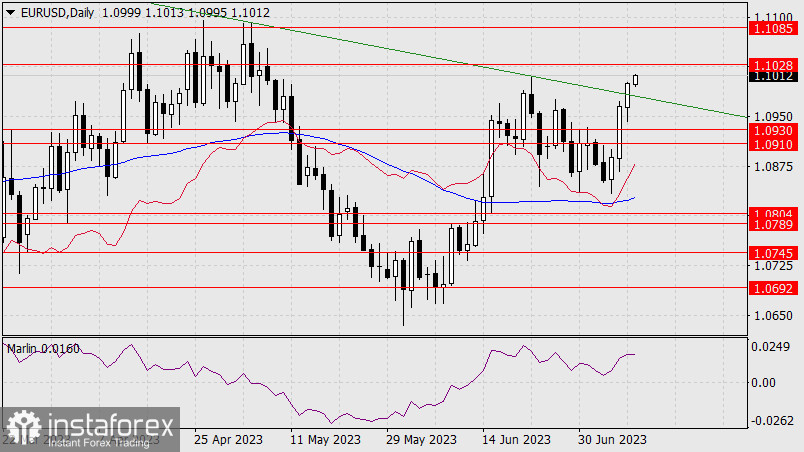

EUR/USD

On Monday, the euro overcame the upper band of the descending price channel colored in green. Now it's abolished, and the price continues to rise towards the nearest target of 1.1028. Overcoming this level will open the second target of 1.1085. As we remember, all the growth since July 6 is a speculative attack on the dollar, buying the single currency against fundamental data.

Such movements do not last long, we are waiting for the first signs of a reversal from the level of 1.1085. Consolidation above this level can extend the growth to 1.1155. The Marlin oscillator has slightly turned down, indicating a slowdown in the growth rate. Yesterday, the S&P 500 finally showed gains (0.24%) after a corrective drop since July 3. But we are also waiting for a reversal on the stock market. Most likely, the drop in the euro and the S&P 500 will be synchronized.

On the four-hour chart, the Marlin oscillator is creating the first sign of forming a sideways range (the gray rectangle on the chart). With this, the pair can slowly rise and will increase the risks for the bulls. Of course, the range may not be established, but the first signs of weakening growth are already there, a lot of effort was spent on such an operation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română