As the euro struggles to regain its footing after yesterday's losses, its hopes lie heavily on positive services PMI data, the only thing currently preventing a significant economic slowdown. Meanwhile, traders are preparing for the publication of the FOMC June meeting minutes. It will shed light on the policymakers' discussion that took place at the June meeting that led to a temporary halt in the interest rate hiking cycle.

The Federal Open Market Committee paused the rate hike cycle after 10 consecutive increases over a period of 15 months. The pause happened despite inflation persistently falling short of initial forecasts. At the same time, policymakers clearly indicated that the June pause does not cancel the two additional rate hikes that will occur later this year, which caught investors off guard.

Even though Fed Chair Jerome Powell did not try to explain why the committee decided to pause rate hikes, investors still obtained a convoluted understanding of what to do next. This confusion is evident in the bond market, which continues to behave erratically and which has a yield curve inversion. On the one hand, the pause signals that the Federal Reserve is about to stop the tightening cycle. On the other hand, persistent high inflation, which Powell has voiced concerns about, could entrench itself further into the economy if left unchecked, especially considering the absence of labor market issues and the surprise surge in economic growth during Q1 2023. The minutes may provide insights into policymakers' plans. However, this is unlikely as the emphasis will be on the upcoming July data releases, as Powell cautioned.

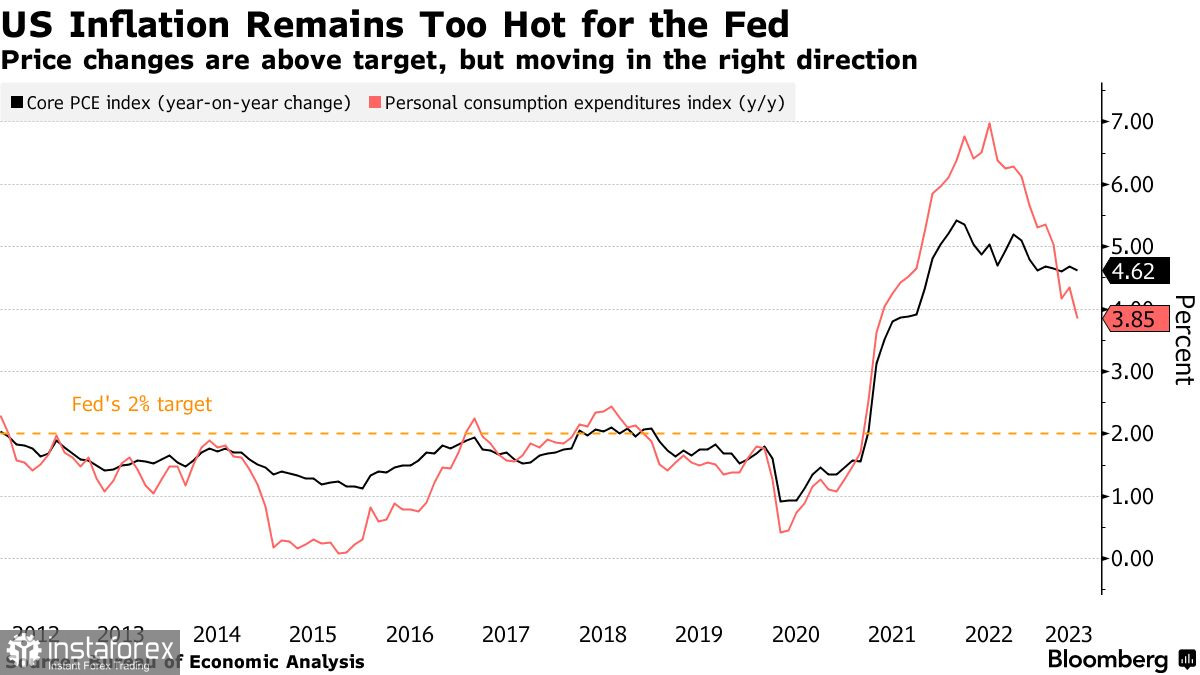

In the near future, two key data releases will be published: the employment report for June and the consumer price data for the same month, which will be released on July 12. Notably, the Federal Reserve's preferred gauge of inflation, the Personal Consumption Expenditures (PCE) price index, recorded its slowest year-on-year increase in over two years in May. However, policymakers are currently more focused on core prices, which exclude food and energy. The core CPI has increased by 4.6% since May 2022 compared to an earlier 3.8% advance.

Powell also noted that Federal Reserve officials wanted more time to assess economic data in light of previous aggressive rate hikes and the tightening of lending conditions following bank failures in March. Last week, the Fed Chair revealed that the overwhelming majority of FOMC members expected two or more rate hikes. Today's minutes might also reinforce market expectations for the July hike, which will support the US dollar against the euro and the pound sterling.

However, the July rate hike is all but confirmed and already priced in to some extent. Therefore, investors find it increasingly difficult to navigate the market based solely on standard Federal Reserve projections, which can be revised at any moment. One thing is clear: since inflation risks are still tilted towards growth, the Fed's communication will remain assertive in the run-up to the meeting on July 25-26.

On the technical side, euro bulls need to climb above 1.0900 and establish a foothold there. This will allow EUR/USD to move towards 1.0930. It is possible to reach 1.0975 from that level, but it will be quite difficult without new positive data from the eurozone. Should the trading instrument decline, substantial market activity by bulls is expected only around the support level of 1.0860. If there is no activity there, it would be a good idea to wait for a retest of the low at 1.0835 or open long positions at 1.0800.

As for the technical picture of GBP/USD, demand for the pound remains fairly strong, indicating the continuation of a bullish market. It will be possible to expect an upward movement of the pair after it settles above 1.2735. A breakthrough above this range will bolster prospects for further recovery towards 1.2770 and potentially pave the way for a more pronounced surge towards 1.2805. If the pair declines, bears will attempt to take control below 1.2690. A successful breakout below this range would deal a blow to the positions of bulls, driving GBP/USD towards the support at 1.2660 and opening the way towards 1.2620.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română