Global stock markets edge higher as the latest US inflation data ruled out the possibility of further rate hikes by the Fed.

Earlier, market sentiment worsened because investors believed that the Fed will raise rates twice more amid generally positive US employment data. Risk appetite dipped, while both Treasury yields and dollar saw growth. Demand increased again only when consumer inflation decreased in annual terms.

Most likely, positive sentiment will persist, so stock indices, reacting to the results of corporate earnings reports for the second quarter and incoming production indicators, will grow after a local correction. Treasury yields will also move, but a decline should not be expected as the market will balance between the level of interest rates and government bond yields. A similar behavior may be seen from dollar, as after the ICE index broke through the strong support level of 100.00 points, a limited recovery may occur, followed by a reversal.

Dollar's decline will reflect the noticeable change in market sentiment amid falling expectations of further Fed rate hikes.

Forecasts for today:

EUR/USD

The pair may move to 1.1185, and then increase to 1.1340 and 1.1485. The main driver for growth will be the expectation of a halt in Fed rate hikes.

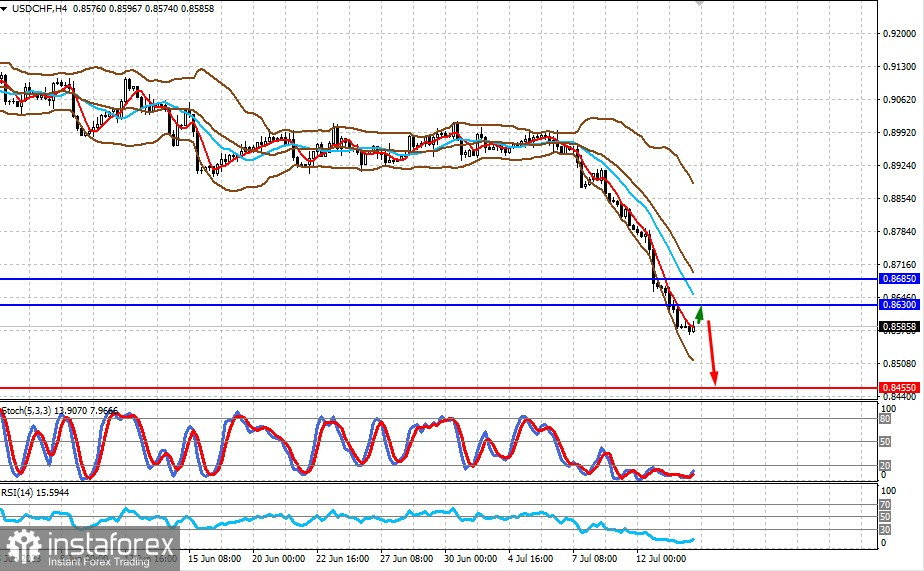

USD/CHF

The pair broke through the support level of 0.8685. A consolidation below it could lead to further weakening to 0.8455, but this will happen only after a local rebound to 0.8630.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română