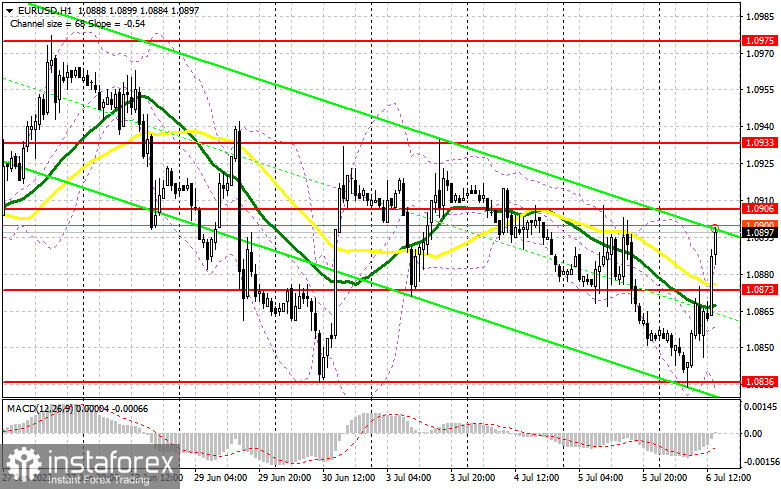

In my morning forecast, I drew attention to the 1.0863 level and recommended making market entry decisions based on it. Let's look at the 5-minute chart and figure out what happened there. The rise and formation of a false breakout at this level allowed a sell signal for the euro, resulting in a pair drop of more than 30 points. However, the euro was quickly bought at the weekly minimum, and on the second try, the bulls managed to break above 1.0863. The technical picture was revised for the second half of the day.

To open long positions in EURUSD, you need to:

Since we are starting to acquaint ourselves with the June US labor market statistics today, traders hurried to fix profits, as the situation may worsen in the first summer month. The focus will be on the change in the number of employed people from ADP for June this year and the weekly number of initial claims for unemployment benefits in the USA. Unlike the ISM services sector business activity index, the trade balance will not play a major role in the currency market. Deterioration of all indicators may further weaken the dollar's positions, despite the Federal Reserve's promise to continue raising interest rates.

Given the significant euro growth in the first half of the day, I prefer to act only on the decrease around the new support of 1.0873, formed due to the European session. The formation of a false breakout there will give a buy signal, allowing a return to the substantial resistance of 1.0906. A breakthrough and a top-down test of this range will strengthen the demand for the euro, giving it a chance to get out to 1.0939, but this is unlikely. The farthest target remains the area of 1.0975, where I will fix the profit.

In case of a decrease in EUR/USD and the absence of buyers at 1.0873, which can only happen after strong reports on the labor market and ISM, the bears will regain control over the market. Therefore, only the formation of a false breakout around the next support of 1.0836, coinciding with the weekly minimum, will give a signal to buy the euro. I will open long positions immediately on the rebound from the minimum of 1.0807 with the goal of an upward correction of 30-35 points within the day.

To open short positions in EURUSD, you need to:

Sellers have shown themselves, but interest in the euro before the US data is increasing quickly. Now the bears need to protect 1.0906, and only an unsuccessful fixation at this level, analogous to what I discussed above, will give a sell signal, capable of pushing EUR/USD back to 1.0873. Fixation below this range and a reverse test from bottom to top is a direct road to 1.0836. The farthest target will be the minimum of 1.0808, where I will fix the profit.

In the event of an upward movement of EUR/USD during the American session and a lack of bears at 1.0906, the situation will return under buyers' control, and the pair will escape the sideways channel. In such a case, I will postpone short positions until the next resistance at 1.0939. There, you can also sell, but only after an unsuccessful consolidation. I will open short positions immediately on the rebound from the high of 1.0975 with the aim of a downward correction of 30-35 points.

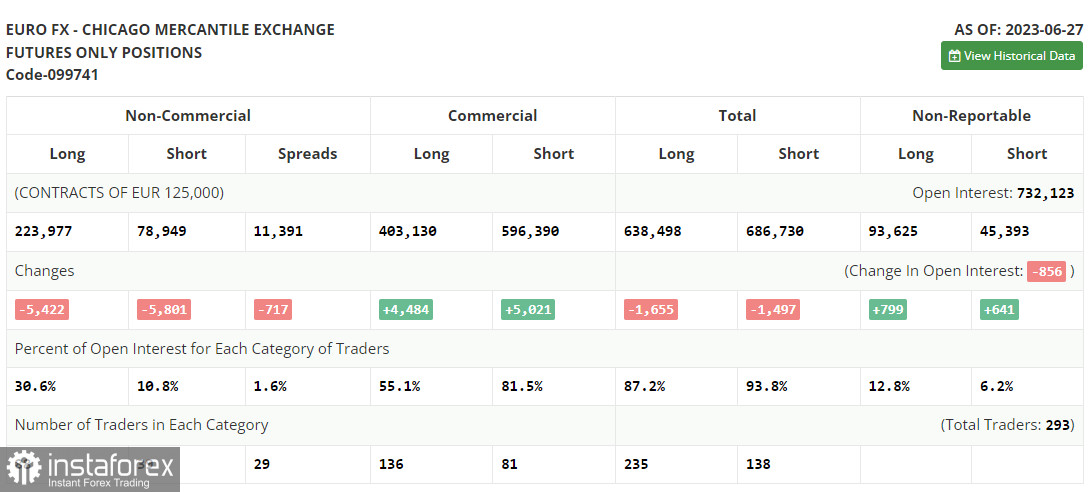

In the COT report (Commitment of Traders) for June 27, there was a decrease in long and short positions, which left the balance of power in the market virtually unchanged. The US GDP data released last week once again confirmed the resilience of the US economy even in the face of high-interest rates, which allows the Federal Reserve to continue actively fighting high inflation, which is gradually returning to normal. In the near future, we will have the minutes of the Fed's meeting and also learn about the state of the US labor market, which can strengthen the position of the US dollar against the euro. The optimal medium-term strategy in the current conditions remains buying on declines. The COT report indicates that non-commercial long positions fell by 5,422 to 223,977, while non-commercial short positions fell by 5,801 to 78,949. As a result of the week, the total non-commercial net position slightly increased and amounted to 145,028 against 144,025. The weekly closing price increased and amounted to 1.1006 against 1.0968.

Indicator signals:

Moving averages

Trading is conducted around the 30 and 50-day moving averages, which indicates market equilibrium.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper border of the indicator at 1.0895 will act as resistance.

Description of indicators

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română