If the United States has not lacked good news lately, Europe has completely forgotten about it. The press constantly highlighted information about excessively high inflation, recession in the Eurozone, stagflation, anything but positive news. EUR/USD clung to the hawkish rhetoric of ECB officials, but it was clearly not enough to continue the rally. And then the good news came!

Industrial orders in Germany grew by 6.4% MoM, significantly surpassing Bloomberg experts' forecast of +1%. The largest increase was observed among manufacturers of all types of transport vehicles. Orders in the "Other transport equipment" category jumped by 137%.

Dynamics of German production orders

If previously the dominant view on the Forex market was that the industrial downturn was barely offset by the services sector, then good news from Germany can change the balance of power. The recovery of the Eurozone after the recession will free up the ECB's hands in terms of deposit rate hikes and strengthen the position of EUR/USD. However, in any currency pair, there are always two currencies, and the future of the U.S. dollar depends on statistics from the American labor market.

As expected, the minutes of the June FOMC meeting did not have a significant impact on the market. Several Committee officials were ready to raise the federal funds rate as early as the beginning of summer, but ultimately agreed to a pause. Investors perceived this circumstance as a bullish signal, but, in reality, it had little effect. The chances of borrowing costs rising to 5.75% by the end of the year increased slightly from 30% to 33%.

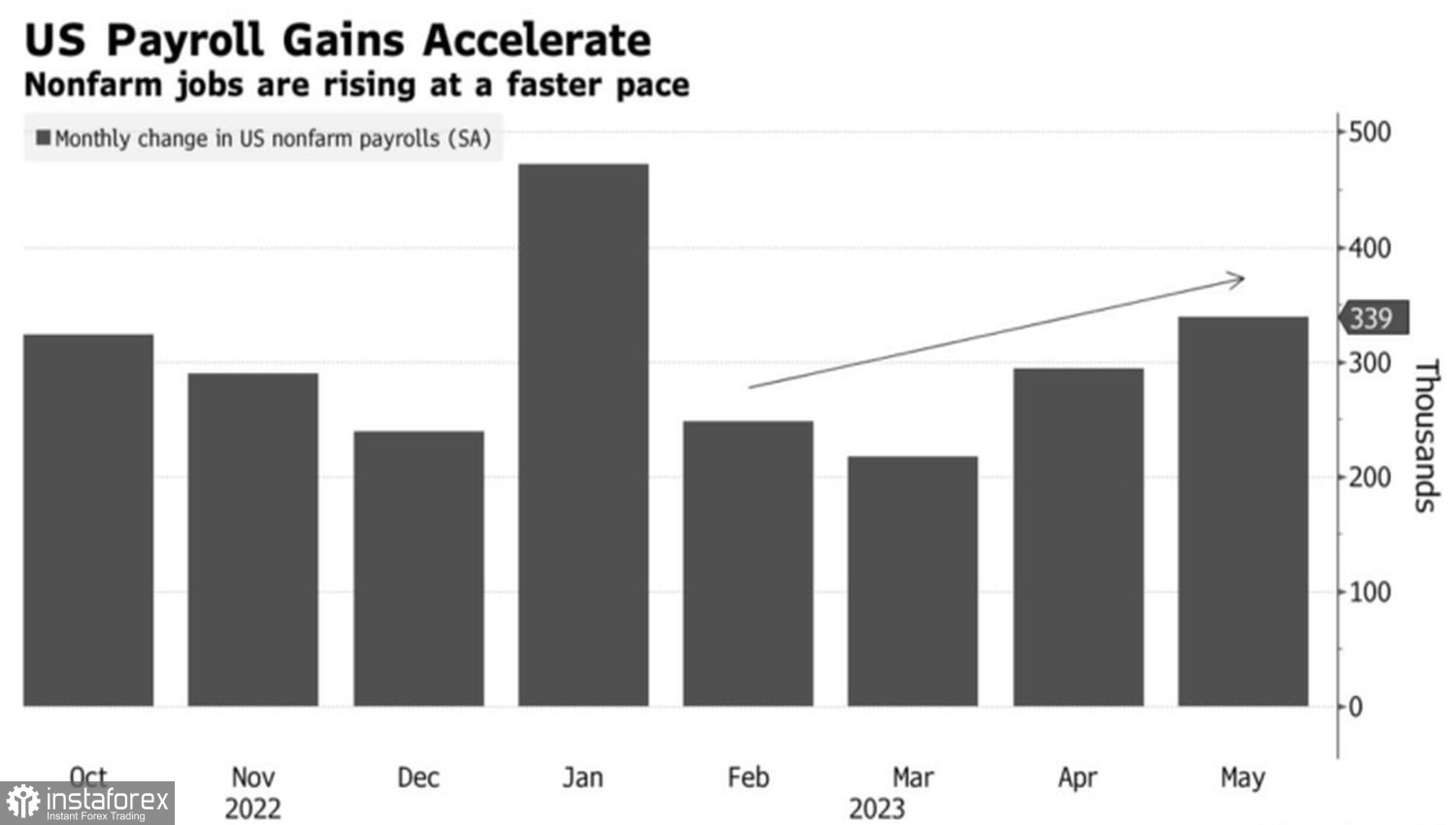

It is evident that regardless of the news from the central bank and Germany, the final verdict will be determined by the U.S. employment report. Over the past three months, the indicator has been increasing on average by 283,000. In June, Bloomberg experts expect it to increase by 225,000. This is a very decent figure, indicating the strength of the labor market.

Employment dynamics in the USA

In reality, it is important to understand that central banks are moving away from the primitive concept of "your problem is a nail, and the only solution is a hammer" towards a more flexible monetary policy. If they continue to raise rates, a recession becomes inevitable. The Fed and its counterparts in other countries urgently need quantitative analysis of the rapid pace of borrowing cost growth, as well as the patience to allow monetary restriction to do its job. Therefore, pauses are inevitable.

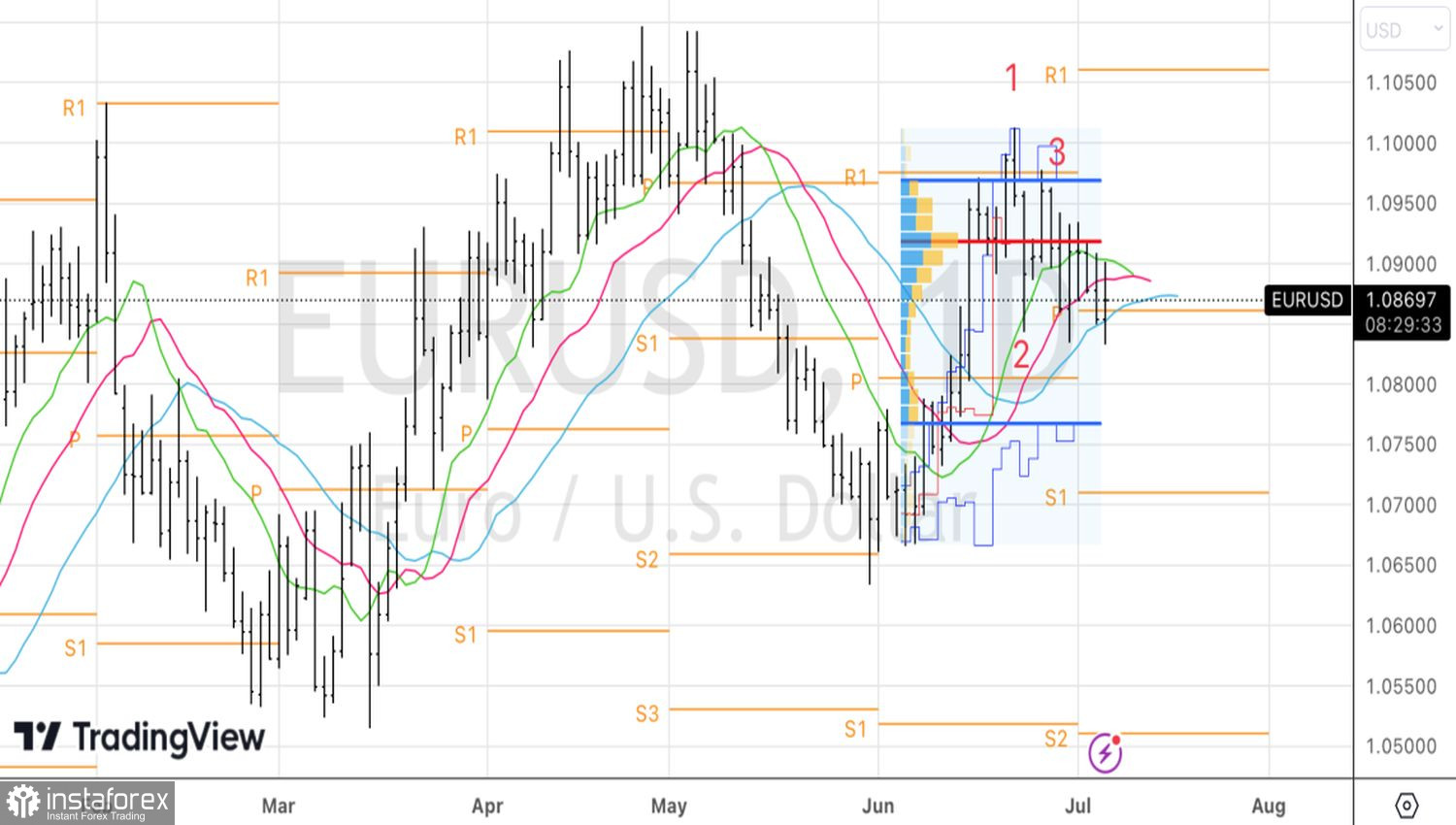

Under such conditions, there is a high probability of medium-term consolidation for EUR/USD. This scenario of events over the next three months is considered the most likely by 27 out of 60 Reuters experts. Another 19 predicted a decline in the pair, and 14 predicted its growth.

Technically, on the daily chart of EUR/USD, a Triple Bottom pattern has formed. It allowed the pair to approach 1.09, where selling pressure emerged. As a result, it dropped to the pivot level of 1.086, and the battle for it will be fought tooth and nail until the release of U.S. labor market data for June. The recommendation is to stay out of the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română