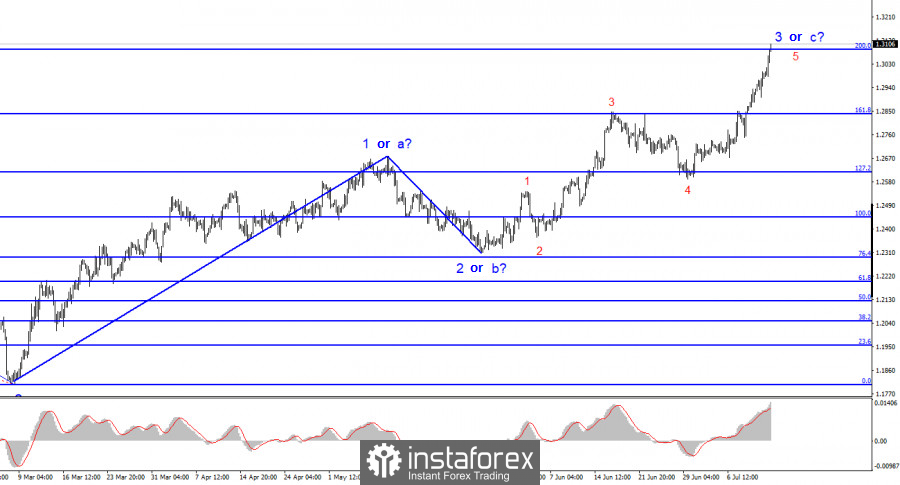

The wave pattern of the pound/dollar pair has shifted towards a more understandable and simpler form. Instead of seeing a complex corrective section of the trend, we can discern an impulsive upswing or a simpler corrective motion. The development of the upward wave, labeled 3 or c, is ongoing, offering the pound a significant chance to escalate to the 31 figure. The pound has no reason to continue rising (and many reports and events confirm my opinion), and the supposed wave 3 or c may be nearing completion. However, the wave pattern has become more complex, and wave 3 or c has taken a more extended form. We can distinctly identify five waves within it, with the last one potentially concluding this week.

The wave pattern of the pound appears significantly more straightforward and intelligible than that of the euro. The third wave could either finalize the rising wave set or stand as the third wave within a five-wave structure. Although the news could have provided insight into this matter, the market currently dismisses it, solely amplifying the pound's daily demand and depreciating the dollar. A failed endeavor to breach the 1.3086 level, equating to a Fibonacci measure of 200.0%, may suggest that the market is poised to generate corrective waves.

The UK's statistical data could be better.

The pound/dollar exchange rate increased by another 110 basis points on Thursday. If the US inflation report can explain yesterday's rise, then today's new dollar decline does not fit the logic. Today in the UK, we saw the release of industrial production and GDP reports. The former saw a volume decrease of 0.6% m/m, exceeding the market's expectation of a 0.4% decline. The GDP declined by 0.1% in May, slightly less than market projections. In three-month calculations, the GDP remained static, contrary to the predicted 0.1% decline. Of the two reports, one was negative for the pound, and the other was conditionally favorable. Regardless of the forecasts, the UK economy has registered a contraction. Let's now attempt to answer the question: why did the pound's demand surge from early morning?

The market is still reacting to yesterday's US inflation report and a downward revision of the expectations for two Fed rate hikes. Yet, the US currency has been down since Monday and Tuesday, reacting to the UK labor market and unemployment news (which were underwhelming compared to expectations). Hence, irrespective of the news environment, the pound strengthens, and the dollar weakens. Based on the above, I see no sense in finding a fundamental reason for the collapse of the US currency. As wave 3 or c remains under construction, we focus on that. The Fibonacci level of 200.0% will help determine whether the structure of this wave will end this week or whether the market is ready to buy further.

General Conclusions.

The wave pattern of the pound/dollar pair implies constructing an ascending wave set. Earlier, I advised buying the pair in case of an unsuccessful attempt to break through the 1.2615 mark, which equates to 127.2% Fibonacci, and then purchasing with targets near the 1.3084 mark, corresponding to 200.0% Fibonacci. All targets have now been achieved, but a successful attempt to break through 1.3084 could lead to a new impulse with targets around 1.3478 (261.8% Fibonacci).

The picture resembles the euro/dollar pair on a larger wave scale, but there are still some differences. The descending corrective trend section is complete, and the construction of a new ascending one continues, which may already be finished or take a full-fledged five-wave form. And even if it takes a three-wave form, the third wave can be extended or shortened.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română