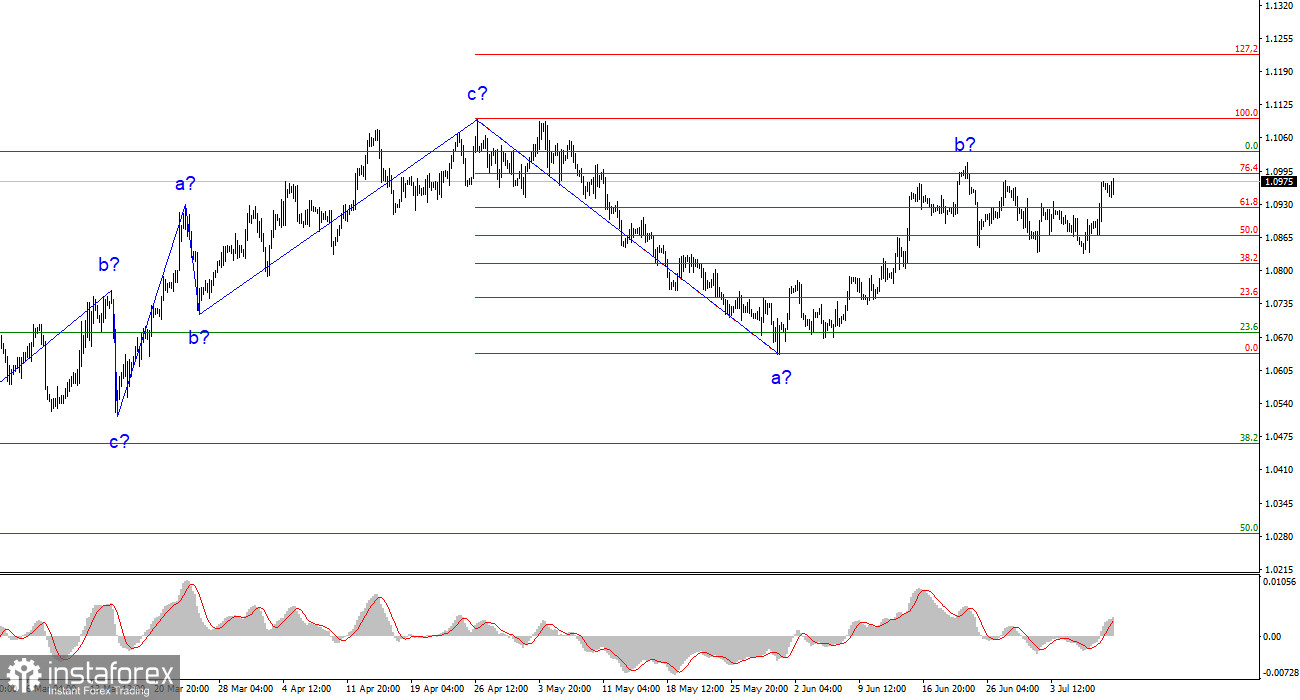

The euro and the pound spent the first day of the week along different lines, but in general, it seems similar. The EUR/USD instrument retreated just a bit, and closer to the end of the day it traded higher again, updating the Friday peak. The GBP/USD instrument saw a much stronger pullback, but also regained strength in the second half of the day. Therefore, both instruments are still bound to rise, which brings me closer and closer to the conclusion that the third wave of the uptrend segment is now being built on the euro, and the wave markings of the euro and the pound coincide.

During the day, the market could wait for the speeches of Loretta Mester and Raphael Bostic from the Federal Reserve. However, at the time of writing, there is no information about their speeches. But there is information from the European Central Bank in the form of comments from Francois Villeroy de Galhau and Mario Centeno. ECB Governing Council member, and Bank of Portugal Governor, Mario Centeno, believes that inflation in the eurozone will come under 3% by the end of the year. The consumer price index is currently 5.5%, so the value of 3% by December is quite achievable. Centeno said that inflation is coming down faster than it was rising a year and a half ago, and the labour market is the strongest it's ever been. He added that the rate may have to be raised several more times to be sure of reaching the target mark of 2.0%.

The French central bank President Francois Villeroy de Galhau has announced that the ECB is close to the peak of interest rates. De Galhau called a pause a "plateau," noting that it will not be the peak value, but close to it. He assured the markets that the central bank does not intend to raise the target inflation value and will continue to aim for 2%.

From all the above, we can conclude that the European Union is close to the peak interest rate. If this is indeed the case, demand for the euro may start to decline soon, although after the July meeting (no one doubts this), the rate will rise by another 25 basis points. However, I remind you that the Federal Reserve also intends to raise the rate twice more. Therefore, both central banks are in roughly the same conditions. Based on this, I assume that the euro will build a full-fledged ascending wave with a peak above 11 figures, but I do not expect the euro to start a sharp rally in the coming months. If by the end of the year, the Fed begins to signal a softening of monetary policy, then the euro will have its own reasons to rise again.

Based on the analysis conducted, I conclude that the downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument on "down" signals from the MACD indicator. The supposed wave b is apparently over. According to the alternative layout, the ascending wave will be longer and more complicated, this will be the main scenario in case of a successful attempt to break through the current peak of the wave b.

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward set of waves. Earlier, I advised buying the instrument in case of a failed attempt to break through the 1.2615 mark, which is equivalent to 127.2% Fibonacci. Wave 3 or c may take a more extended form, or wave e in a wedge will be built. Now a successful attempt to break through the 1.2842 mark will indicate a complication of the ascending wave 3 or c (which is quite likely), and in this case, I advise long positions with targets located around 1.3084, which corresponds to 200.0% according to Fibonacci. If there is no breakthrough, we sell again with 1.2615 as the target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română