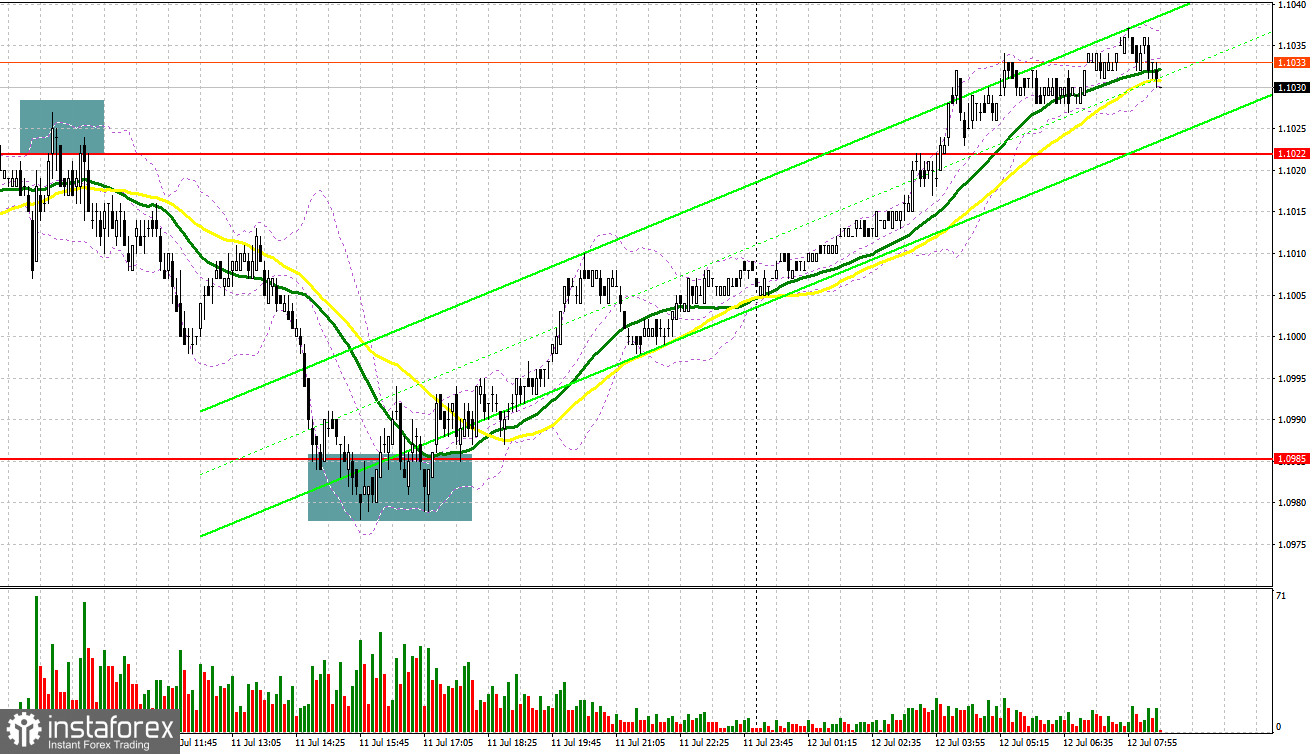

Yesterday, there were several excellent entry points. Now, let's look at the 5M chart and figure out what actually happened. In the morning article, I turned your attention to 1.1022 and recommended making decisions with this level in focus. A rise and a false breakout of this level gave a sell signal, which resulted in a drop of more than 45 pips. In the afternoon, the pair grew by 30 pips amid the protection of 1.0985 and the buy signal. When to open long positions on EUR/USD:

When to open long positions on EUR/USD:

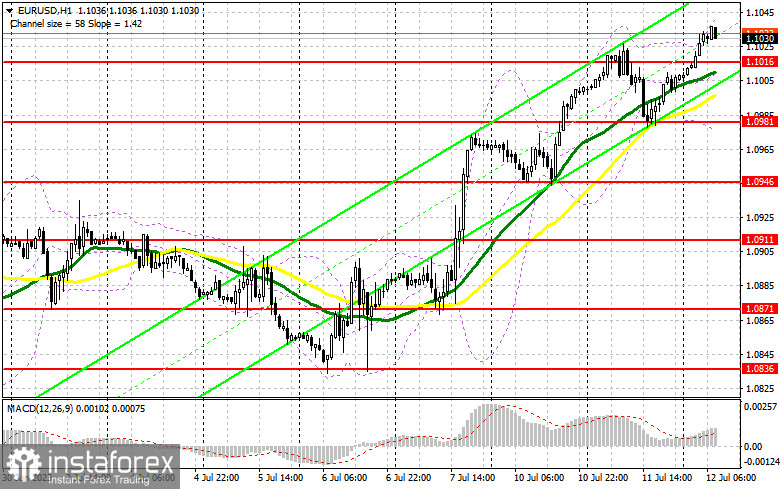

Many market participants are still betting on the further growth of the euro amid expectations of a sharp decrease in inflationary pressure in the United States and the end of the tightening cycle this autumn. Consolidation of the pair above the 1.1000 level is also a very strong bullish signal. The American session will be very interesting today. In the morning there will be only a speech by ECB Executive Board Member Philip Lane.

It is unlikely to affect the positions of major traders. In the morning, it is better to go long only after the decline and a false breakdown of the support level of 1.1016. The moving averages are passing in positive territory below this level. It will give a buy signal, causing a rise to the resistance level of 1.1053. Only hawkish comments from ECB policymakers may help the pair grow higher. A breakout and a downward retest of 1.1053 will boost demand for the euro. The pair has a chance to approach a new monthly high of 1.1090.

A more distant target is 1.1129 where I recommend locking in profits. If EUR/USD declines and bulls fail to protect 1.1016, the pressure on EUR/USD will increase, especially given the data that will be released in the afternoon. Therefore, only a false breakout of the support level of 1.0981 will give new entry points into long positions. You could buy EUR/USD at a bounce from 1.0946, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers need to defend 1.1053. Otherwise, bullish sentiment will remain strong. I would advise you to go short from this level only after growth and a false breakout. It could provide a sell signal with the prospect of a decline to the support level 1.1016. There I expect larger buyers to enter the market. Consolidation below this range as well as an upward retest could trigger a downward movement to 1.0981. It will indicate a fairly large correction of the euro. A more distant target will be the level of 1.0946 where I recommend locking in profits. If EUR/USD rises during the European session and bears fail to protect 1.1053, which is possible given the market sentiment before the US data, the bulls will continue to build an uptrend. In this case, it is better to postpone short positions until a false breakout of the resistance level of 1.1090. You could sell EUR/USD at a bounce from 1.1129, keeping in mind a downward intraday correction of 30-35 pips.

If EUR/USD rises during the European session and bears fail to protect 1.1053, which is possible given the market sentiment before the US data, the bulls will continue to build an uptrend. In this case, it is better to postpone short positions until a false breakout of the resistance level of 1.1090. You could sell EUR/USD at a bounce from 1.1129, keeping in mind a downward intraday correction of 30-35 pips.

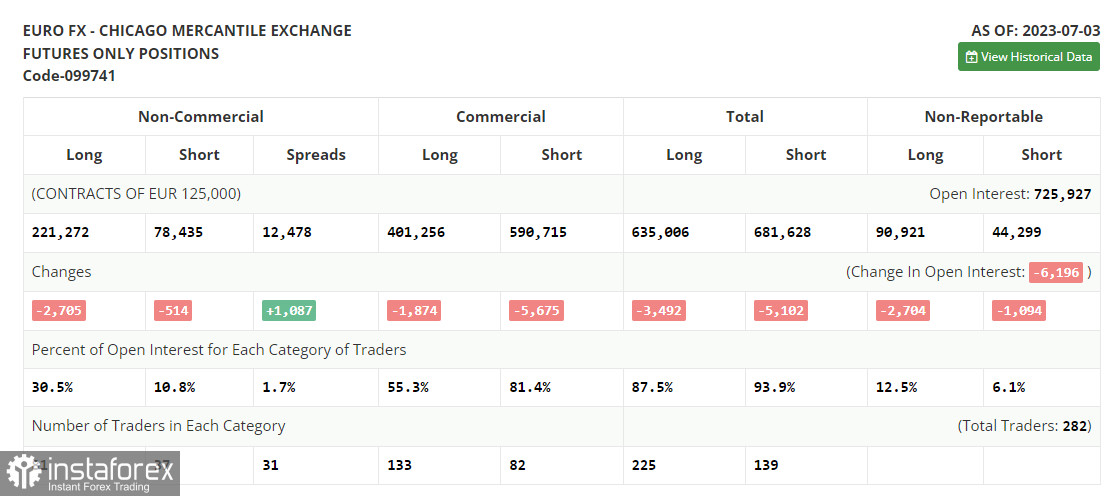

COT report

According to the COT report (Commitment of Traders) for July 3, there was a drop in long and short positions. As a result, the market sentiment remained unchanged. The US labor market data showed the first signs of cooling. It is bullish for risk assets as well as traders who expect further aggressive tightening from the central banks of their countries. However, the Fed could take a pause. Many analysts believe that traders have already riced in the upcoming rate hikes. If fresh reports signal a decrease in inflation, it may lead to a larger sell-off of the US dollar. The medium-term strategy in the current conditions is to go long on the decline. The COT report showed that long non-profit positions decreased by 2,705 to 221,272, while short non-profit positions fell by 514 to 78,435. At the end of the week, the total non-commercial net position slightly slid and amounted to 142,837 against 145,028. The weekly closing price come in at 1.0953 against 1.1006. Indicator signals:

Indicator signals:

Moving averages:

Trading is carried out above the 30-day and 50-day moving averages, which indicates the continuation of a bull market.

Note: The author considers the period and prices of moving averages on the H1 (1-hour) chart that differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0981 will serve as support.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română