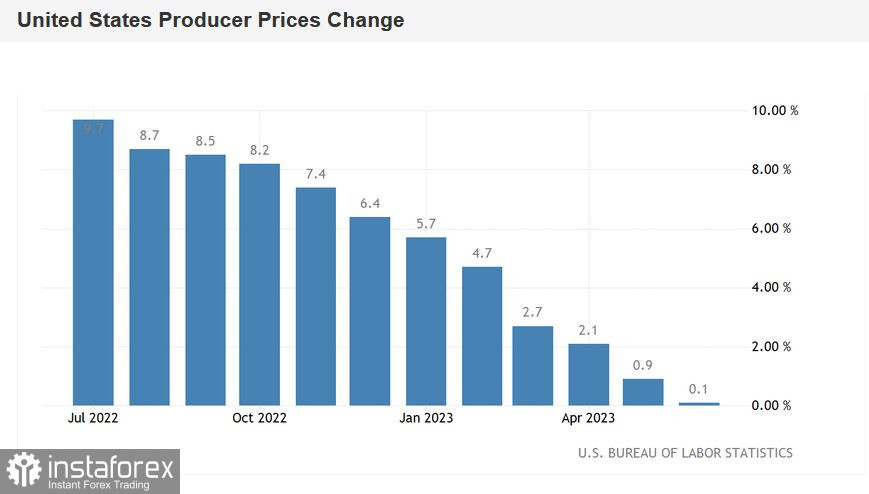

Producer Price Index

As it is known, the catalyst for the upward surge of EUR/USD was the report on the growth of the Consumer Price Index, which reflected a slowdown in inflation in the United States. Both the headline and core CPI ended up in the "red zone." On Thursday, the picture was complemented by another significant inflation release, namely the Producer Price Index, which serves as an early signal of changes in inflationary trends or their confirmation. In this case, we are dealing with confirmation of a downward trend. The report once again came out in the "red zone" despite relatively weak forecasts. The headline index in annual terms plummeted to 0.1% against an expected decline to 0.4% (the indicator has been declining for 12 consecutive months), the slowest pace of growth since August 2020. The core Producer Price Index demonstrated a similar dynamic, dropping to 2.4% in June (the lowest value since January 2021) against an expected decline to 2.6%. In this case, the indicator has been decreasing for 15 consecutive months.

After the publication of this report, the probability of maintaining the status quo at the September meeting increased to 87%, according to the CME FedWatch Tool. The probability of a rate hike at the November meeting decreased to 20%. However, the chances of a rate hike in July remain very high, with a probability estimated at 95%.

In other words, despite the slowdown in inflation in the United States, traders have almost no doubt that the central bank will raise the interest rate by 25 basis points at the upcoming meeting. At the same time, confidence is growing that the July decision will be the last within the current cycle of monetary policy tightening. And this circumstance puts strong pressure on the greenback.

Emotional Swings

Indirectly, Federal Reserve Chairman Jerome Powell played a role in the dollar's weakening. At the end of June, he noticeably toughened his rhetoric, thus doing a disservice to the greenback. In his speech at the ECB Forum in Sintra, Portugal, he stated that many committee members are advocating for two or more rate hikes this year. Amid such rhetoric, the dollar strengthened across the market, and the EUR/USD pair "dived" to the base of the 8th figure. Additionally, final data on US economic growth for June were published. According to revised data, the U.S. GDP growth in the first quarter was not 1.3% but 2%. And to top it all off, the May Nonfarm Payrolls were in favor of the dollar, with almost all components coming out in the "green zone."

However, the inflation data released this week have reshaped the fundamental picture. Now there is growing skepticism among experts regarding additional rate hikes after the July meeting. In particular, currency strategists at Commerzbank expressed confidence that the July rate hike will be the last in the current tightening cycle of the central bank. Similar views were voiced by analysts at UBS Group, who pointed out that there are encouraging signs that inflation in the services sector is decreasing (this component of the inflation report greatly concerned Powell and some of his colleagues). According to UBS experts, the Federal Reserve will not declare victory over inflation yet, but the June data confirm the possibility that the end of rate hikes is not far off, and this fact will exert background pressure on the American currency.

It is noteworthy that even the relatively hawkish comments made by representatives of the Federal Reserve after the CPI data did not help the dollar. For example, San Francisco Federal Reserve Bank President Mary Daly stated Thursday that it is still "too early to declare victory over inflation," particularly due to wage growth. Another Fed representative, Christopher Waller, similarly expressed support for further rate hikes, citing labor market stability and positive overall indicators of the U.S. economy. He also reiterated the thesis that it is still too early to declare victory over inflation. As an argument, he recalled the events of last year when inflation initially slowed down but then picked up again.

However, despite such statements, the greenback continues to face significant pressure: the U.S. Dollar Index today declined to the base of the 99th figure (the lowest level since April 2022). Based on data from the CME FedWatch Tool and comments from several experts, the market still doubts that the Federal Reserve will maintain a hawkish stance after the July meeting. And these doubts work against the American currency.

Conclusions

The EUR/USD pair might not have exhausted its growth potential yet, but opening long positions today can be risky. The infamous Friday factor is to blame. After such a sharp and almost non-retractable price surge, many traders will hesitate to leave their positions open ahead of the weekend. By taking profits, buyers may dampen the upward momentum and trigger a corrective pullback.

Therefore, it is advisable to make trading decisions at the start of the next week. If the pair remains within the 12th figure, the next target for the upward movement will be the 1.1300 level, and surpassing it will open the way to the resistance level of 1.1420 (the lower boundary of the Kumo cloud on the monthly timeframe).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română