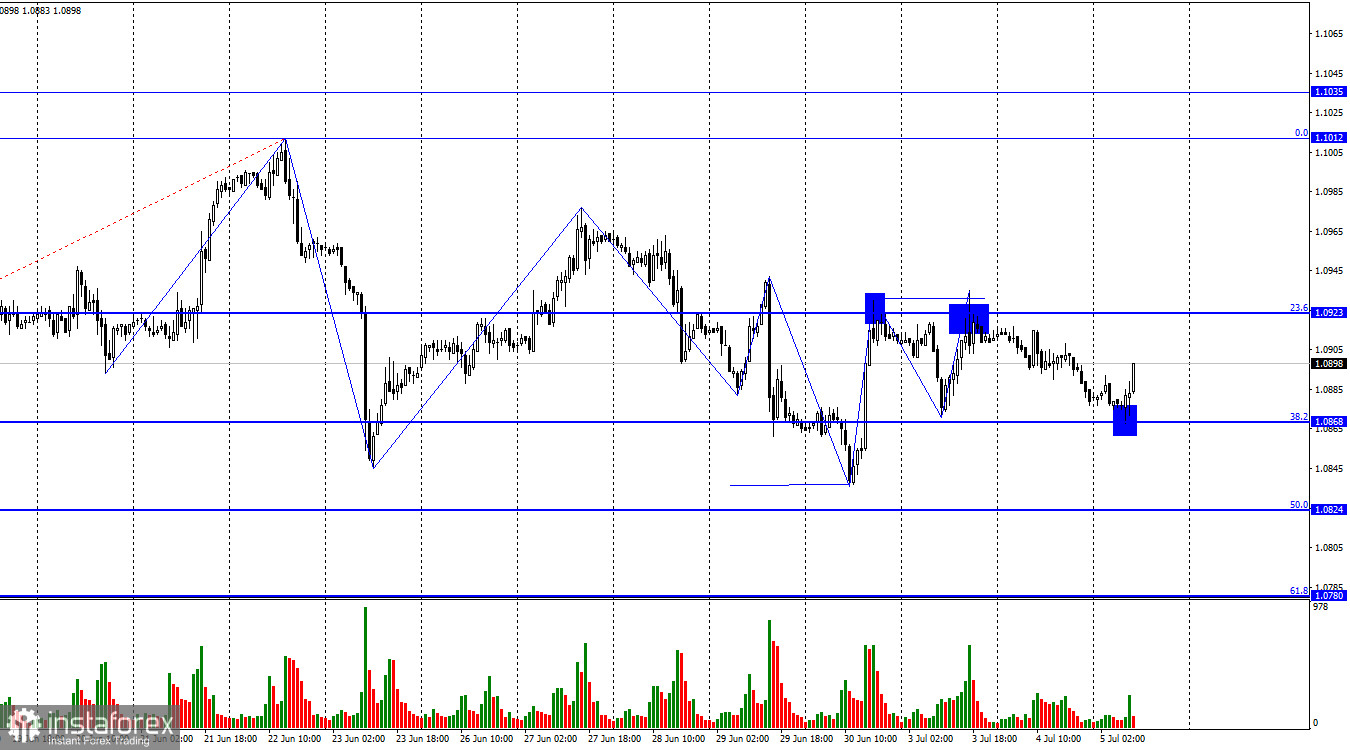

The EUR/USD pair spent the entire Tuesday falling towards the corrective level of 38.2% (1.0868). On Wednesday morning, a rebound from this level was made, allowing the pair to favor the EU currency and start a new growth toward the Fibo level of 23.6% (1.0923). A rebound of quotes from the level of 1.0923 will work in favor of the US currency and a new fall to 1.0868. Fixing the pair's rate above the level of 1.0923 will increase the probability of further growth of the euro towards the corrective level of 0.0% (1.1012).

I want to draw the traders' attention to the fact that the movement is now horizontal. The peak of the last upward wave has only formally broken through the peak of the previous ascending wave. The low of the last downward wave has only formally broken through the low of the last descending wave. The last two lows and two peaks almost perfectly coincide with each other. And they also coincide with the levels of 1.0868 and 1.0923. Thus, there is no doubt about the sideways trend. Since we have clear boundaries of the sideways range, all that remains is to trade on the rebound from them or wait for the pair to exit the sideways trend.

Yesterday can be considered a day off, as traders' activity was minimal. The news background was absent due to the holiday in the USA - Independence Day. Today, several reports will be released in the European Union (of minor importance), and in the evening - the publication of the FOMC minutes, which is the most important event. However, it will only be in the evening, and during the day, it will be difficult for the pair to get out of the horizontal corridor.

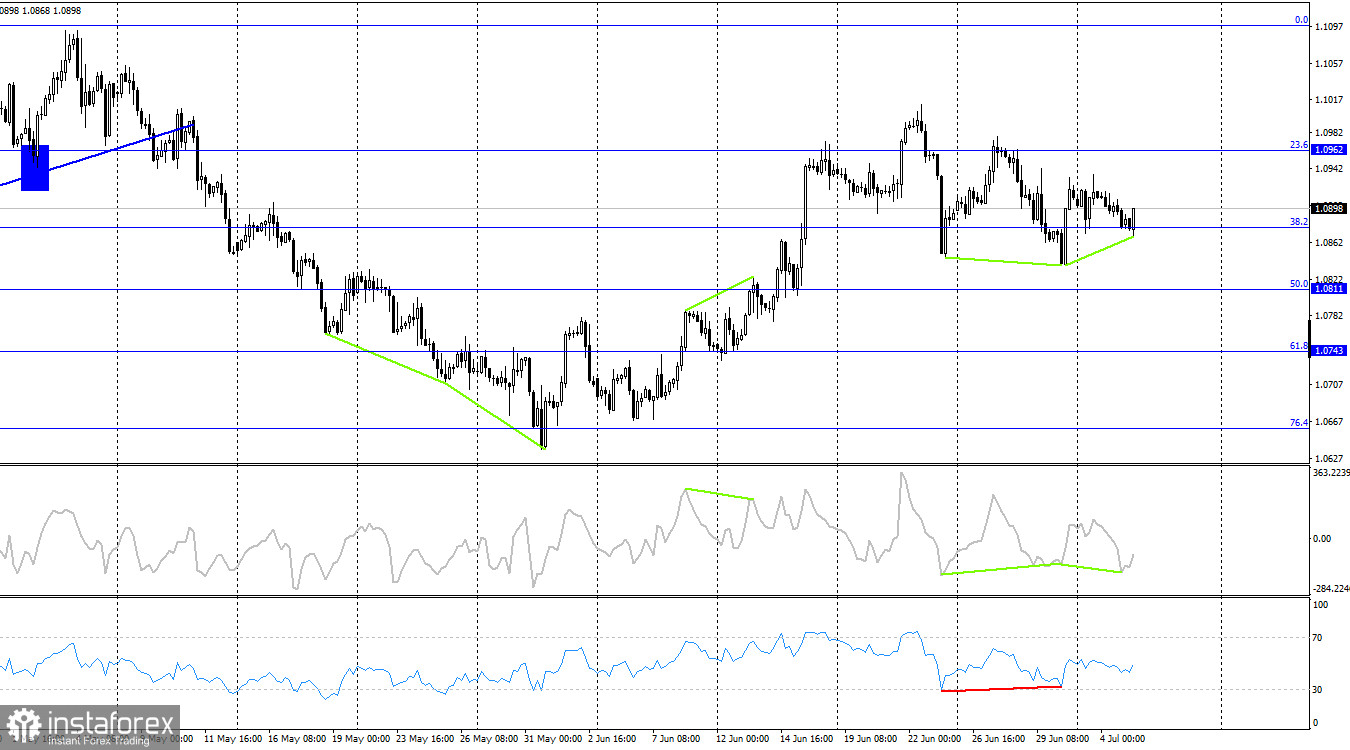

On the 4-hour chart, the pair reversed in favor of the euro currency after forming a "bullish" divergence at the CCI indicator. Thus, the growth process can be continued towards the corrective level of 23.6% (1.0962). However, on the hourly chart, we have a horizontal corridor with the lower line right around the divergence low. Therefore, it is better to trade this corridor now. Today, no new emerging divergences are observed at any of the indicators.

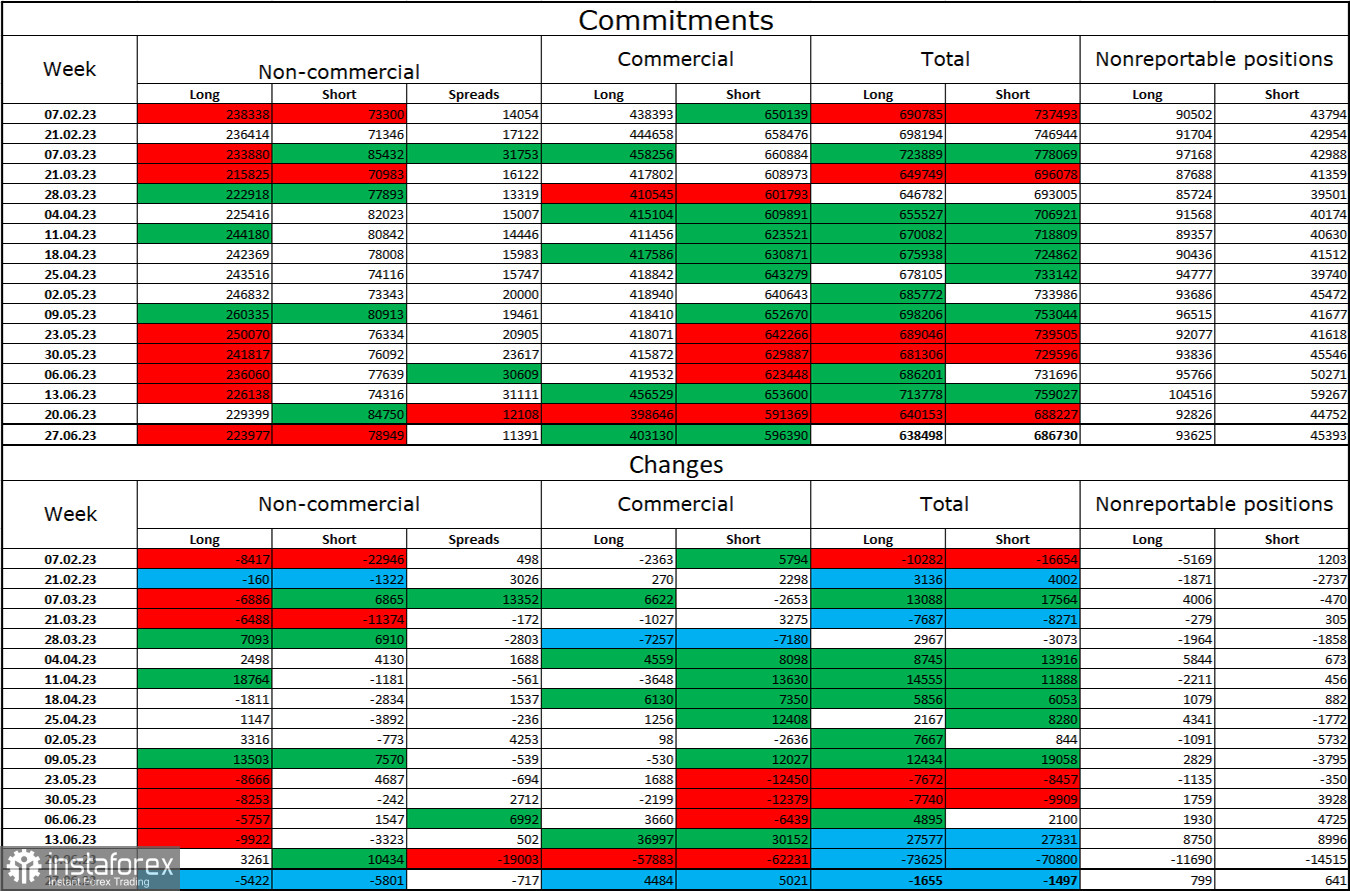

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 5422 long contracts and 5801 short contracts. The sentiment of major traders remains "bullish," but it's slowly weakening. The total number of long contracts concentrated in the hands of speculators now amounts to 224 thousand, and short contracts - only 79 thousand. A strong "bullish" sentiment remains for now, but I think the situation will continue to change soon. The European currency has been falling more often than rising over the past two months. The high value of open long contracts suggests that buyers may start to close them soon (or have already started, as the latest COT reports suggest) - there is currently too strong a bias towards bulls. The current figures allow for a new fall in the euro soon.

News calendar for the USA and the European Union:

European Union - Germany's services sector business activity index (07:55 UTC).

European Union - Business activity index in the services sector (08:00 UTC).

USA - FOMC meeting minutes (18:00 UTC).

The July 5 economic events calendar contains several insignificant entries. The impact of the news background on traders' sentiment for the rest of the day may be weak.

EUR/USD forecast and advice for traders:

Sales were possible with a rebound from the level of 1.0923 on the hourly chart with targets of 1.0868 and 1.0824. The first target was worked out, and a buy signal was formed. Small purchases of the pair on a "bearish" trend are possible. Yesterday I advised buying with a rebound from the level of 1.0868 with a target of 1.0923. This trade can now be kept open. For more serious purchases, I suggest paying attention only after closing above the level of 1.0923.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română