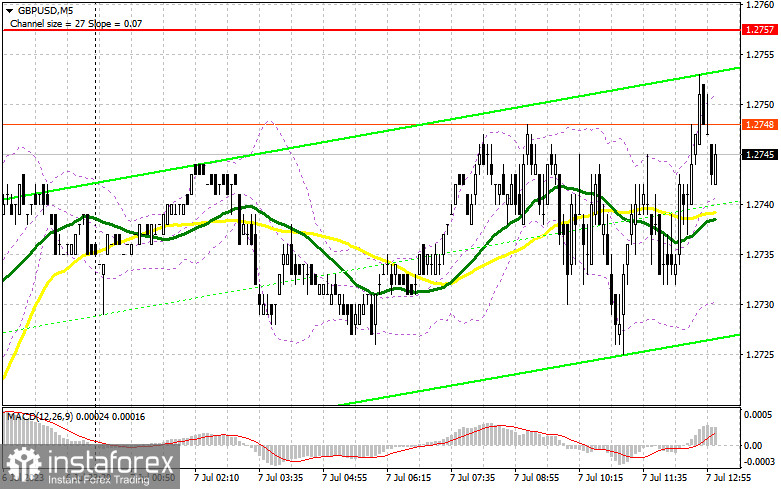

In my morning forecast, I drew attention to the level of 1.2717 and recommended making decisions about entering the market from this point. Let's look at the 5-minute chart and figure out what happened there. The levels I identified needed to be updated, which did not allow signals for market entry. From a technical point of view, everything stayed the same for the second half of the day.

To open long positions on GBP/USD:

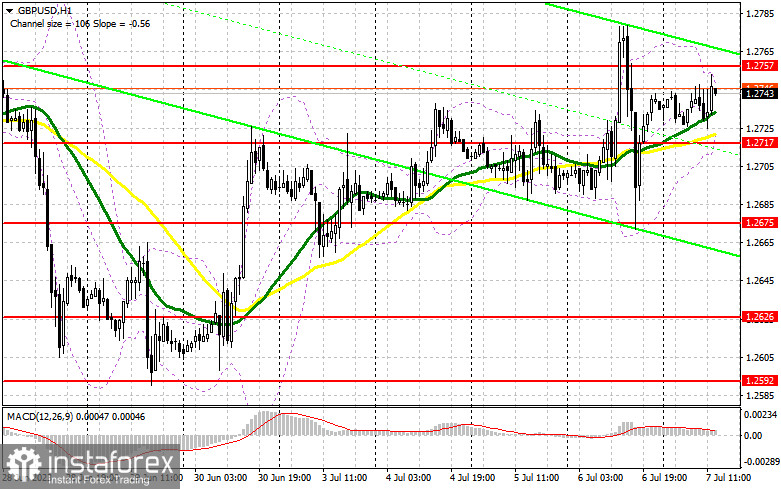

The upward potential of the pound remains, but it should be helped by data on the US unemployment level and the number of people employed in the non-agricultural sector. A reduction in this indicator will weaken the dollar's position and lead to a sharp upward movement in the pair. Otherwise, if the labor market shows strength, pressure on the pound will increase just as it did yesterday in the second half of the day. I plan to open long positions only when there is a decline in the area of 1.2717 and only after a false breakout is formed there. This is necessary to ensure the presence of major players in the market, especially since moving averages are located there, playing on the bulls' side. In this case, the target will be the nearest resistance of 1.2757, a breakout and a test of which from top to bottom will form an additional signal to buy, which will return the pound's strength and lead to the update of 1.2798. In the event of going above this range, we can talk about a spike to 1.2834, where I will fix the profit.

In case of a GBP/USD drop and the absence of buyers at 1.2717, which will only happen if there is a very good report on the growth of employment in the US, the bears will again feel the power. If this happens, I will postpone long positions to 1.2675. There will be purchases only on a false breakout. Opening long positions on GBP/USD immediately on a rebound is possible from 1.2626 with a correction target of 30-35 points within the day.

To open short positions on GBP/USD:

Sellers took a break, as it is hard to guess what the reaction to the data could be and what they will be – especially after yesterday's report from ADP. The bears need to focus on protecting the nearest resistance at 1.2757, where a false breakout will give the first signal to sell in anticipation of a decline to the support of 1.2717, formed as a result of yesterday. A breakout and a reverse test from the bottom to the top of this range will provide an entry point to sell with a target of updating 1.2675. The further target will be the minimum of 1.2626, where I will fix the profit.

In case of GBP/USD growth and the absence of bears at 1.2757 in the second half of the day, and everything will depend on the number of people employed in the US economy in June of this year, the bulls will strengthen control over the market, especially after the morning statements of Bank of England representatives on the topic of interest rates in the UK. In this case, only a false breakout in the next resistance area of 1.2798 will form an entry point into short positions in anticipation of the pound moving down. In the absence of activity there, I advise selling GBP/USD from 1.2834 in anticipation of a pair rebound down by 30-35 points within the day.

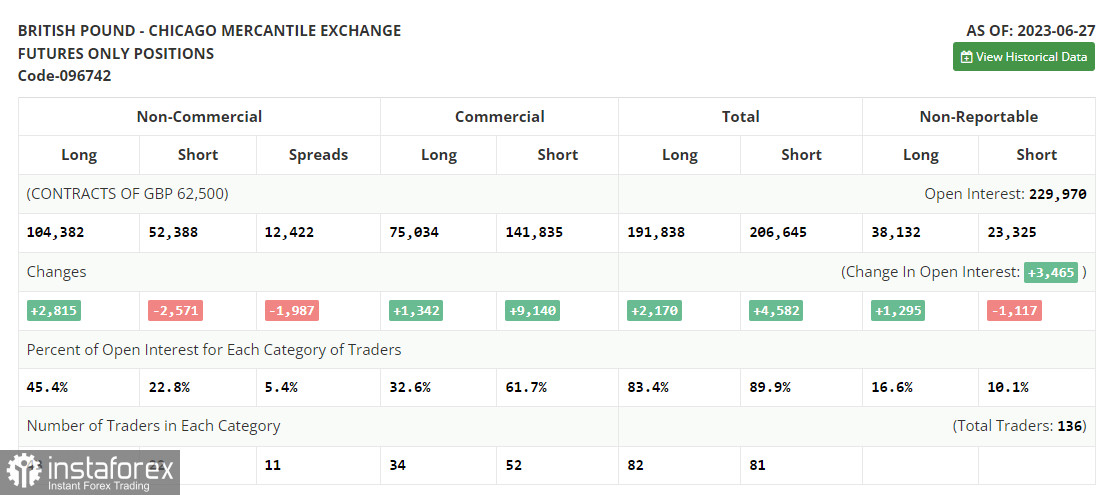

The Commitment of Traders (COT) report for June 27 showed a slight reduction in short positions and minimal growth in long ones. Pound buyers have every chance to continue acting more aggressively, as the Bank of England, despite all the pressure and problems in the economy, will continue to adhere to a high-interest rate policy due to serious inflation problems affecting household living standards. The fact that the Federal Reserve paused the monetary policy tightening cycle last month and the Bank of England does not plan to do so makes the British pound's attractiveness stronger. The optimal strategy remains to buy the pair on dips. The latest COT report states that short non-commercial positions grew by 2,815 to 104,382, while long non-commercial positions decreased by 2,571 to 52,388. This led to a slight growth of the non-commercial net position to a level of 51,994 against 46,608 a week earlier. The weekly price decreased and was 1.2735 against 1.2798.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decrease, the lower border of the indicator at around 1.2717 will act as support.

Indicator Descriptions

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română