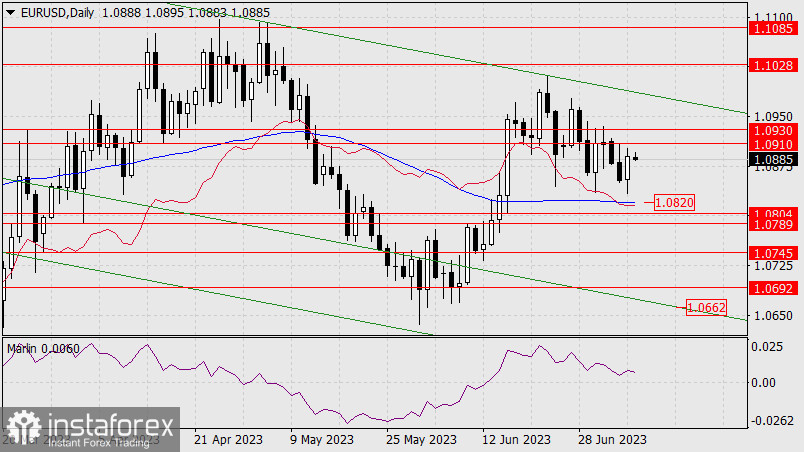

EUR/USD

The eurozone retail sales report for May remained unchanged, the US ADP data for June showed employment growth of 497,000 in June against the expected 228,000, and the ISM Services PMI increased from 50.3 in May to 53.9 in June. Traders struggled, but the bulls eventually won - the euro was bought against strong news. Trading volume was the highest since June 1.

We don't know why the bulls were so persistent, especially with the collapse of the EuroStoxx50 by 2.93% (!). It is also unclear whether investors will trade the same way after today's expected good US employment data. From a purely technical perspective, this is possible, but not above the range of 1.0910/30, as it would have been much easier to get out of it a few days earlier. The bears must simply close the day with a black candlestick. This will be enough to resume the attack on the 1.0789-1.0804 target range without any problems from the new week.

On the four-hour chart, yesterday's turbulent events took place under the balance indicator line, that is, the growth had a corrective structure, and the reversal with the overlap of yesterday's growth by 37 points might even happen today. The Marlin oscillator is in the positive area - as a preparation for another bullish attack, although the main events, of course, will occur with the release of the US labor data.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română