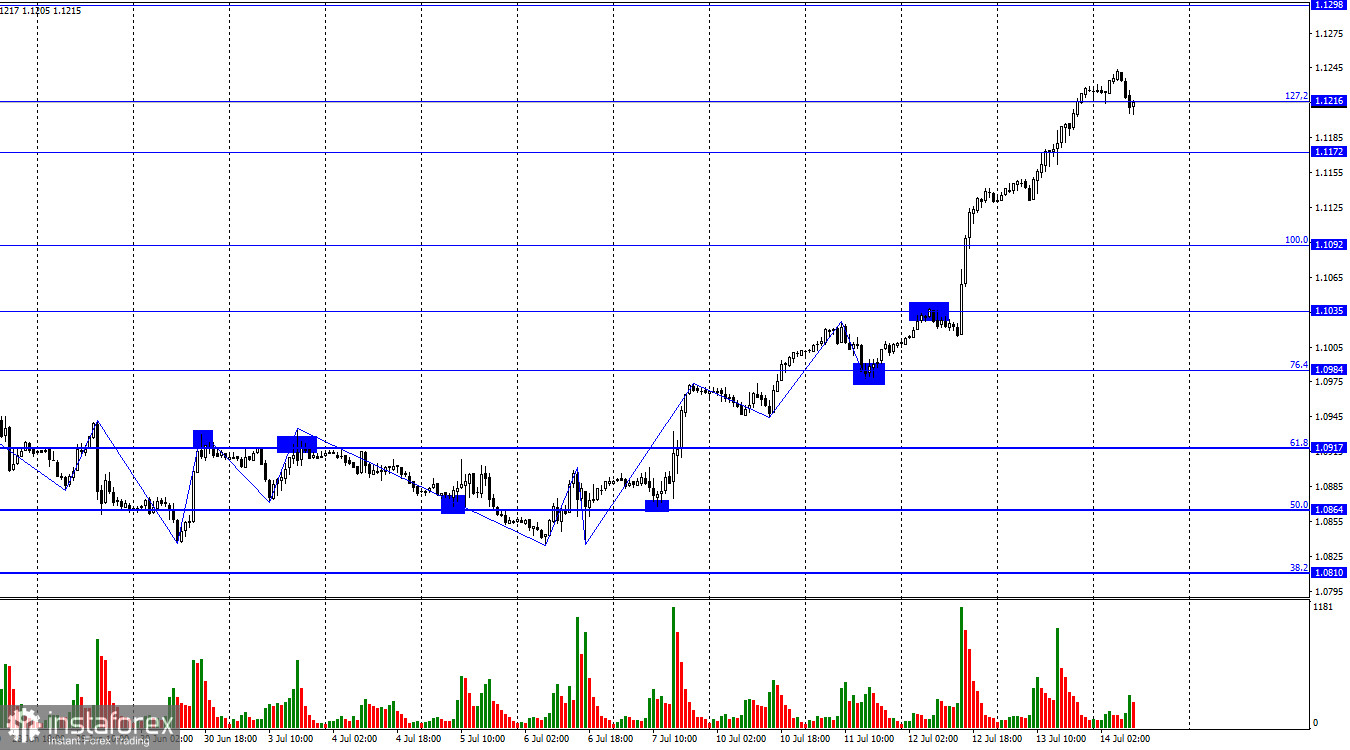

The EUR/USD pair continued the growth process on Thursday and consolidated above the levels of 1.1172 and 1.1216. Today, on Friday, it was not possible to achieve consolidation below the Fibonacci level of 127.2% (1.1216), which would have been very appropriate. Thus, the growth of quotes may continue today towards the next level of 1.1298.

The waves are now of secondary importance for the simple reason that they do not exist. We have observed the pair's growth for the past 3–4 days, meaning that this whole movement is one wave. There are no signs of the end of the "bullish" trend on the hourly chart. For this, at least one wave down is needed, and then, ideally, a wave upward that does not break through the peak of the previous ascending wave. But this is different from the charts now.

Hardly anyone will argue that this week the only cause of the collapse of the American currency was one report - inflation in the US. Traders began to get rid of the US currency as early as Monday, expecting a significant decrease in inflation. And from Wednesday, they continued to get rid of the dollar because inflation fell even lower than they had calculated. Most major analytical companies immediately lowered the probability of monetary policy tightening after the July meeting, and now it is no more than 20% for the rest of the year.

The market's reaction to American inflation turned out to be excessive. Almost five days of working off one report - that's too much. The dollar does not deserve such a fate, given the state of the American economy and the current size of the Fed's rate. However, the market is clearly of a different opinion now. There were no loud performances by members of the FOMC or the ECB during the week, the European regulator did not toughen the rhetoric, and the American one did not soften it. The problem is only in the US inflation report.

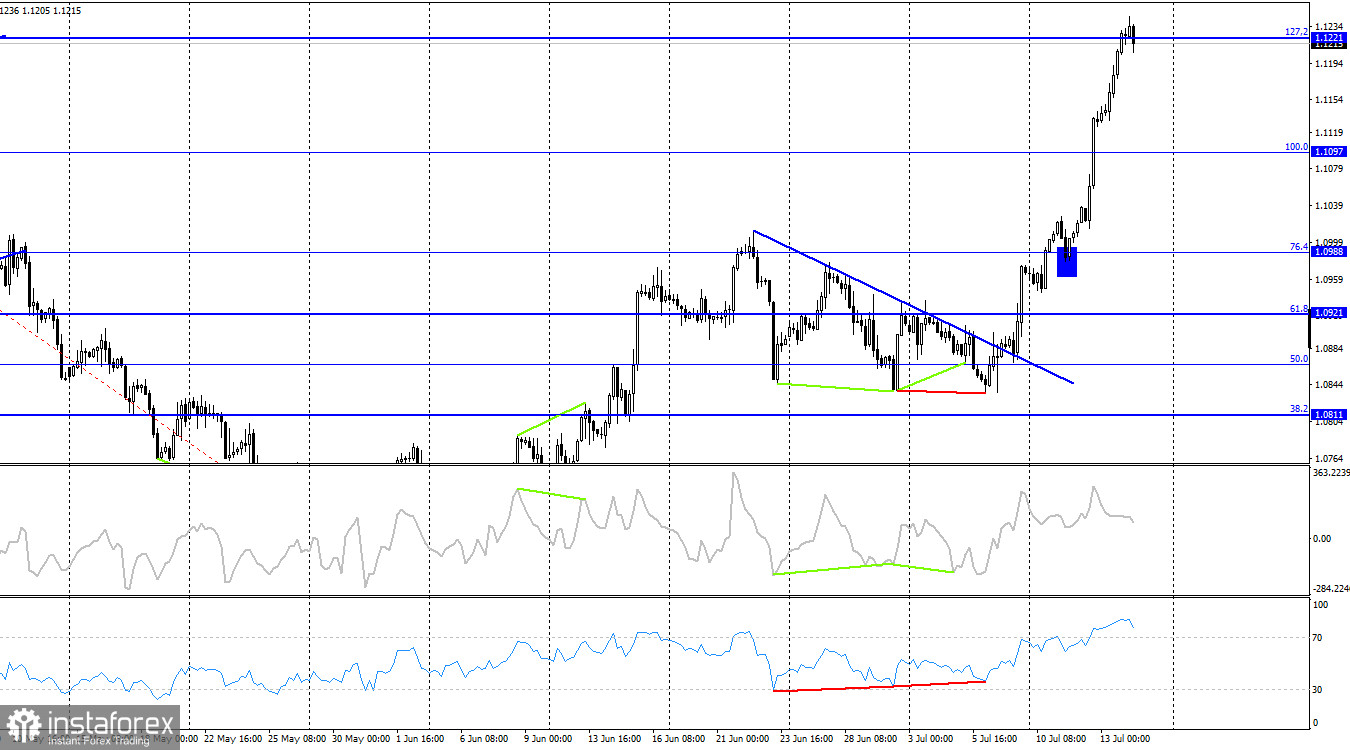

On the 4-hour chart, the pair consolidated above the Fibonacci level of 127.2% (1.1221), allowing it to continue the growth process towards the next corrective level of 161.8% (1.1380). As I already said, traders did not consider many reports and factors this week, but the euro is growing, and there are no graphic signals for a reversal. The CCI indicator was ripe for a "bearish" divergence but was canceled. There are no new divergences.

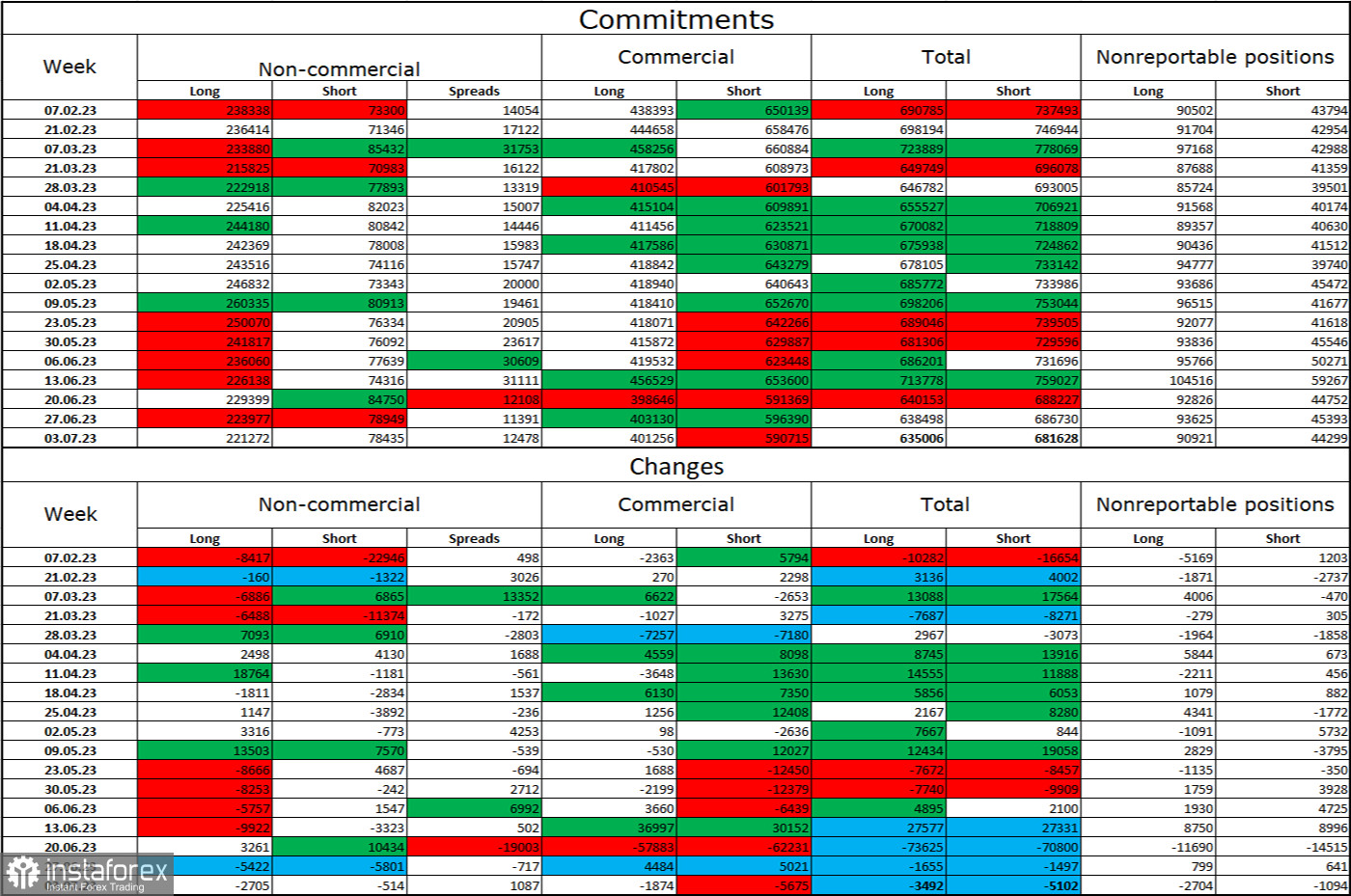

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 2705 long and 514 short contracts. The sentiment of major traders remains "bullish" but is gradually weakening. The total number of long contracts held by speculators now stands at 221 thousand, while short contracts are only 78 thousand. The bullish sentiment persists, but the situation will change in the opposite direction soon. The European currency has been falling slightly more often than rising in the last two months. The high value of open long contracts suggests that buyers may begin to close them soon (or have already started, as suggested by recent COT reports) - there's too strong a skew towards the bulls now. The current figures allow for a further drop in the euro soon.

News calendar for the US and the European Union:

US - University of Michigan Consumer Sentiment Index (14:00 UTC).

The economic events calendar for July 14th contains one insignificant entry. The influence of the news background on traders' sentiment for the remainder of the day will be very weak. It's a good time for a correction, but there are no signs of it starting yet.

EUR/USD forecast and trading advice:

Small sales are possible with consolidation below the level of 1.1216 on the hourly chart, with targets at 1.1172 and 1.1092. The trend is bullish, so do not count on a strong fall in the pair. I advised purchasing the pair on a rebound from the level of 1.1092 on the hourly chart, with targets at 1.1172 and 1.1216. The targets have been reached as the pair continues to grow steadily.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română