Even before the inflation data was published, almost no one believed that US inflation would cool further than expected, with headline CPI falling to 3% from 4%. Everyone was sure of a somewhat faster decline in inflation. Most agreed on the 3.1% figure. This sapped demand for the US dollar. But reality exceeded all expectations, as inflation slowed to 3.0%. This made everyone believe that the Federal Reserve would limit itself to just one more interest rate hike. There was even a suggestion that the Fed might support a skip in the policy-tightening. It's possible that by the end of the year, the interest rate in the United States will even start to decrease. And the dollar instantly began to depreciate, although it was already quite oversold.

So, it's time to talk about the need for a rebound or minor correction. But it should have a good reason to do so. Formally, this role was played by the UK industrial production report. UK's industrial production continued to contract as it fell 2.3% in May. This is better than the forecast of 2.4%. Now investors are much more concerned about the interest rate disparity. So, further contraction in industrial production, at best, slightly slowed the weakening of the US dollar. But such a thing could end up in a corrective movement, albeit with a slight delay. So, a rebound seems the most likely scenario. But before that, the market will tread water for a while.

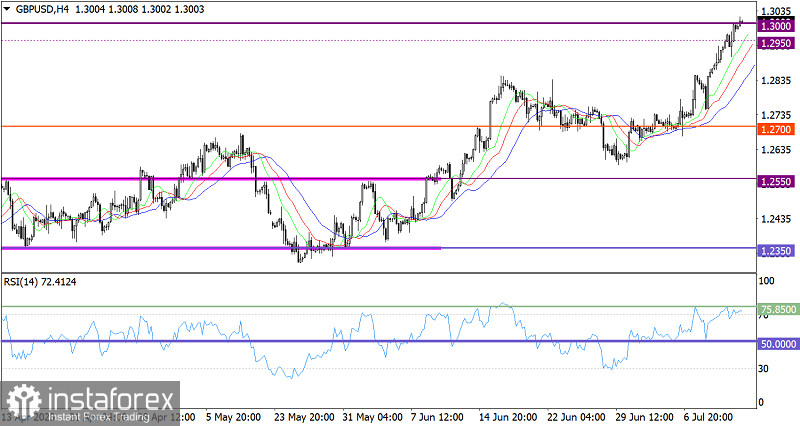

The GBP/USD pair broke through the 1.3000 level. The pound sterling has strengthened by about 350 points since the beginning of July. This is quite significant, considering that the pair has not entered a corrective phase since then.

On the four-hour chart, the RSI readings show that the pair is in overbought territory which points to aggressive long positions.

On the same time frame, the Alligator's MAs are headed upwards, which corresponds to the direction of the price movement.

Outlook

From a technical perspective, aggressive new long positions on the pair can lead to consolidation. This can result in a pullback from the area of the psychological level. However, speculators may completely ignore technical signals of overbought conditions. In this case, trading the pair within the level of 1.3000 can become a lever for subsequent growth.

The complex indicator analysis unveiled that in the short-term, medium-term and intraday periods, indicators are pointing to an uptrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română