The euro aimed to restore the upward trend against the U.S. dollar and clearly miscalculated its strength. The market pricing takes into account two ECB deposit rate hikes. At the same time, investors underestimate the potential for federal funds rate hike. According to ING, such a situation should lead to a fall in EUR/USD to 1.08. That's where the fair value of the main currency pair lies.

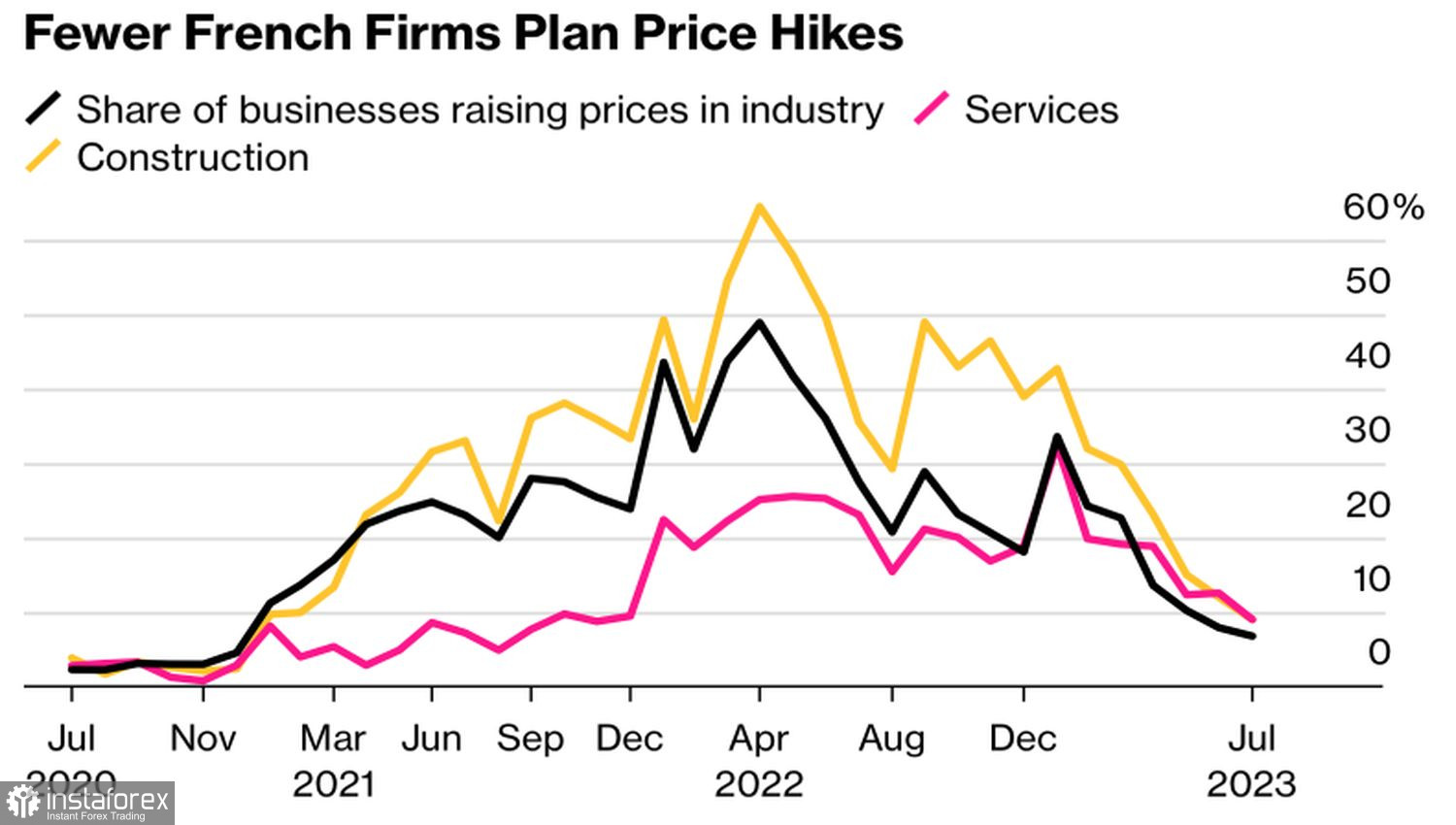

If the market expects FOMC forecasts to be wrong, why wouldn't it think the same about the ECB? According to a survey of 8,500 companies conducted by the Bank of France, only 8% introduced a price increase in June, the lowest figure in two years. On the contrary, the share of those who reduced tariffs jumped to a three-year high. As a result, Bank of France head Francois Villeroy de Galhau noted that the slowdown in inflation should be very noticeable next year.

Dynamics of French companies raising prices

So why continue tightening monetary policy if inflation will return to the target anyway? It's quite possible that the July deposit rate hike will be the last in the cycle. The market overestimates the determination of the European Central Bank, and this may end badly for EUR/USD, especially since monetary restriction hurts an already weak eurozone economy.

In July, investors' confidence in the German economy fell more than Bloomberg experts expected. The current conditions index also fell, signaling a slow exit from the recession, if it can recover from the downturn at all. The weak statistics from ZEW were attributed to the negative impact of rising global interest rates and weak demand for European manufacturers' products from China. History shows when the global economy is suffering, the eurozone is not at ease.

Dynamics of Investors' Confidence in the German Economy

In this regard, the slowdown of Chinese inflation in June is another blow to EUR/USD. Investors hoped that after the pleasant surprise of German manufacturing orders, investor confidence would also be pleasing. However, given the recovery problems China is experiencing, it's hard to expect all positivity from the eurozone. As a result, ING's forecasts are gradually coming true.

Investors still focus on the release of U.S. inflation data. A slowdown in the growth rate of CPI and the core indicator should knock out the U.S. dollar. The market tended to this opinion after the employment report. But if the main competitor is too weak, should EUR/USD "bears" be sad?

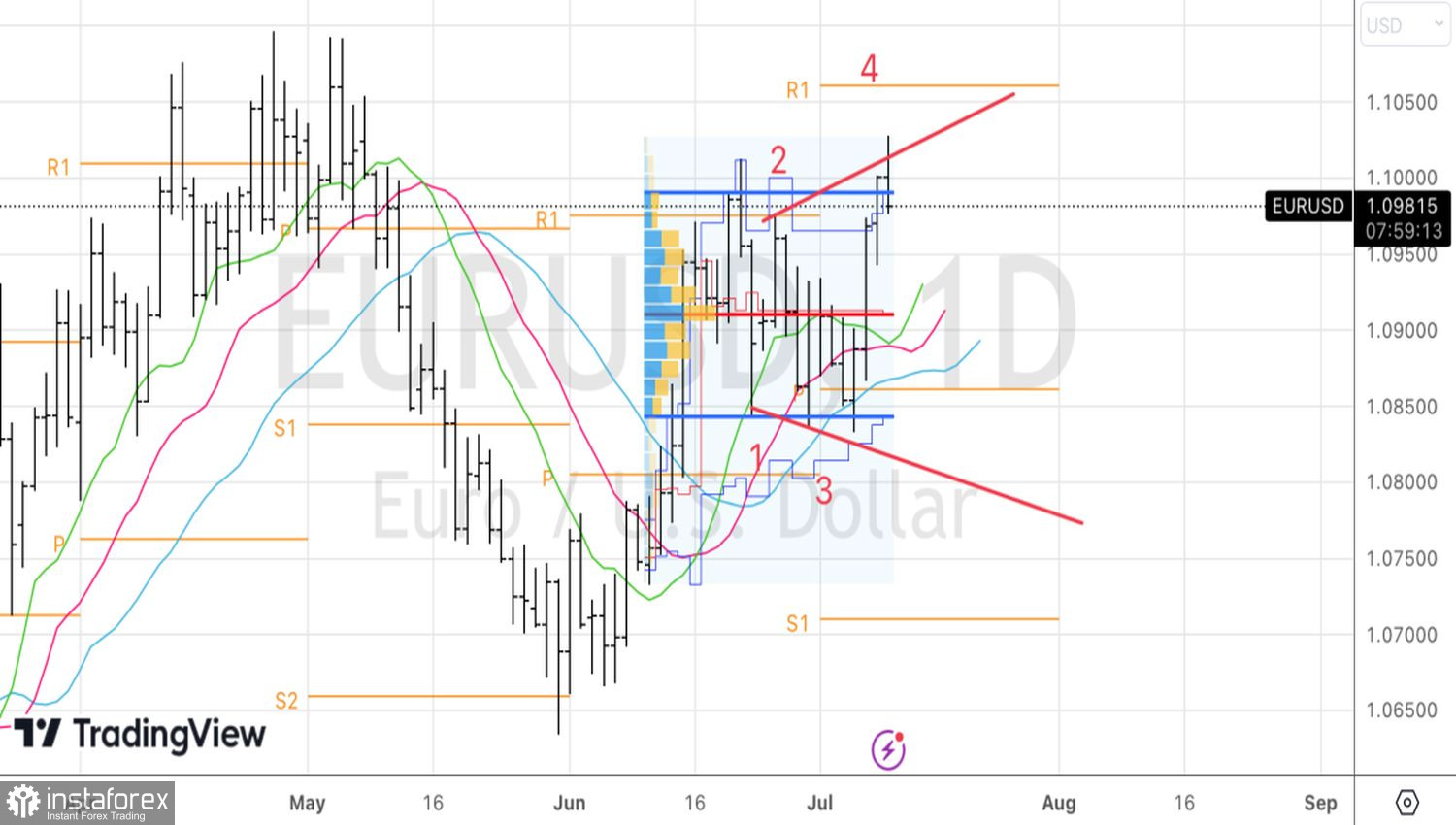

Technically, on the daily chart of the currency pair, the risks of implementing the previously voiced scenario with the formation of a Broadening Wedge pattern have increased. An aggressive short entry with this model implies selling EUR/USD on a break of support at point 2, located near the mark of 1.0975. A successful assault will allow building up short positions opened from 1.101.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română