Analysis of GBP/USD 5M.

The GBP/USD pair showed a meteoric rise last Friday. In the European trading session, the pair did not change significantly although it maintained a bullish bias. At the start of the American session, it jumped following US reports. in my opinion, the NFP report was not weak. However, bulls are strong now. So, they pushed the pair higher. Besides, downbeat US macro stats provided a good buy signal. Thus, the pound sterling may resume a medium-term uptrend. On Monday, the pair could slightly decline but this correction is unlikely to affect the overall trend.

The GBP/USD pair showed a meteoric rise last Friday. In the European trading session, the pair did not change significantly although it maintained a bullish bias. At the start of the American session, it jumped following US reports. in my opinion, the NFP report was not weak. However, bulls are strong now. So, they pushed the pair higher. Besides, downbeat US macro stats provided a good buy signal. Thus, the pound sterling may resume a medium-term uptrend. On Monday, the pair could slightly decline but this correction is unlikely to affect the overall trend.

According to the latest report, the "Non-commercial" group of traders closed 7,900 long positions and 6,100 short ones. Thus, the net position of non-commercial traders decreased by 1,800 positions in a week but in general it continued to rise. The net position has been steadily growing over the past 10 months as well as the pound sterling. Now, the net position has advanced markedly. This is why the pair will hardly maintain its bullish momentum. I believe that a long and protracted downward movement should begin. COT reports signal a slight growth of the British currency but it will not be able to rise in the long term. There are no drivers for opening new long positions. However, there are no technical signals for short positions yet.

According to the latest report, the "Non-commercial" group of traders closed 7,900 long positions and 6,100 short ones. Thus, the net position of non-commercial traders decreased by 1,800 positions in a week but in general it continued to rise. The net position has been steadily growing over the past 10 months as well as the pound sterling. Now, the net position has advanced markedly. This is why the pair will hardly maintain its bullish momentum. I believe that a long and protracted downward movement should begin. COT reports signal a slight growth of the British currency but it will not be able to rise in the long term. There are no drivers for opening new long positions. However, there are no technical signals for short positions yet.

The British currency has already grown by a total of 2,500 pips. Without a downward correction, the continuation of the uptrend will be illogical. The Non-commercial group of traders has opened 96,500 long positions and 46,100 short ones. Such a gap means the end of the uptrend. I remain skeptical about the long-term growth of the pound sterling but speculators continue to buy because the pair is growing. Usually, BTC shows such movements.

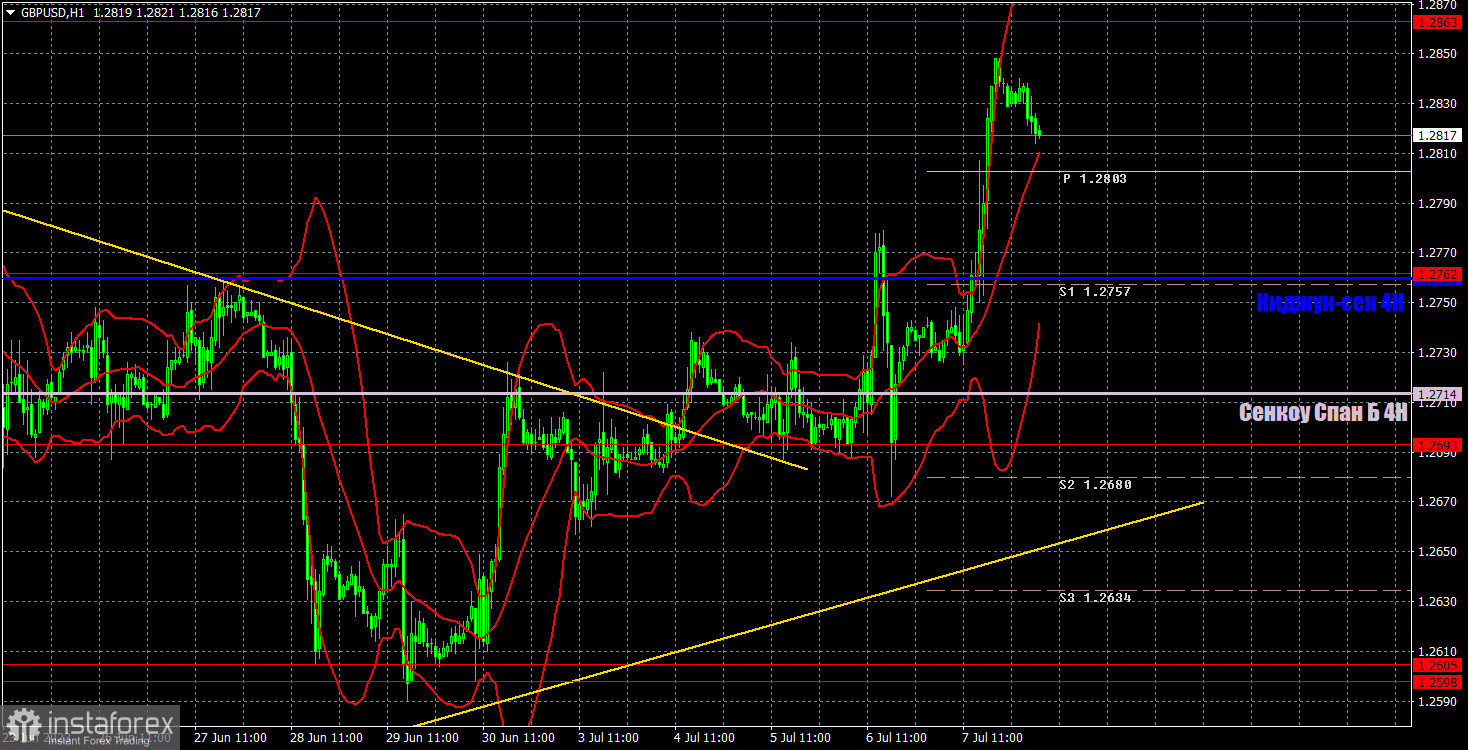

Analysis of GBP/USD 1H.

On the 1H timeframe, the pound/dollar pair maintains an upward trend. The ascending trend line indicates a further rise. So, traders are opening new long positions. However, the pound sterling is overbought. It is likely to decline in the medium term. Yet, it surpassed the descending trend line. Hence, it could move to new highs. According to the technical analysis, the pound sterling has drivers for a further increase.

On July 10, traders should pay attention to the following key levels: 1.2429-1.2445, 1.2520, 1.2598-1.2605, 1.2693, 1.2762, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2714) and Kijun-sen (1.2760) lines can also provide signals, e.g. rebounds and breakout of these levels and lines. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 20 pips. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits.

BoE Governor Andrew Bailey will give a speech on Monday. He is excepted to provide new information. This is why spectators need to take notice of it. Fed policymakers will also make speeches but they are unlikely to say anything new.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română