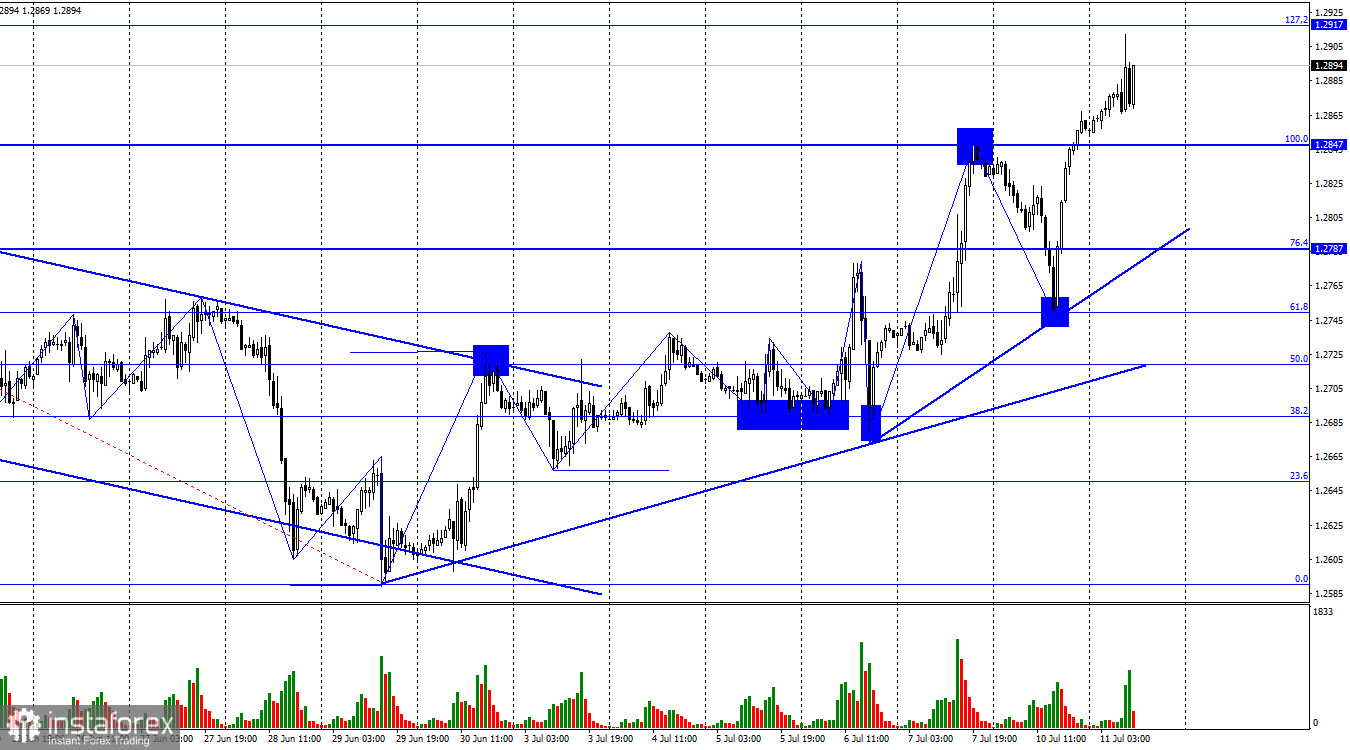

On the hourly chart, the GBP/USD pair on Monday completed a fall to the 61.8% level according to the new Fibonacci grid, rebounded from it, and resumed the growth process. Consolidating the pair's rate above the corrective level of 100.0% (1.2847) allows us to count on the continuation of growth toward the next Fibonacci level of 127.2% (1.2917). And closing above this level will increase the chances of further growth towards 161.8% (1.3007). Two ascending trend lines characterize the current mood of traders as "bullish."

The waves also tell us that the trend is "bullish." Each subsequent peak is higher than the previous one, and each subsequent low is higher than the previous one. Thus, it is now possible to form a downward wave, after the completion of which I will wait for a new rise in the British currency, even though the informational background does not support it at this time. However, traders ignore this fact, and graphical analysis shows that the market is ready to increase purchases. There are no prerequisites to expect the end of the "bullish" trend on the hourly chart now.

This morning, reports on unemployment and wages were released in Britain. The unemployment rate rose from 3.8% to 4.0%, the number of claims for unemployment benefits increased by 26,000 (with traders expecting -22,000), and average earnings increased by 6.9%, slightly above forecasts. All three reports can rather be called negative for the British currency than positive. Everything is clear with unemployment. If it grows, the Bank of England has less room for maneuvering on the rate. Wage growth indicates that inflation is stimulated by it, and the Bank of England will have to raise the rate longer and stronger. However, the rate has already risen to 5%, and the capabilities of the British regulator are not limitless.

In any case, two of the three reports can be written off as a loss for the pound.

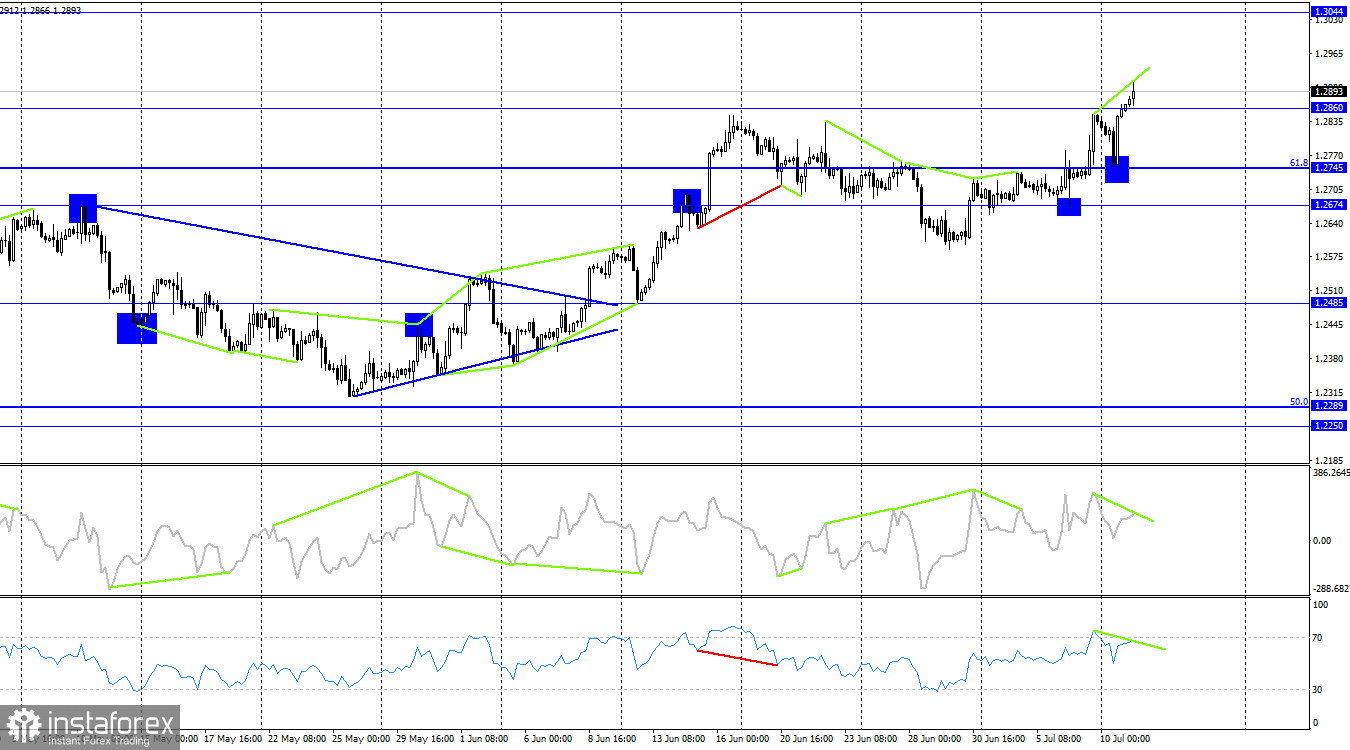

On the 4-hour chart, the pair rebounded from the 1.2745 level and fixed above the 1.2860 level. Thus, the growth of quotes can continue towards the next level of 1.3044. A "bearish" divergence is brewing on the CCI and RSI indicators, which may indicate the start of forming a "bearish" wave on the hourly chart. There are no sell signals, and the British currency ignores the information background that should have led to its fall.

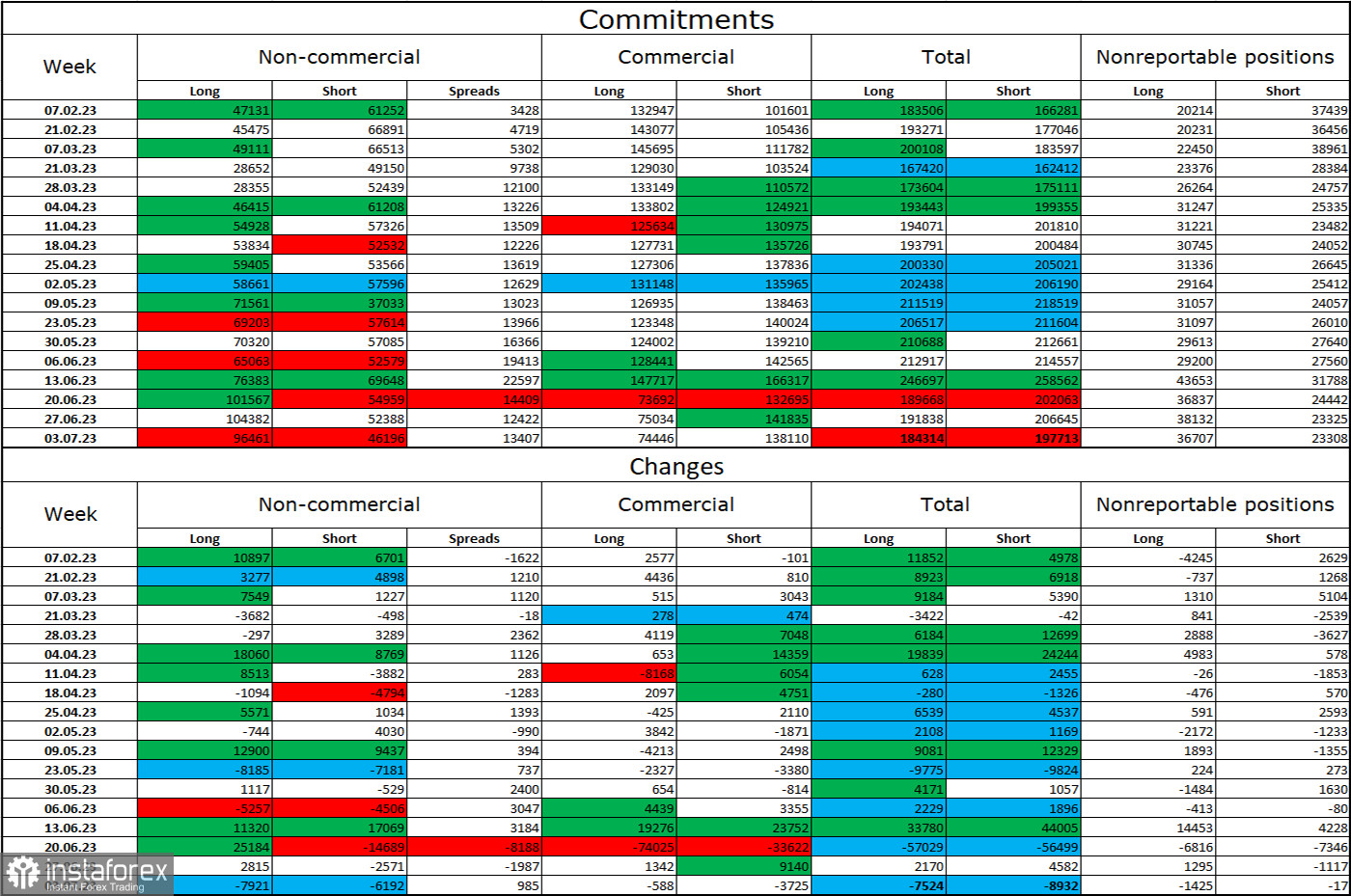

Commitments of Traders (COT) report:

The mood of the "Non-commercial" category of traders has become less "bullish" over the last reporting week. The number of long contracts held by speculators decreased by 7921 units, but the number of short contracts also decreased by 6192. The overall sentiment of large players remains fully "bullish," and a double gap has formed between the number of long and short contracts: 96 thousand versus 46 thousand. The British pound has good prospects for continued growth, and the information background now supports it more than the dollar. Nevertheless, it is becoming increasingly difficult to count on a strong rise in the pound. The market does not consider many factors supporting the dollar, and the pound is growing only on expectations of new and new rate hikes by the Bank of England.

News calendar for the USA and the UK:

UK - unemployment rate (06:00 UTC).

UK - change in the number of claims for unemployment benefits (06:00 UTC).

UK - change in average earnings (06:00 UTC).

On Tuesday, the economic events calendar contains three important reports, but all three are already available to traders. The influence of the information background on the mood of traders for the rest of the day will be absent.

GBP/USD forecast and trading advice:

On a "bullish" trend, sales of the British currency can be very small. For example, in the case of a rebound on the hourly chart from the level of 1.2917 with the target of 1.2847. I advised purchases upon closing above the level of 1.2847 on the hourly chart or in case of a rebound from the level of 1.2779. In reality, a rebound occurred from the level of 1.2749, which does not change the essence of the matter.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română