The British pound skyrocketed on the news that wages in the UK rose more than expected. According to Bank of England Governor Andrew Bailey, average earnings are currently at a level that is fueling inflation, maintaining pressure for higher interest rates. This has a positive impact on the pound's prospects but negatively affects the future of the economy, which is likely to face a recession next year. High inflation is also expected to exacerbate the cost of living crisis in the UK.

As indicated by the report from the Office for National Statistics, average weekly earnings excluding bonuses held at 7.3% in the three months through May. Figures for the period through April were revised upward. The indicator equaled its highest level on record, while economists had expected the wage growth rate to slow down to 7.1%.

ata confirms that the labor market is still hot as wage growth remains unacceptably high, which will further stimulate inflation. These figures are the first of two pieces of important data that will help the Bank of England decide on interest rates at its next meeting scheduled for August 3. However, the situation may change before that point. The second piece of crucial statistics is inflation data which will be published next week.

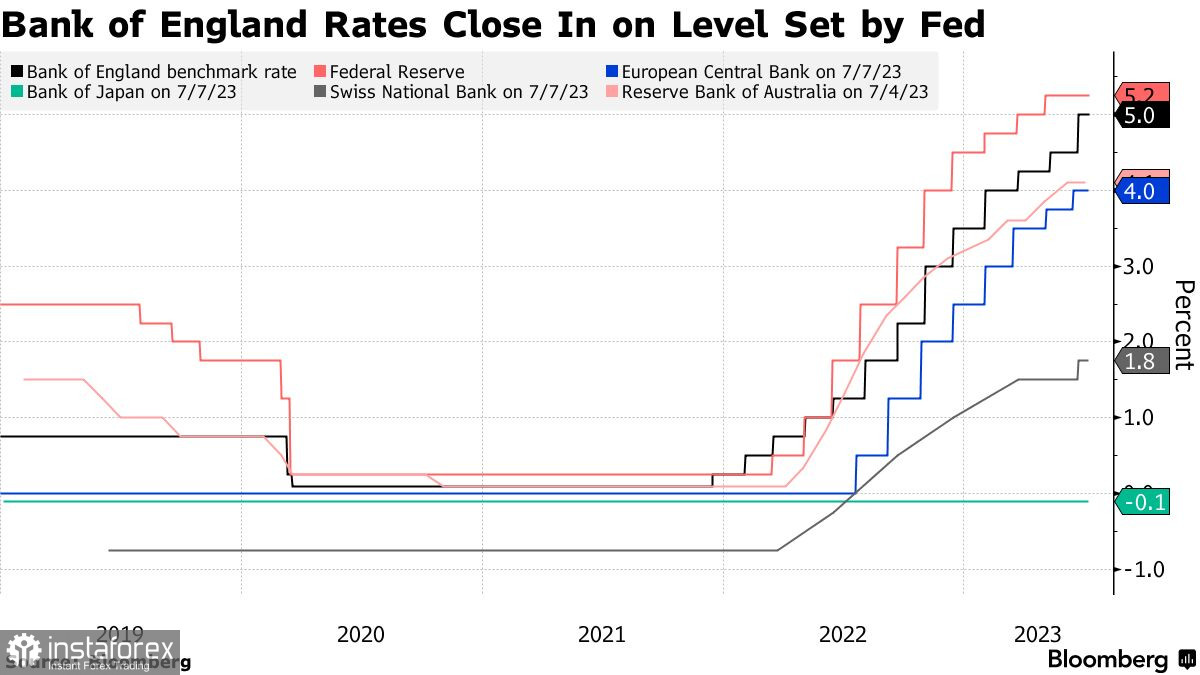

Against this backdrop, the yield on 10-year UK government bonds fell 2 basis points to 4.62%, the same as the yield on US Treasury bonds. According to interest rate futures market data, the Bank of England is expected to raise borrowing costs by at least 150 basis points by March next year, leading to an increase in the base rate to 6.5%. This is comparable to approximately 4% for the European Central Bank and approximately 5.5% for the Federal Reserve.

"Our jobs market is strong with unemployment low by historical standards," Chancellor of the Exchequer Jeremy Hunt said. "But we still have around 1 million job vacancies, pushing up inflation even further. Our labor market reforms — including expanding free childcare next year — will help to build the high wage, high growth, low inflation economy we all want to see," he added.

The report also showed strong employment growth along with an unexpected jump in the unemployment rate to 4%. More and more people are looking for jobs, which is a sign that tightness in the labor market may be starting to ease. However, the number of employed people increased by 102,000 in the last quarter, surpassing the 85,000 expected by economists.

This report on wage growth increases the chances for the Bank of England to repeat June's shock 50-basis-point rate hike in August. Strong CPI data to be published next week will provide a final decision on this matter. Until then, the British pound is likely to gain value against the US dollar.

From a technical point of view, demand for the British pound remains fairly high, indicating a continuing bull market. The pound/dollar pair is expected to rise after the price consolidates above 1.2910. A breakout of this level will boost hopes for a further recovery to the area of 1.2940 and a possible surge to 1.2970. In case of a decline, bears will try to take control of the market at the level of 1.2870. If they succeed, a breakout of this mark will bring the pound/dollar pair back down to the low of 1.2835 and probably 1.2790.

As for the euro/dollar pair, buyers need to push the price above 1.1025 to retain control of the market. In this case, the pair is likely to head for the 1.1050 mark. However, to climb to 1.1090, the euro needs fresh upbeat data from the euro area. In the case of a slide, major buyers are expected to take the lead only at around 1.0985. If bulls' trading activity is subdued in this area, it would be a wise decision to wait for the price to hit a new low at 1.0945 or go long at 1.0910.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română