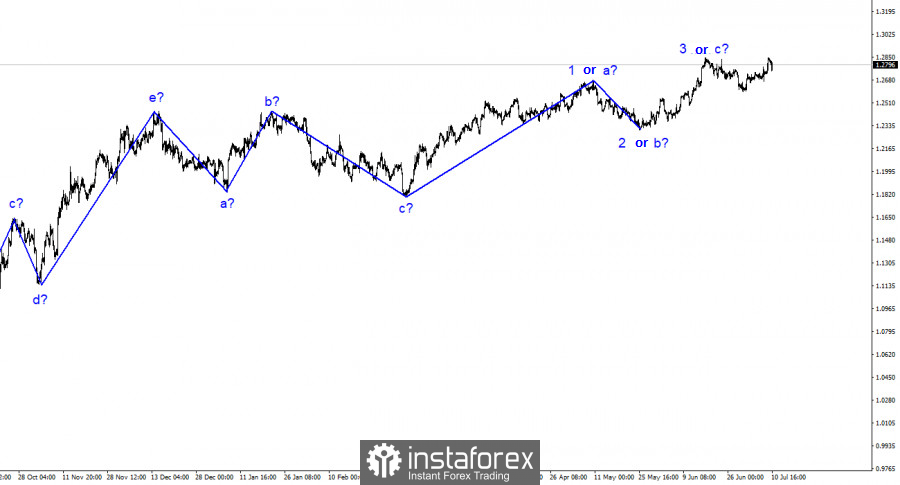

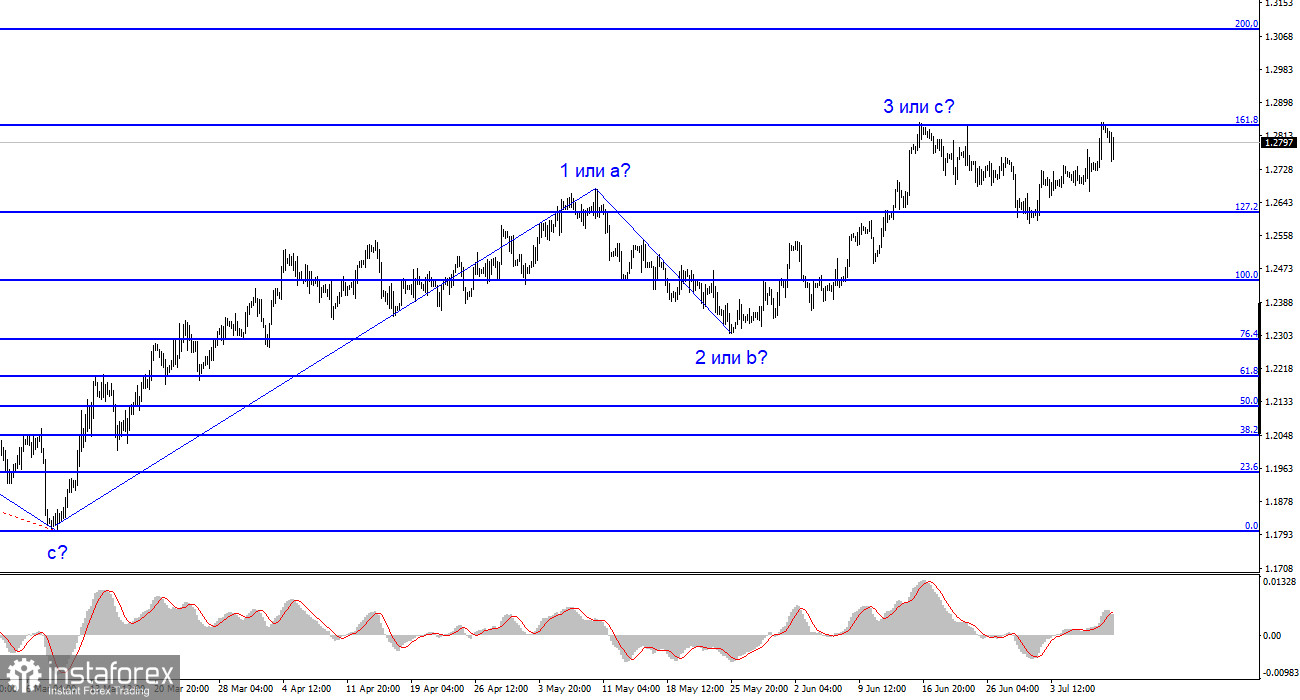

The wave pattern of the pound/dollar pair has shifted into a less complicated and more discernible form. Instead of a complex correctional part of the trend, we can see an impulse ascending or a simpler correctional one. The formation of upward wave 3 or c is ongoing, providing the British currency an excellent chance to grow up to the 30-figure mark. In my opinion, there are no reasons for the pound to continue rising to the 30th or 35th figure (which is quite possible if we are talking about an impulse or at least a simple five-wave part of the trend), and the assumed wave 3 or c may already be completed. Yet the wave pattern can always evolve into something more complex. All four attempts to break through the 161.8% level have failed, along with the attempt to breach the 127.2% Fibonacci level.

For the euro, a downward set of waves is expected, but the wave pattern could also transform to resemble the pound's, resulting in nearly identical patterns. Within wave 3 or c, a five-wave structure can emerge (or a wedge-shaped a-b-c-d-e configuration can be established), indicating the possibility of at least one more upward wave. However, the fifth wave may have already finished around the 1.2842 mark.

The US labor market is showing the first signs of slowing down.

The pound/dollar exchange rate rose by 100 basis points on Friday; today, it dropped by 20. A rollback after growth on Friday took place, which suggests a fifth test of the 1.2842 mark soon. If the current wave pattern is correct, demand for the pound could escalate even further in the coming period, even without news-driven momentum.

Let me remind you that last week presented ample reports that could cause the pair to rise or fall. The market deemed Friday's US reports to be the most crucial ones. While these weren't detrimental to the dollar, demand for the currency dropped sharply. This market behavior signifies the pair's readiness for new purchases. Today, Fed members Rafael Bostic and Loretta Mester were scheduled to speak in America, but information regarding this still needs to be released. I anticipate FOMC officials will refrain from relaxing their stance, but the Board of Governors' sentiment is currently less important for the dollar. The demand for it continues to decrease, and the US central bank cannot amplify its "hawkish" stance on monetary policy as it's already at its peak. This week, a decline in inflation to 3.1% y/y may be revealed, which would further minimize the necessity of persisting with tightening monetary policy. If the rate ceases to rise, the market will have considerably fewer incentives to purchase the US currency, which is already minimal.

General conclusions.

The wave pattern of the pound/dollar pair has changed and suggests the formation of an increasing set of waves. I previously advised buying the pair in case of a failed attempt to break through the 1.2615 mark, which is 127.2% by Fibonacci. Wave 3 or c can take on a more extended form, or wave e can be built in a wedge. A successful attempt to break through the 1.2842 mark will indicate a complication of the ascending wave 3 or c (which is quite likely). In this case, I advise buying with targets located near 1.3084, which corresponds to 200.0% by Fibonacci. If the breakthrough does not happen, sell again with a target of 1.2615.

On a larger wave scale, the picture is similar to the euro/dollar pair, but there are also some differences. The descending correction part of the trend is finished, and the formation of a new ascending one continues, which can already be completed, or it may take a full-fledged five-wave form. And even if it takes on a three-wave form, the third wave can turn out to be elongated, or it can be shortened.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română