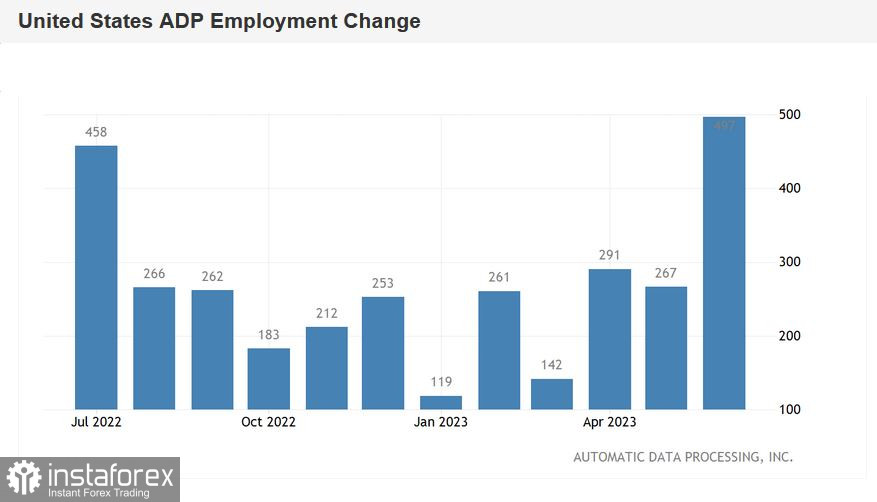

The ADP employment data supported the dollar bulls and strengthened the dollar's position. The report is a kind of "harbinger" of the Non-Farms (which is set for release on Friday), so the latest figures should be acknowledged as a "preview" of the official report.

Despite the unexpectedly strong ADP report, sellers of EUR/USD were unable to leave the price range of 1.0850-1.0930, although they made an attempt to do so. This is another failure: on Wednesday, the bears also tried to stay at the base of the 8th figure, reacting to the hawkish minutes of the Federal Reserve's June meeting. But upon reaching the 1.0834 mark, sellers were in a hurry to lock in profit, thereby extinguishing the downward momentum. The ISM Services data also contributed to increased dollar buying. The index is forecast to have increased to 51.3 but the ISM Services PMI unexpectedly jumped to 53.9 in June of 2023, pointing to the strongest growth in the services sector in four months. Take note that the ISM manufacturing index updated a two-year low in June, once again finding itself in the "red zone".

However, market participants have essentially ignored the day's reports. Apparently, traders need a more powerful information driver. A news impulse is necessary to push the pair out of the current flat. So either the price drops to the base of the 8th figure and in the medium term heads towards the 7-6 figures, or it surpasses the 1.1000 target.

The most important economic report of the week will be published on Friday, July 7. The June Non-Farms will either strengthen the position of the greenback or allow buyers to organize another surge.

The strong ADP employment report encouraged dollar bulls because, as I mentioned, it is a harbinger ahead of the Non-Farms publication. If the official figures repeat the trajectory of this report, we will likely witness another dollar rally.

The current consensus forecast for official data indicates that the labor market in June will show positive dynamics. According to experts, last month, more than 200,000 (222,000) jobs were created in the non-agricultural sector in the US (339,000 in May, exceeding forecast estimates). The private sector of the economy should rise by 205,000. However, the unemployment rate should decrease to 3.6%, after a slight increase in May to 3.7%.

We should also pay attention to the inflationary component of the Non-Farms. According to preliminary forecasts, the average hourly wage in June should reach 4.2% y/y, reflecting a slowdown (in May it was at 4.3%). Although this slowdown will be minimal, the projected result (4.2%) will be the weakest since September 2021. Take note that the inflationary component of the Non-Farms is important for EUR/USD traders even outside the context of increasing or decreasing employment. The market will still be confident in a July interest rate hike, but doubts about the Fed's next steps will allow buyers to test the upper limit of the 1.0850–1.0930 range again.

Speaking of the latest ADP report, it supported the dollar bulls. The data noted private sector employment growth of 497,000 in June. This is more than double the expected 226,000 growth. Therefore, there's still a certain intrigue regarding Friday's data: dollar bulls can now count on exceeding forecast values. But if the official figures do not even reach forecasts, then the EUR/USD buyers will have a reason to rally to the upper band of the aforementioned price range.

Thus, the market is frozen in anticipation of the key macro data of the week, which will be released at the start of the US session on Friday. The minutes of the June meeting, as well as the "green hue" of the ISM Services data, boosted the dollar, while Non-Farms are capable of having a more significant impact on the greenback.

Before the release of Friday's data, it would be better to take a wait-and-see position. Despite the fact that sellers are trying to overcome the lower band of the range 1.0850-1.0930, selling is still risky. After all, the strong report from the ADP agency can do a bearish favor to the sellers: if the official report turns out to be weaker than forecasts, the dollar will come under strong pressure, considering such a bright "preview" from the ADP.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română