After a rapid collapse in May–June, gold is struggling for direction. On the side of the bears in XAU/USD are the rising yields of U.S. Treasury bonds and a strong dollar, while bulls are betting on sustained geopolitical tension and delayed effects of tightening monetary policy. Since the start of the interest rate hike cycle by G10 currency issuing central banks, they have increased by 3,765 basis points. Sooner or later, monetary restriction will reflect on the the global economy's condition.

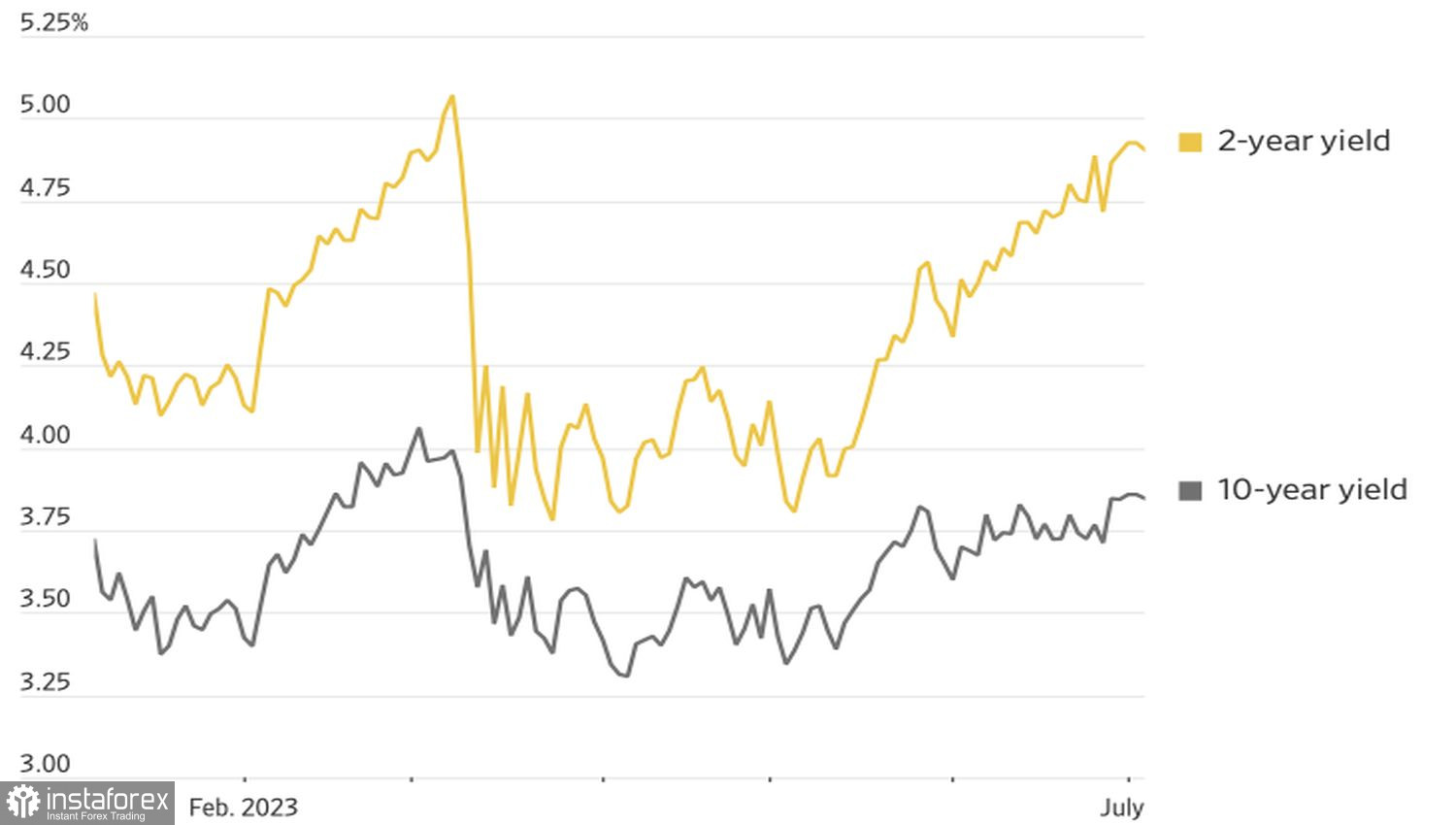

Dynamics of U.S. Treasury bond yields

This is unlikely to happen in the near future. The U.S. remains strong, the labor market is extremely tense, and inflation stubbornly high—under such conditions, the Federal Reserve simply has to continue what it started. The central bank intends to raise the federal funds rate to 5.75% by the end of 2023 and will not lower it below 4% by the end of 2024. High borrowing costs are key to the resilience of the U.S. dollar and the growth of Treasury bond yields. In such an environment, precious metals feel out of place.

At the same time, stock indices are rising, and the spread between corporate and treasury bond rates is narrowing, which indicates a growth in global risk appetite and puts pressure on safe-haven assets.

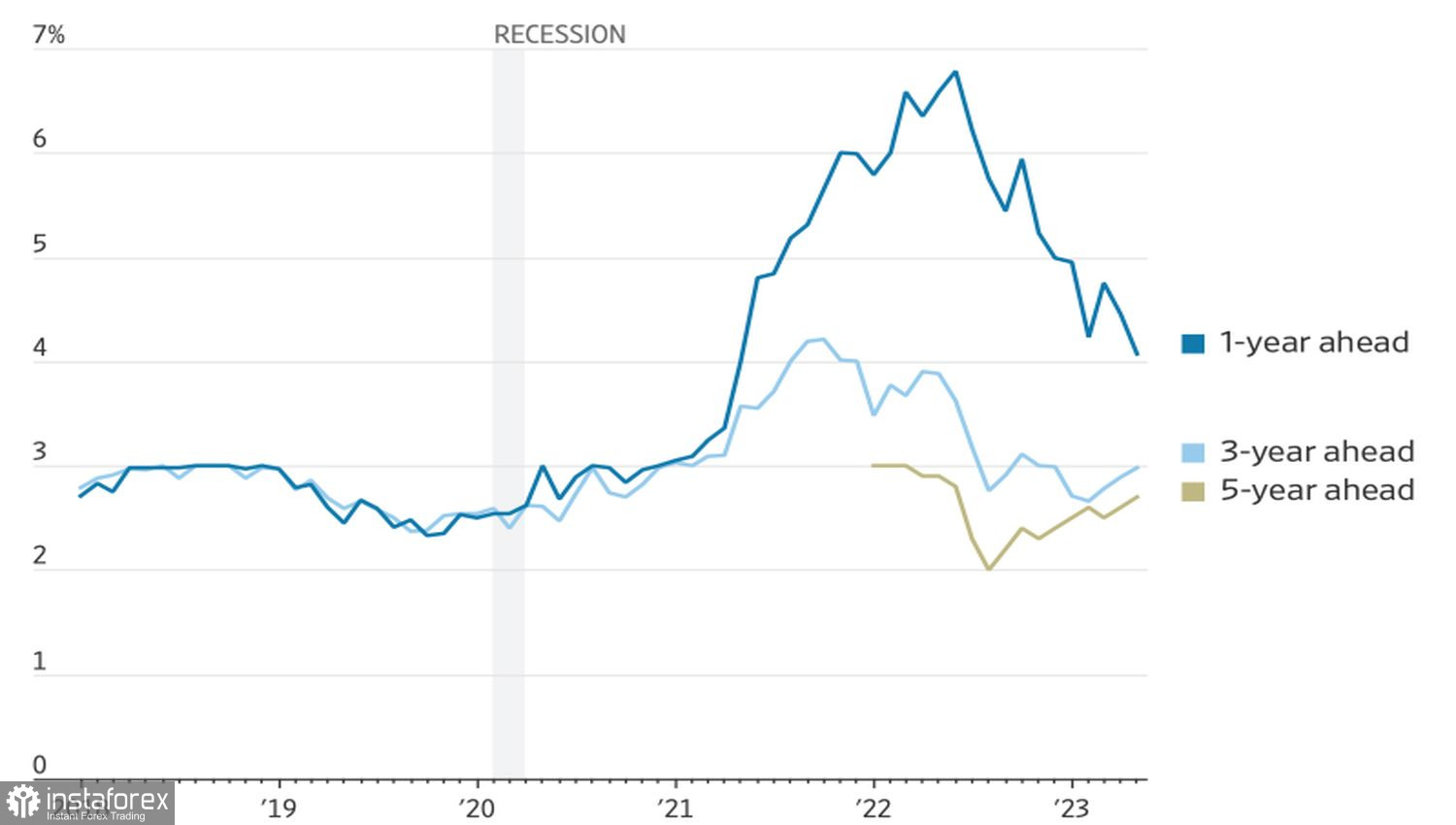

The uncomfortable situation for precious metals is exacerbated by declining inflation expectations. Consumers expect to see prices at 4.1% a year from now, which is significantly below the recent peak of 6.8%. In three years, the figure will be 3%. Prior to the pandemic, the talk was about 2.8%, and then the Fed considered inflation expectations to be securely anchored. The lower they fall, the higher the real yield on U.S. Treasury bonds will rise. Bad news for XAU/USD.

Dynamics of inflation expectations in the U.S.

What's next? There are two most viable scenarios. First, the U.S. economy finally begins to feel the pain of tightening monetary policy. In the third quarter, U.S. macro data worsens, and gold gradually recovers; however, in the fourth quarter, the chances of a soft landing sharply increase, and the precious metal falls out of favor again.

The second scenario assumes that the time lag between the start of monetary restriction and economic pain is longer than the average 18 months. The data continues to please fans of the U.S. dollar, which negatively affects XAU/USD.

No one knows what will actually happen. However, a hint may come from the U.S. labor market. The 245,000 in employment expected by Bloomberg experts is a strong figure. It will convince of the market's resilience and will serve as a basis for selling precious metals. It's another matter if the statistics disappoint.

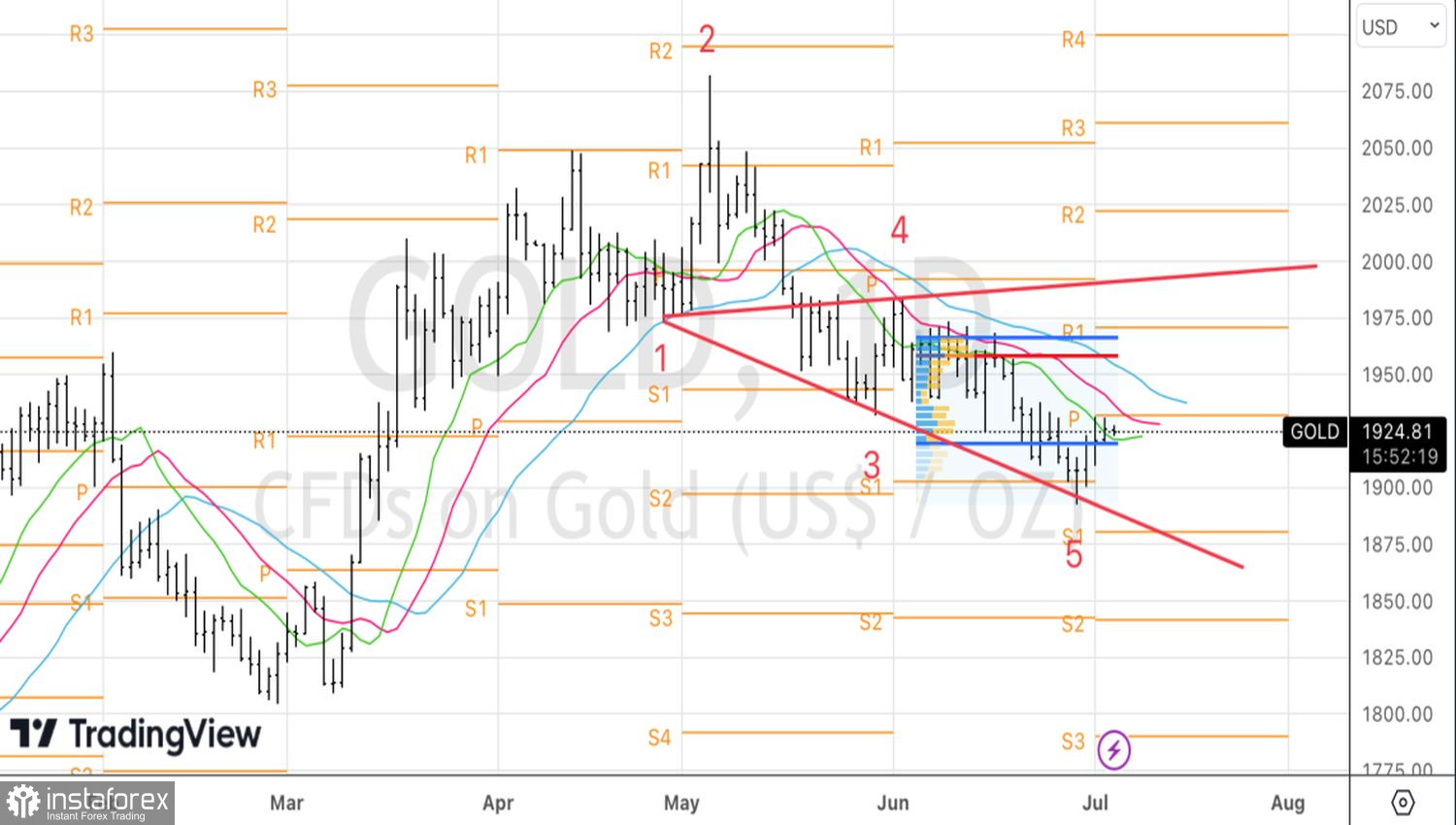

Technically, on the daily chart, the inability of gold to stay within the fair value range of $1,919–$1,967 per ounce will be a reason for selling on a rebound from the EMA. As long as quotes stay below $1,959, we focus on shorts. Above this mark, the Wolfe Wave reversal pattern will be activated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română